Litecoin (LTC) has actually seen a considerable uptick in large-holder coin circulation to exchanges in the recently.

This results from the consistent autumn in the coin’s worth and big owners’ wish to stop more losses. Since this writing, LTC professions at $65.73, dropping by nearly 15% in the previous 7 days.

Litecoin Whales Offer Their Holdings

Litecoin’s (LTC) continuous cost decrease in the previous couple of weeks has actually created a few of its big owners to send their coins to cryptocurrency exchanges.

On-chain information reveal that the coin’s big owner netflow has actually risen by over 464% in the last 7 days.

This statistics procedures the web quantity of symbols that big owners move right into or out of exchanges. When it rises, a lot more symbols are being moved from big owners’ budgets to exchanges. This shows that this friend of capitalists is preparing to offer their symbols. This might cause a rise in marketing stress and more cost decrease.

On the various other hand, when the statistics decreases, it recommends that big owners are withdrawing their symbols from exchanges, potentially to hold them for a longer term. This is in some cases because of market unpredictability or them just awaiting a far better chance to get in brand-new placements.

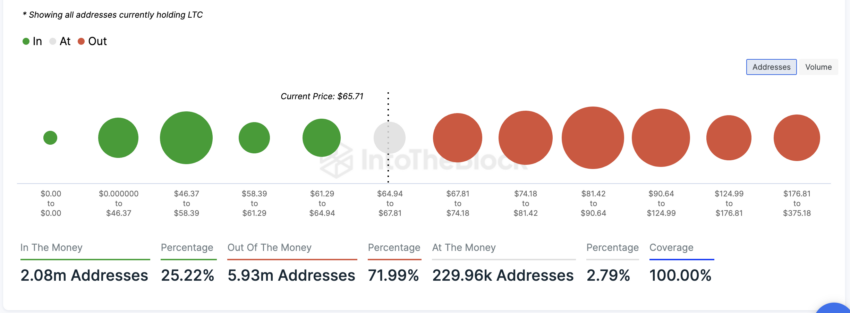

Examining LTC’s monetary data clarifies why its big owners have actually been marketing. Presently, 5.93 addresses, 72% of all LTC owners, are “out of the cash.”

An address is taken into consideration out of the cash if the existing market value of a possession is less than the ordinary price at which the address acquired the symbols it presently holds.

On the other hand, 2.08 million addresses, standing for 25% of all LTC owners, hold their coins at a revenue.

Find Out More: Litecoin: A Full Overview to What it is And Just How it Functions

The consistent decrease in LTC’s cost will certainly bring about an uptick in the variety of capitalists holding muddle-headed. Consequently, to stop financial investment losses, LTC whales have actually magnified profit-taking task.

LTC Cost Forecast: The “Nays” Have it

Analyses from LTC’s Relocating ordinary convergence/divergence (MACD) sign validate the bearish prejudice towards the altcoin. Investors utilize this sign to assess cost patterns, energy, and prospective acquiring and marketing possibilities on the market.

Since this writing, LTC’s MACD (blue) relaxes listed below its signal (orange) and absolutely no lines. When a possession’s MACD is established by doing this, it is a bearish indicator that recommends that marketing task outweighs acquiring energy.

If this pattern proceeds, LTC’s cost might go down to $63.98.

Nonetheless, if market view changes from bearish to favorable, it might drive the coin’s worth up towards $68.60.

Please Note

In accordance with the Count on Job standards, this cost evaluation short article is for educational objectives just and must not be taken into consideration monetary or financial investment guidance. BeInCrypto is dedicated to exact, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.