The innovation business flying simply beyond our radar might be the ones that have one of the most space to run this year. Undoubtedly, there’s even more to spending than simply acquiring the biggest 7 business in the stock exchange. Larger has actually been much better, at the very least in the previous year. However what has actually functioned best in the current past might not remain to function so well in the future. Today, financiers might want to have a look at some Strong-Buy-rated supplies for a chance at taking advantage of the tech-driven rally while possibly staying away from the largest craters in the roadway.

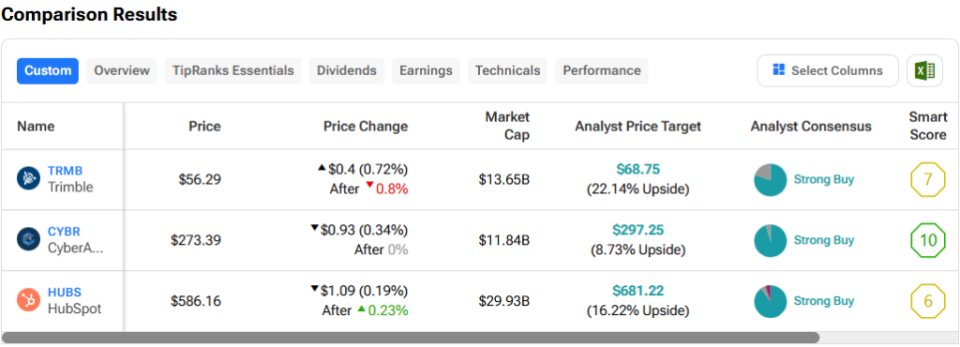

For that reason, allow’s usage TipRanks’ Comparison Tool to compare and contrast 3 remarkable technology supplies– TRMB, CYBR, and centers– that have what it requires to elude the marketplace’s present heavyweights.

Trimble (NASDAQ: TRMB)

Shares of geospatial technology company Trimble have actually been having a hard time to hang onto the huge rise they delighted in given that bottoming in November 2023. The technology company, which offers a wide variety of sectors, currently locates itself in a modification, down near to 15% from 52-week highs. In spite of the share slip, which came weeks after the business reported a solid very first quarter (revenues per share of $0.64 vs. $0.62 anticipated), I tend to remain favorable as Trimble wants to introduce brand-new items that might become significant long-lasting development chauffeurs.

Looking in advance, brand-new scanning systems such as the X9 3D laser scanner, which it flaunted in Geo Week 2024 previously this year, might be a prompt driver that assists TRMB supply out of its rut. It’s greater than simply a much faster and much more exact 3D screener, though; its auto-calibration abilities can assist individuals conserve time and take a little human mistake out of the formula.

Without a doubt, such brand-new technology makes Trimble a particular niche technical pioneer and one that Cathie Timber might have been incorrect to cut. At composing, the supply professions at 20.2 times onward price-to-earnings (P/E), significantly listed below the Scientific and Technical Instruments sector standard of 19.9 times.

What’s the Cost Target for TRMB Supply?

TRMB supply is a Solid Buy, according to experts, with 4 Buys and one Hold appointed in the previous 3 months. The average TRMB stock price target of $68.75 indicates 22.1% upside possible.

CyberArk Software Application (NASDAQ: CYBR)

From geospatial technology to cybersecurity, we have CyberArk Software program. It’s a smaller sized ($ 11.8 billion market cap) Israeli company that is worthy of to be pointed out whenever the friend is gone over on tv after a significant violation reignites rate of interest in cybersecurity names. With numerous cybersecurity gamers on the market, each flaunting one-of-a-kind specializeds, CyberArk’s offerings are entitled to interest.

CyberArk’s support remains in identification protection, an appealing sub-scene in the cybersecurity market. As the Israel-based company proceeds enhancing its currently remarkable Identification Safety System, it is difficult not to be favorable on the light-weight cybersecurity company looking at a substantial market.

In spite of its dimension, CyberArk sticks out as a market leader in the Identification and Accessibility Administration (IAM) market, which can appreciate a substance yearly development price (CAGR) of 15% in between currently and 2032, according to Ton Of Money Company Insights With remarkable registration yearly repeating earnings (ARR) development of 60% published in 2014, CyberArk appears like a golden goose planned.

At writing, CYBR supply is close to a fresh all-time high. Shares get on the luxury of the past-year historic array at 14.5 times price-to-sales (P/S). Nevertheless, the abundant multiple might deserve spending for such a rapid cultivator in a financially rewarding edge of cybersecurity.

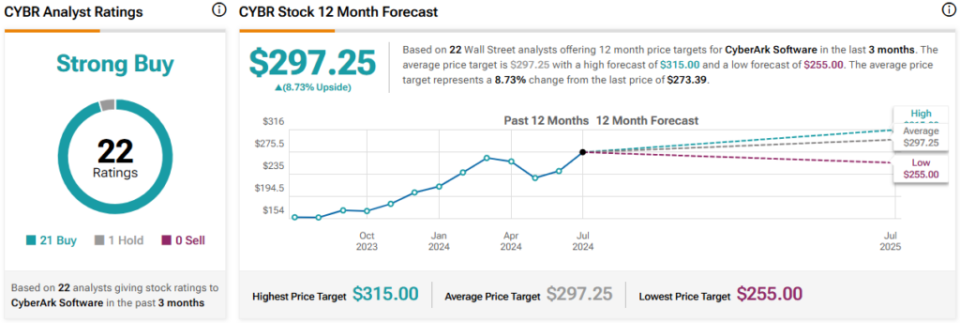

What’s the Cost Target for CYBR Supply?

CYBR supply is a Solid Buy, according to experts, with 21 Buys and one Hold appointed in the previous 3 months. The average CYBR stock price target of $297.25 indicates 8.7% upside possible.

Hubspot (NASDAQ: CENTERS)

Hubspot supply has actually been blistering warm over the previous 2 years, rising practically 80%. Though the rally has actually given that petered off in 2024, the tiny- and medium-sized (SMB) company software application company might still have legs entering into the 2nd fifty percent of the year as IT investing aim to experience a little an uptick. As an engaging requisition target with a good deal of AI technology under the hood, I tend to remain favorable on the supply, much like experts.

Undoubtedly, current headings have actually been controlled by babble concerning a possible $33 billion Alphabet ( NASDAQ: GOOGL) requisition. Durable, AI-leveraging consumer partnership administration (CRM) software application absolutely appears to be the missing out on item of the Alphabet problem. A bargain would certainly assist it better clash versus a few of its software-as-a-service (SaaS) opponents, most significantly venture gigantic Microsoft ( NASDAQ: MSFT), which has actually been active instilling AI throughout the collection.

Extra lately, records kept in mind that “prospective buyers” have actually tipped up, sharing rate of interest in demolishing the company for an unidentified quantity.

Bargain or otherwise, Hubspot sticks out as an engaging software application healing play and a major CRM market disruptor as it triples down on AI devices to assist consumers “function smarter.” At 80.6 times onward price-to-earnings (P/E), center shares do not come low-cost. Nevertheless, if Google and others are looking at a possibly greater admission rate, possibly financiers might go to danger of undervaluing the size of the development story.

What’s the Cost Target for HUBS Supply?

centers supply is a Solid Buy, according to experts, with 18 Buys and one Hold appointed in the previous 3 months. The average HUBS stock price target of $681.22 indicates 16.2% upside possible.

The Takeaway

The complying with Strong-Buy-rated software application plays deserve looking into as they want to take any kind of market possibilities headed their method. Whether we’re discussing Trimble and its brand-new 3D scanner, CyberArk’s ever-improving identification protection offering, or Hubspot’s AI-first software application that’s captured the interest of “prospective buyers,” it’s clear some substantial possibilities exist outside the marketplace’s leading 5. Of the triad, experts see one of the most upside possibility (22%) from TRMB supply.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.