Bitcoin is connecting the hemorrhage of recently, maintaining at area prices, yet still stuck within a bearish development. Unless there is a definitive close, preferably over $60,000, vendors will certainly still control cost activity in the brief to tool term.

Is Bitcoin Readying To Compete Greater?

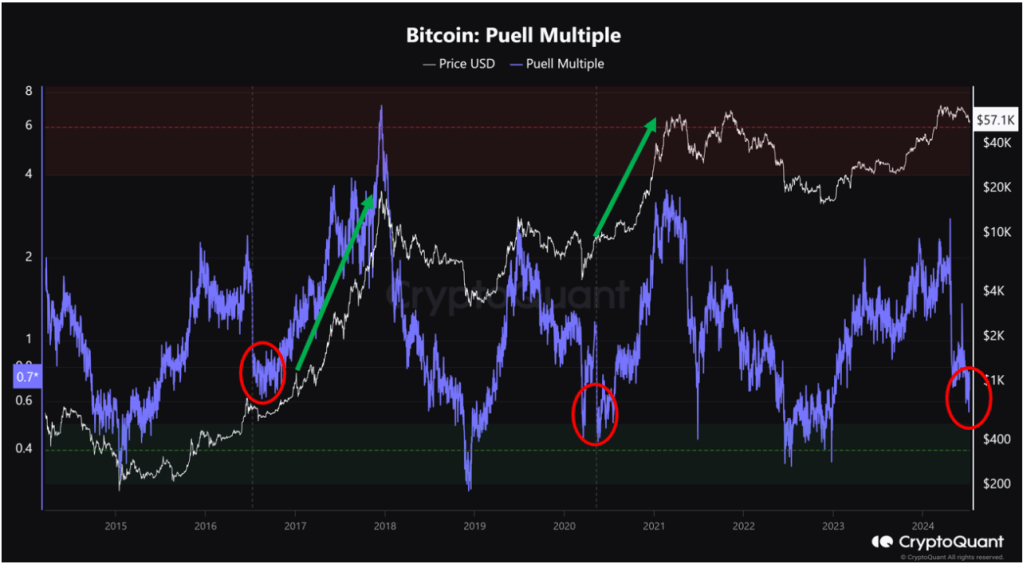

In the middle of this state of events, specifically after recently’s sharp dump that pressed BTC to as reduced as $53,500, there is positive outlook. One investor assumes Bitcoin is preparing to jump greater, as the Puell Several sign tips. The device is vital to assess miner success in any way cost factors, establishing whether it mores than or under-valued.

Pointing Out CryptoQuant data, the expert is persuaded the Bitcoin market is bottoming, and recently’s collision was a critical end of the June leg down. Via the Puell Several sign, individuals can predict whether an improvement is finishing or simply starting.

Historically, when the sign drops, maybe a great signal, specifically for investors timing cost bases in a bearish market. With bases, picking the start of a bull cycle can be very easy.

The Puell Several sign is dropping, complying with the very same manuscript as seen in 2016 and 2020 prior to rates appeared. This development recommends that the present leg down, which has actually required numerous countless lengthy liquidations, is finishing. Nevertheless, whether the bull run remains in its onset continues to be to be seen.

Up until now, Bitcoin is secure, including 7% from July 2024 lows. Despite the fact that there is hope, the break listed below Might and June 2024 lows recently indicate bears remain in control.

For the uptrend to return to, and as stated previously, bulls should shut over $60,000. Nonetheless, for conventional investors, a definitive close over $66,000 and $72,000 might signify a significant change in pattern. In that occasion, Bitcoin might retest and also damage $73,800.

USDT Liquidity Increasing However BTC Supply Spike Deflating Bulls

Self-confidence continues to be high in the meantime. One expert notes that the USDT liquidity is increasing in very early Q3 2024. Generally, whenever stablecoin liquidity climbs, it might indicate rate of interest in riskier possessions like BTC and crypto gets on the increase.

The failing of rates to increase instantly might be as a result of the spike in supply as the German federal government discharges. As soon as this overhang is soaked up, the uptrend will certainly return to.

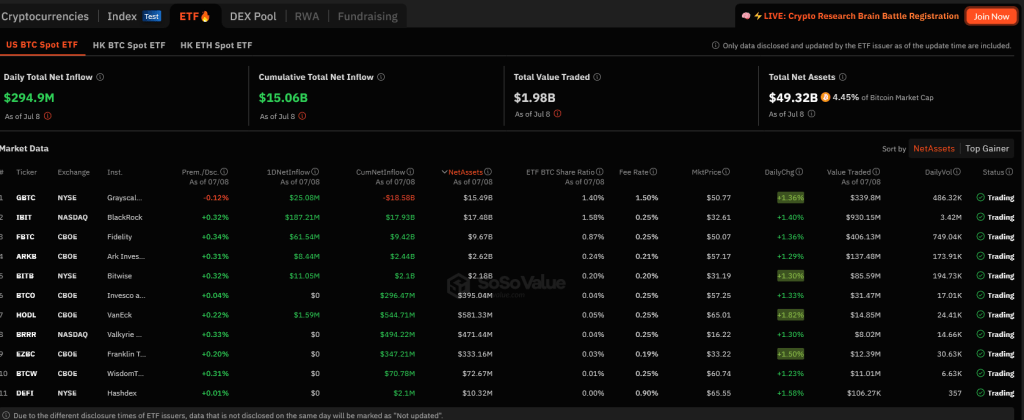

Fortunately for bulls is that area Bitcoin exchange-traded fund (ETF) providers have actually been getting as Germany offloads. Since July 8, SosoValue information shows that all area ETF providers included $294 million well worth of BTC, with BlackRock leading the pack.

Function photo from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.