Amazon (AMZN) Internet Solutions (AWS) is introducing its fourth-generation Graviton cpu, the Graviton4 chip, the business shared solely with Yahoo Money.

The brand-new chip guarantees to provide significant renovations in efficiency and performance, consisting of 3 times the calculate power and memory of its precursor, 75% even more memory transmission capacity, and 30% far better efficiency, according to Rahul Kulkarni, Amazon’s supervisor of item monitoring for Compute and AI.

” Jointly it’s supplying a lot more cost efficiency, which indicates for each buck invested, you obtain a great deal even more efficiency,” Kulkarni shown Yahoo Money at Amazon’s chips laboratory in Austin, Texas.

Need for chips is expanding as semiconductors remain to play a crucial function in the international economic situation, powering almost whatever we make use of. The market is presently valued at $544 billion and is anticipated to go beyond $1 trillion by 2033, driven by raising need for AI.

Consequently, hyperscalers such as Amazon, Apple (AAPL), Alphabet (GOOG, GOOGL), and Microsoft (MSFT) are developing custom-made chips to fulfill their particular requirements, cut expenses, and supply clients a lot more budget-friendly alternatives.

” Every one of these business are investing a great deal of cash on establishing chips,” claimed Patrick Moorhead, that invested over a years as a vice head of state at AMD. “They will not speak about just how much they’re spending, yet they have these huge R&D spending plans.”

Nvidia (NVDA) continues to be the leading gamer in the AI chips market, with greater than 80% share of the marketplace for graphics refining devices (GPUs). Yet there suffices need to sustain numerous rivals, according to Moorhead, that presently functions as chief executive officer and primary expert at Moor Insights & & Technique.

Although the Graviton4 chip is not an AI chip, it sustains AWS’s Inferentia and Trainium chips, which are concentrated on the modern technology. Trainium completes straight with Nvidia’s AI chips, which are thought about the fastest and most effective out there.

Nonetheless, AWS’s objective is not to unseat Nvidia, Kulkarni highlighted. Rather, the cloud provider wishes to supply a sensible choice for clients concentrated on cost efficiency, which they wish will certainly permit them to take a lucrative piece of the quickly increasing AI-driven chips market.

” Now, if a client is a lot more concentrated on time to market, Nvidia-based items that we provide are a fantastic choice,” Kulkarni claimed. “There are clients for whom set you back ends up being an extremely excessive facet of running their service. If they intend to do even more cost-optimized AI work like training or reasoning, after that our Inferentia and Trainium items come to be a fantastic choice.”

Just how Amazon maintains growth expenses down

Along with acquiring chips from manufacturers like Nvidia, AMD (AMD), and Intel (INTC), Amazon likewise makes its very own chips internal. AWS presently provides 2 primary sorts of chips: those made for AI and those produced basic objectives, like the Graviton4.

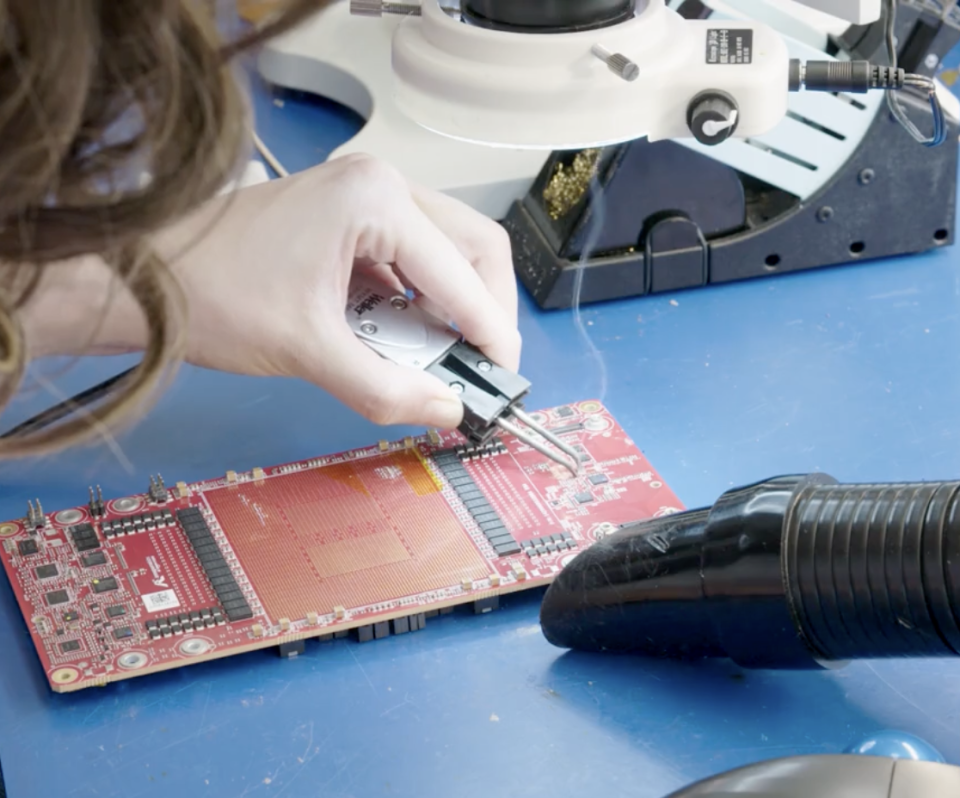

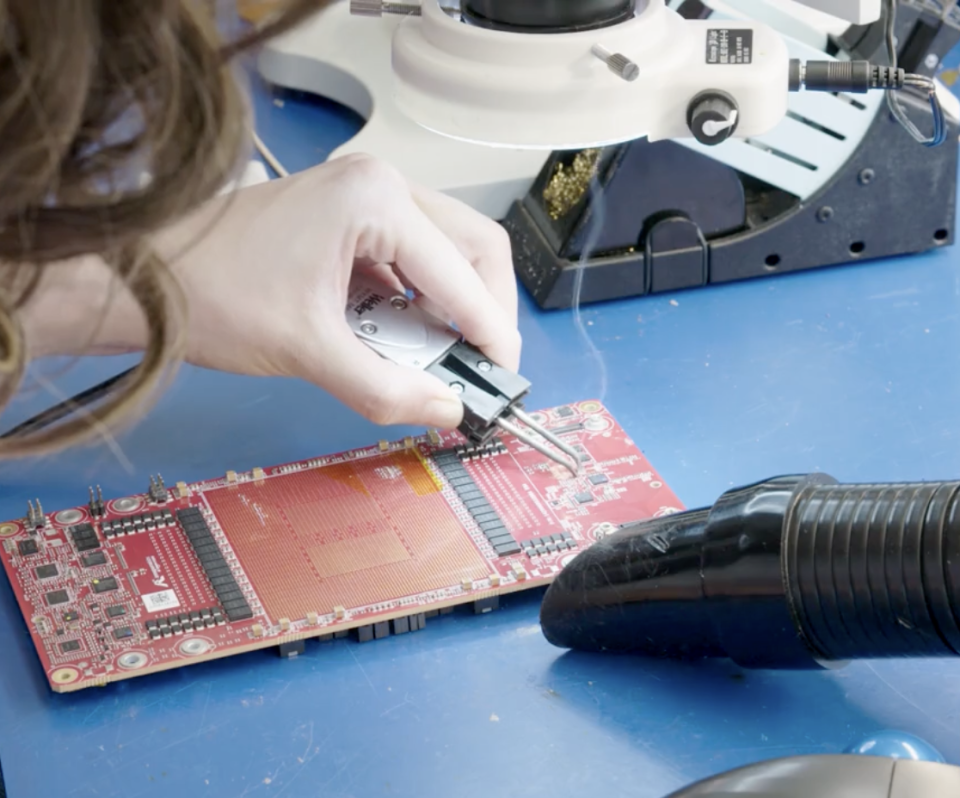

In an uncommon consider AWS’s laboratory, Yahoo Money saw AWS designers solder and examination chip layouts, making use of software application to seek efficiency problems and repair them on website.

It’s one method the business claims it drives down growth expenses.

” We can tune the item, song this silicon, to simply concentrate on points that truly matter for client work,” claimed Kulkarni.

AWS has actually not divulged particular rates information for the Graviton4, yet the cpus are rented out at $0.02845 per secondly of calculate power. This price-performance proportion is vital for AWS, as it utilizes its exclusive chips to power its cloud framework and web servers.

” AWS clients can make use of Graviton4 to reduce their expense for IT in fifty percent,” claimed Moorhead.

It’s not almost giving chips to clients– AWS’s chips approach is likewise concerning making use of every one of its chip offerings to power its very own initiatives, consisting of a brand-new huge language design, a prospective competitor to OpenAI’s ChatGPT.

Moorhead kept in mind that while the growth of chips is pricey, it can cause significant financial savings in the future.

” Allow’s claim you can conserve $200 a chip, and you’re acquiring a countless them a year,” Moorhead claimed. “That builds up, which’s a great deal of cash that you can gather to do that.”

For capitalists, profits assumptions from chip growth might affect business revenues greater than real chip manufacturing. As AWS wants to take its specific niche deliberately, screening, and verifying its chips, experts have actually seen the business’s expanding impact in the semiconductor area.

Expert profits assumptions are greater for Amazon than for Microsoft or Alphabet, and the earnings margins for AWS alone got to 38% in the initial quarter of 2024.

” AWS has a great deal of reputation in the semiconductor area,” Moorhead claimed. “10 years earlier, I had inquiries concerning just how a business such as this can do chips when you entertain spending numerous billions of bucks to do that. Yet they are excellent at it.”

Go Here for the current modern technology information that will certainly affect the securities market

Review the current monetary and service information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.