Trading quantity for USDC stablecoin has actually risen to $23 billion a year. This development comes amidst an expanding need for openness as investors move in the direction of managed stablecoin choices.

MiCA structure’s execution was an essential advancement, with certified stablecoin providers getting a totally overhauled guidebook.

USDC Leads Need For Managed Stablecoins With $23 Billion Trading Quantity

A Kaiko record suggests that the regular trading quantity for Circle’s USDC stablecoin has actually risen in 2024. This greater than increases the $9 billion taped in 2015 and virtually 5 times the $5 billion seen in 2022.

The development in trading quantity has actually moved USDC to test the 14% market share that the reserve-backed stablecoin First Digital USD (FDUSD) flaunts. Based upon the record, streamlined exchanges (CEX) represent the majority of these quantities, contrasted to decentralized (DEX) choices.

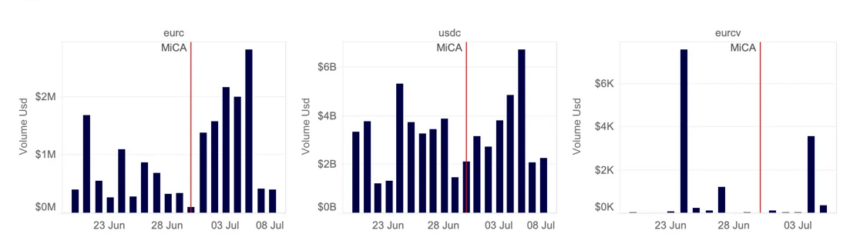

According to the record, USDC and its sibling, the Euro-denominated EURC stablecoin, have actually seen the best day-to-day trading quantity given that June 30, when the very first component of the MiCA structure entered into impact in the European Union.

SocGen’s Euro CoinVertible (EURCV) stablecoin likewise saw substantial quantity. Nevertheless, it was not as long as the EURC, provided it is just offered on Bitstamp exchange.

Remarkable quantity upticks, paired with the function of CEXes in driving the passion, recommend an expanding passion in certified stablecoins. This is contrasted to their non-compliant equivalents, which presently control the marketplace with 88% of complete stablecoin quantity. Nonetheless, the record mentions the opportunity of MiCA transforming the tables for the certified stablecoins.

” The share of certified stablecoins has actually enhanced over the previous year, recommending enhanced need for openness and managed choices. Thus far, this fad has actually primarily profited USDC,” a passage in the Kaiko Study read.

Additionally Check Out: What Is Markets in Crypto-Assets (MiCA)? Whatever You Required To Know

MiCA Structure Can Change the Equilibrium for Compliant Stablecoins

The MiCA structure’s execution in Europe on June 30 was a spots advancement in the stablecoin market. With its execution, stablecoin providers obtained a totally overhauled guidebook with details needs like “whitepaper magazine, administration, books monitoring, and prudential criteria.”

Circle protected an Electronic cash Establishment (EMI) certificate on July 1, a day after MiCA execution. EMI certificate is a need for any type of provider wanting to provide buck- and euro-pegged crypto symbols in the EU. It allows the company to “onshore” its Euro-denominated EURC stablecoin to consumers within the bloc.

Without a doubt, MiCA conformity is driving the appeal of the USDC stablecoin. The stamp of depend on supplies a lot more tailwinds for even more use of the stablecoin for continuous futures negotiation, Kaiko Research study kept in mind. Institutional capitalists, for example, that have their very own conformity needs when joining by-products markets, might want to such limits when discovering stablecoin options.

” USDC’s market share in these continuous markets is simply a portion of USDT’s. Its expanding use for continuous negotiation speaks with capitalists’ altering choices as stablecoin guidelines enter impact.”

A webinar organized by SOLIDUS laboratories showed that the 2nd component of the structure would certainly resolve the avoidance and restriction of market misuse. It will certainly be completely suitable by December 30, 2024. To browse these regulative adjustments effectively, participating in aggressive prep work, developing solid inner plans, and executing innovative security systems will certainly be vital.

Jeremy Allaire said both stablecoins are topped to prosper under the brand-new structure based upon the company’s certified record. According to the Circle chief executive officer, this document of success settings both stablecoins for even more success in the stablecoin market.

Find Out More: Crypto Policy: What Are the Conveniences and Drawbacks?

USDC’s primary market opponent in the stablecoin market, Tether’s USDT, is not EMI-licensed. Its chief executive officer, Paolo Ardoino, is still unconvinced by MiCA’s assumption of 60% support in financial institution cash money.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to supply exact, prompt details. Nevertheless, visitors are suggested to validate truths individually and seek advice from a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.