Binance remains to safeguard its heft as the biggest crypto trading system by trading quantity metrics worldwide. As the exchange transforms 7, records suggest that its Bitcoin (BTC) holdings remain to expand.

Central exchanges such as Binance and Coinbase help with the acquiring, marketing, and trading of cryptocurrencies, functioning as middlemans in between purchasers and vendors.

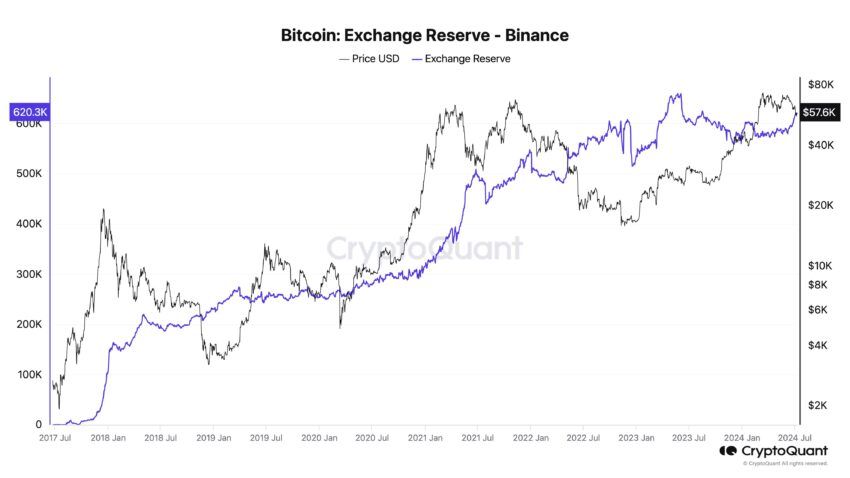

Binance’s Bitcoin Exchange Get Soars 10%

CryptoQuant owner and chief executive officer Ki Youthful Ju reports that Binance Exchange’s Bitcoin holdings have actually enhanced by 10% because very early 2024. The contrary occurred for various other exchanges, whose BTC holdings plunged by 8%.

Learn More: Binance Evaluation 2024: Is It the Right Crypto Exchange for You?

The record comes as Binance announced its 7th wedding anniversary on Wednesday with a brand-new limited-time reference promo. Qualified customers will certainly share approximately 700 BNB in token coupons.

” When the individual (‘ referrer’) effectively welcomes a brand-new Binance individual, the referrer will certainly obtain a 0.01 BNB token coupon and the brand-new individual will certainly obtain a 0.005 BNB token coupon.”

Regardless of these turning points, Binance lately dealt with governing concerns with authorities from various territories. As an example, the United States Stocks and Exchange Payment (SEC), to name a few, secured down versus the trading system for presumably unnaturally blowing up trading quantities.

” Via thirteen costs, we declare that Binance chief executive officer Changpeng Zhao and Binance entities took part in a considerable internet of deceptiveness. Problems of rate of interest, absence of disclosure, and determined evasion of the legislation are a few of the various other criminal activities,” SEC Chair Gary Gensler wrote.

The economic regulatory authority additionally called Binance out for drawing away consumer funds and falling short to limit United States consumers from its system. It apparently additionally misguided financiers regarding its market security controls. On the other hand, others pointed out offenses, consisting of allowing the trading of crypto symbols regarded safety and securities.

Alternatively, Coinbase, the biggest US-based crypto exchange on trading quantity metrics, is amongst exchanges whose Bitcoin holdings have actually diminished. This is specifically fascinating considered that Coinbase has an one-upmanship by being the custodian for a lot of area Bitcoin ETF (exchange-traded funds) providers in the United States. Nevertheless, Tolou Resources Monitoring owner Spencer Hakimian states Coinbase’s duty amongst ETF providers can be the trouble.

” Numerous ETFs within the United States most likely harming Coinbase’s target audience. Much less so for Binance,” Hakimian wrote.

Learn More: Coinbase Evaluation 2024: The Most Effective Crypto Exchange for Beginners?

The development of area ETFs in the United States strengthened Coinbase’s situation, with its Chief Executive Officer Brian Armstrong trumpeting the exchange. Legal Representative John E. Deaton, a famous XRP supporter, resembled Armstrong. He recognized that “Coinbase will certainly be a huge champion” as the exchange stood at the facility of the ETF project.

” Coinbase will certainly be a huge champion. I anticipate to see BlackRock and Lead purchase even more. Incidentally, 90% of Gary Gensler’s $120 million ton of money is with Lead,” Deaton remarked.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to offer precise, prompt details. Nevertheless, viewers are suggested to confirm realities individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.