BUIDL, a tokenized United States treasury released by property monitoring large BlackRock in collaboration with Securitize, has actually exceeded the $500 million mark in market price, according to information from RWA.xyz.

This accomplishment makes BUIDL the biggest tokenized fund out there. It likewise highlights the expanding impact of real-world property (RWA) tokenization in the monetary industry.

BUIDL Push On in the RWA Tokenization Market

Released in March this year, BUIDL swiftly exceeded even more recognized funds in market capitalization, like Franklin Templeton’s Franklin OnChain United States Federal Government Cash Fund (BENJI). This fast climb highlights the boosting rate of interest in tokenized properties.

BUIDL’s market price rise has actually likewise affected the more comprehensive RWA token industry. CoinGecko information shows a 3.5% boost in the overall market capitalization of RWA-related properties within the last 24 hr.

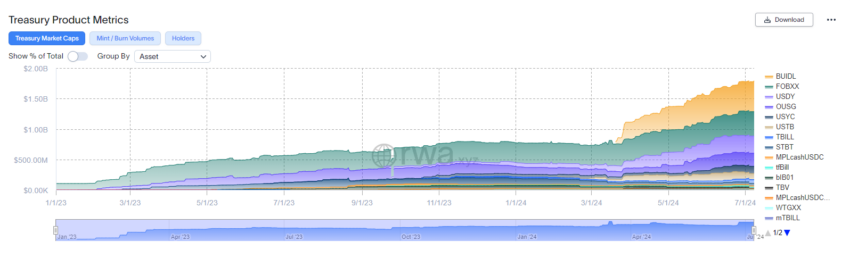

Leading the cost are ONDO and Rule (OM) symbols, which saw rises of 2% and 5.1%, specifically. The total tokenized treasury market has likewise knowledgeable impressive development, with its overall market capitalization rising from $572.40 million to $1.79 billion, noting a 212.72% year-on-year boost.

Find Out More: How To Invest in Real-World Crypto Assets (RWA)?

This development includes the functional applications of tokenized treasuries. RWA.xyz keeps in mind a raising fad being used tokenized treasuries as security in numerous monetary ecological communities.

For example, Superstate’s USTB and BUIDL are currently approved as security on the FalconX Network, while Ondo Financing’s USDY can be made use of on Drift Procedure. In addition, Moody’s current bond score upgrade to Hillside Lighting International Limited, the provider of OpenEden’s tokenized United States T-bills (TBILL). The “A-bf” score boosts TBILL symbols to investment-grade standing, boosting their interest capitalists.

Business like Hamilton likewise press the borders of RWA tokenization by discovering various blockchain systems. Recently, Hamilton revealed the tokenization of the very first United States Treasury expenses on Bitcoin layer-2 remedies, consisting of Stacks, Core, and BoB.

RWA tokenization includes transforming substantial properties like bonds, realty, and financial debt right into electronic symbols on blockchain networks. These electronic depictions can be switched, moved, and leveraged within DeFi ecological communities. Mohamed Elkasstawi, founder and chief executive officer of Hamilton, clarified prospective brand-new possibilities in the RWA tokenization industry to BeInCrypto.

” We prepare for that tokenized properties will certainly bring enhanced openness, liquidity, and ease of access to standard monetary markets. Our team believe that allowing fractional possession and 24/7 liquidity will certainly equalize accessibility to high-grade financial investment possibilities,” he claimed.

Find Out More: RWA Tokenization: A Check Out Safety And Security and Count On

Significant banks, consisting of Goldman Sachs, JPMorgan, and Citi, are proactively discovering and buying tokenization innovations. In addition, speaking with companies like McKinsey and Boston Consulting Team anticipate the RWA market will certainly get to multi-trillion bucks by 2030. This projection and rate of interest mirror the substantial capacity and expanding rate of interest in tokenized properties.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt info. Nonetheless, visitors are recommended to validate realities individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.