As the Q2 revenues period covers, allow’s go into this quarter’s finest and worst entertainers in the customer staples market, consisting of McCormick (NYSE: MKC) and its peers.

The customer staples market consists of firms participated in the production, circulation, and sale of crucial, daily items. These items, likewise referred to as “staples,” are basic to day-to-day living and consist of packaged food, drinks and alcohol, individual treatment, and family items. Customer staples supplies are thought about protective financial investments due to the fact that customers usually acquire them despite financial problems. To stick out, firms need to have some mix of brand name acknowledgment, item high quality, and cost competition.

The 4 customer staples supplies we track reported an ok Q2; usually, incomes missed out on expert agreement quotes by 0.9%. Rising cost of living proceeded in the direction of the Fed’s 2% objective at the end of 2023, bring about solid stock exchange efficiency. The beginning of 2024 has actually been a bumpier trip, as the marketplace switches over in between positive outlook and pessimism around price cuts because of combined rising cost of living information, and while several of the customer staples supplies have actually gotten on rather much better than others, they jointly decreased, with share costs dropping 2.1% usually considering that the previous revenues outcomes.

McCormick (NYSE: MKC)

The traditional red Heinz catsup container’s rival, McCormick (NYSE: MKC) markets food-flavoring items like dressings, flavors, and spices blends.

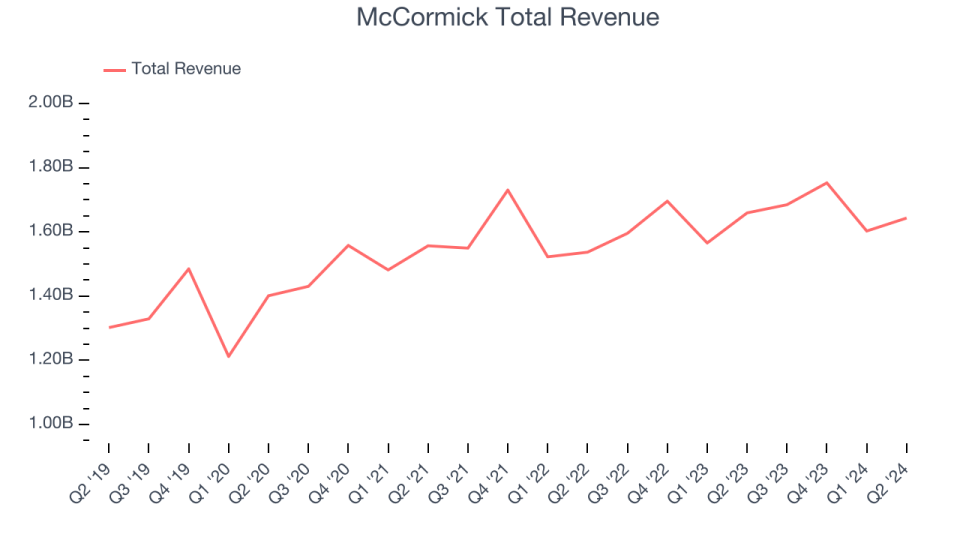

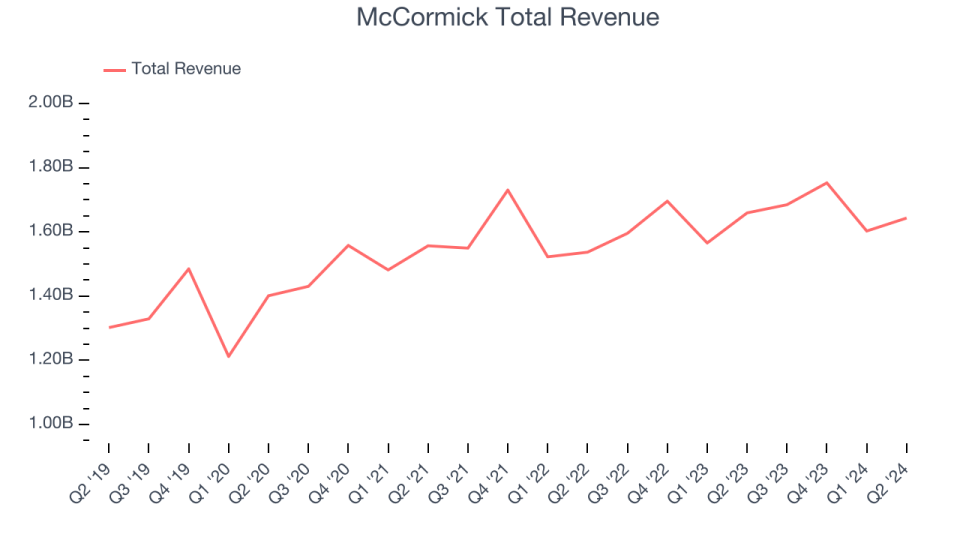

McCormick reported incomes of $1.64 billion, down 1% year on year, according to experts’ assumptions. It was a strong quarter for the business, with a good beat of experts’ natural earnings development and revenues quotes.

Brendan M. Foley, Head Of State and chief executive officer, mentioned, “We are pleased with our efficiency for the very first fifty percent of the year, which remained in line with our assumptions and shows the success of our focused on company financial investments to drive enhancing outcomes and fads. The financial investments we made in our Customer sector drove considerable consecutive quantity renovation in the 2nd quarter, bring about quantity development, and we anticipate proceeded energy for the 2nd fifty percent of the year. In Taste Solutions, reduced need from some fast solution dining establishment and packaged food clients incorporated with the timing of consumer tasks, affected our 2nd quarter efficiency. Our team believe our cooperation and solid technology pipe with our clients will certainly drive enhanced quantity efficiency in the 2nd fifty percent of the year.

McCormick racked up the largest expert approximates beat of the entire team. The supply is up 2.1% considering that the outcomes and presently trades at $69.09.

Is currently the moment to get McCormick? Access our full analysis of the earnings results here, it’s free.

Finest Q2: Constellation Brands (NYSE: STZ)

With a visibility in greater than 100 nations, Constellation Brands (NYSE: STZ) is an around the world popular manufacturer and marketing expert of beer, red wine, and spirits.

Constellation Brands reported incomes of $2.66 billion, up 5.8% year on year, disappointing experts’ assumptions by 0.4%. It was a strong quarter for the business, with positive revenues assistance for the complete year and a good beat of experts’ gross margin quotes.

Constellation Brands supplied the fastest earnings development amongst its peers. The supply is down 1.8% considering that the outcomes and presently trades at $254.09.

Is currently the moment to get Constellation Brands? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: General Mills (NYSE: GIS)

Finest recognized for its profile of giant morning meal grain brand names, General Mills (NYSE: GIS) is a packaged foods business that has actually likewise made a mark in grains, cooking items, and treats.

General Mills reported incomes of $4.71 billion, down 6.3% year on year, disappointing experts’ assumptions by 3%. It was a weak quarter for the business, with a miss out on of experts’ natural earnings development quotes.

General Mills had the weakest efficiency versus expert quotes and slowest earnings development in the team. The supply is down 6.6% considering that the outcomes and presently trades at $62.79.

Read our full analysis of General Mills’s results here.

Just Excellent Foods (NASDAQ: SMPL)

Finest recognized for its Atkins brand name that was influenced by the preferred diet plan of the exact same name, Just Excellent Foods (NASDAQ: SMPL) is a packaged food business whose offerings assist clients attain their healthy and balanced consuming or weight-loss objectives.

Just Excellent Foods reported incomes of $334.8 million, up 3.1% year on year, disappointing experts’ assumptions by 0.9%. It was an okay quarter for the business, with a good beat of experts’ gross margin quotes.

The supply is down 1.9% considering that the outcomes and presently trades at $35.47.

Read our full, actionable report on Simply Good Foods here, it’s free.

Sign Up With Paid Supply Capitalist Study

Assist us make StockStory much more handy to capitalists like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.