Information reveals that ‘paper’ Bitcoin has actually observed a noteworthy rise just recently while the cryptocurrency’s place rate has actually dived down.

Paper Bitcoin Has Actually Been Climbing While Place BTC Has Stayed Stale

In a brand-new thread on X, expert Willy Woo has actually discussed the state of the Bitcoin market. BTC has actually been seeing a bearish pattern just recently, with the German Federal government marketing and Mt. Gox circulations being 2 of the significant resources of FUD amongst capitalists.

Woo explained that Germany marketed around 10,000 BTC, with 39,800 BTC still in the federal government’s guardianship.

The information for the holdings seized by the German federal government|Resource: @woonomic on X

Mt. Gox hasn’t dispersed as much BTC yet, with just 2,700 BTC being gone back to their proprietors. The insolvent exchange still has 139,000 BTC delegated disperse, yet the bearish influence from these holdings depends upon whether the owners obtaining the coins intend to offer.

The pattern in the Mt. Gox equilibrium throughout the years|Resource: @woonomic on X

It would not show up that these 2 entities have actually included that much real marketing stress to the marketplace yet. So, what’s been truth offender behind Bitcoin’s accident? According to the expert, that would certainly appear to be paper BTC.

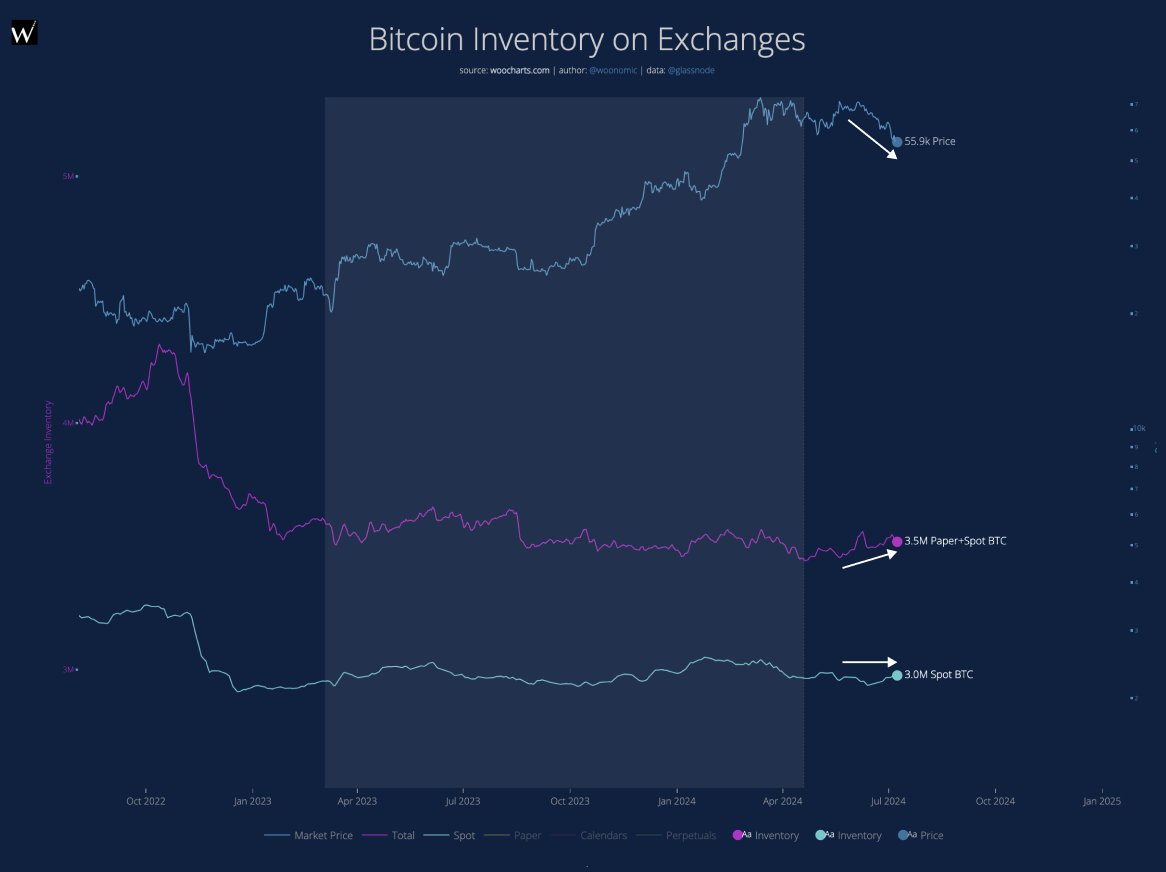

Paper BTC describes the by-products items connected to the cryptocurrency that do not require possession of any type of real BTC symbols. Below is a graph that reveals BTC’s trajectory throughout this most current dive in the property.

Appears like the paper plus place BTC equilibrium has actually gotten on the surge on exchanges|Resource: @woonomic on X

In the chart, the purple line mirrors the mixed paper and place BTC supply presently resting on the different central exchanges in the industry. This supply has actually gotten on the surge just recently.

This boost, nevertheless, can additionally be due to place down payments as opposed to paper Bitcoin being produced. Nonetheless, as heaven contour programs, place BTC has actually been revealing a level trajectory while the general supply has actually raised. This would certainly validate that paper BTC has actually certainly lagged the boost.

In total amount, 140,000 added paper BTC has actually been published just recently. “Currently contrast that to 10,000 BTC that Germany marketed, and you see what created the dump,” claims Woo. Hence, it’s feasible that by-products would certainly need to see a flush if the cryptocurrency needed to make some strong healing.

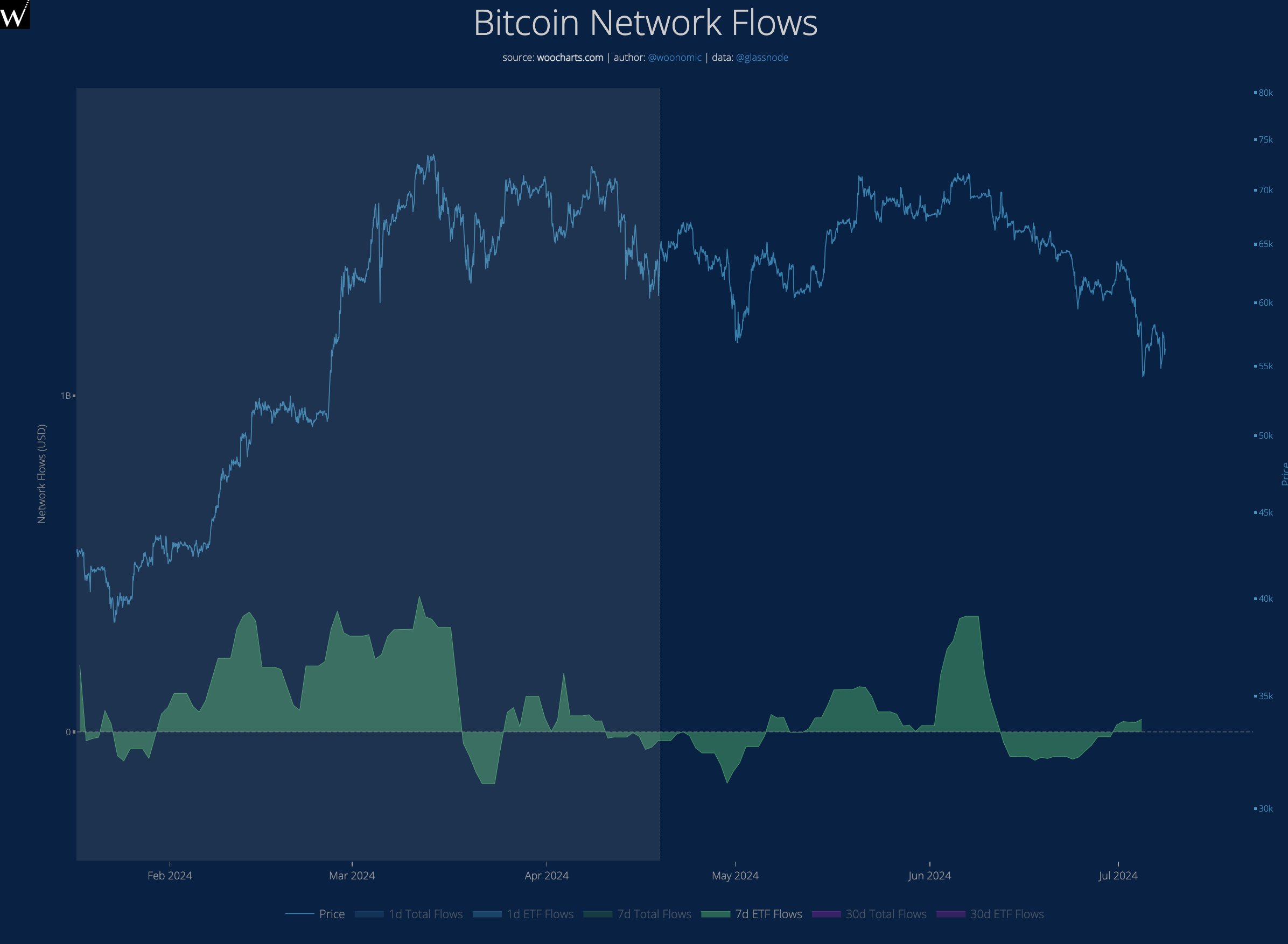

While bearish winds are in advance in regards to the continuing to be Mt. Gox and German federal government offloading, a favorable growth might additionally be developing for the coin. As the expert has actually discussed, the place exchange-traded funds (ETFs) have actually begun to reveal very early indicators of build-up.

The pattern in the 7-day netflows of the BTC place ETFs|Resource: @woonomic on X

BTC Cost

The previous month has actually been a difficult time for Bitcoin owners as the property’s rate has actually decreased by greater than 17% and went down to $57,200.

The rate of the coin has actually been riding on bearish energy just recently|Resource: BTCUSD on TradingView

Included photo from Dall-E, woocharts.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.