Bitcoin’s (BTC) rate is down 24% because peaking at $71,758 in very early June. As view continues to be rise, the following directional prejudice for the leader cryptocurrency depends upon 4 vital stories that remain to unravel.

Retail investors change their trading methods based upon market view, which discusses the extremely unstable nature of crypto.

Essential Variables Affecting Bitcoin Rate Currently

The $54,450 degree has actually provided as a feasible assistance for Bitcoin rate. 2 fell short break downs after the Family member Toughness Index (RSI) evaluated the vital limit of 30 recommend that BTC might have bad.

Nonetheless, whether a recuperation is lasting will certainly rely on exactly how the 4 macro market moving companies play out.

- Ethereum ETFs Introduce Can Inspire Favorable Market Belief

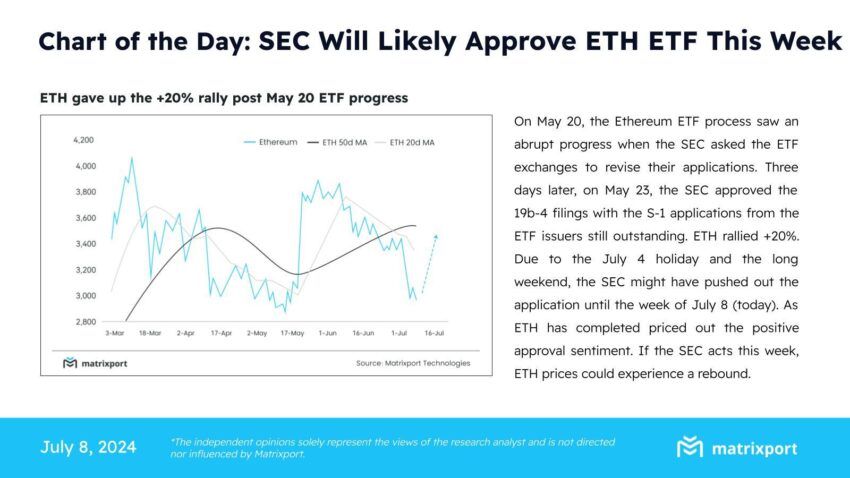

Crypto advocates sign up with Ethereum token owners to see whether Area Ethereum ETFs (Exchange-traded funds) will certainly start trading today. The United States Stocks and Exchange Compensation (SEC) gathered last S-1 Types from possible ETH ETF companies on Monday. This recommends development in the authorization procedure for these economic tools.

Crypto economic solutions system Matrixport shares the positive outlook. The company prepares for feasible launches today as the target date for companies to send modified S-1 filings gets to.

According to the record, development might be as swift as in May, when the regulatory authority green-lit the 19b-4 types just 3 days after entries.

In addition to the anticipated launch, the Matrixport record prepares for a 12% recuperation in the Ethereum rate to $3,400. This supposition comes as ETH leapt 20% in May after authorization of 19-b filings. Favorable view from an authorization is anticipated to overflow to Bitcoin, sustaining a recuperation.

Additionally Check Out: Ethereum ETF Clarified: What It Is and Exactly How It Functions

2. Mt. Gox Effect May Currently Be Priced In

Anxiousness around Mt. Gox payments remains to discolor as the marketplace has actually currently made up or valued in the influence. Mt. Gox Recovery Trustee launched payments in Bitcoin and Bitcoin Money (BCH) recently.

Bitstamp exchange, in contract with Mt. Gox, showed that it will certainly guarantee that financiers are made up asap. It highlighted a 60-day timeline for token circulation, with some lenders currently validating invoice. Sea serpent, among the 5 exchanges the trustee will certainly utilize for repayment, has a 90-day timeline.

Japan’s Bitbank and SBI VC Profession exchanges have currently obtained and apparently dispersed their assigned funds. In so doing, they properly defeated their 14-day timeline. As lender repayment by the inoperative exchange’s trustee proceeds, positive outlook remains to be recovered on the market.

This might bode well for Bitcoin rate, particularly if lenders do not money in upon function.

” Much of these lenders are lasting Bitcoiners, very early adopters that are technically proficient and have actually formerly turned down hostile deals to liquidate their cases for money,” Alex Thorn, Galaxy’s head of research study opined

3. German Federal government’s Bitcoin Sell-off

Considering That June 19, the German federal government has actually relocated greater than 10,000 BTC. This deserves nearly $1 billion in Bitcoin relocated to numerous crypto budgets and exchanges. This militarized the current Bitcoin sell-off as financiers front-run a feasible supply shock.

Nevertheless, based upon Arkham information, token equilibriums are diminishing in the govenment’s book.

There is supposition that the German federal government will ultimately reduce on Bitcoin purchases, which might play for the front runner crypto property. Among the nation’s MPs, Joana Cotar, that is a prominent crypto lobbyist, claimed German’s regional media had actually caught the phone call out, with financiers in the nation revealing temper.

” The German press selects it up,” Cotar wrote.

Find Out More: That Has one of the most Bitcoin in 2024?

4. Federal Get Chair Testament Today

Rising cost of living is progressively decreasing in the United States, and the nation’s economic situation is revealing stamina however is still away from satisfying degrees. With these, a soft touchdown promises, particularly after the July 5 favorable pay-roll information. The Federal Get’s long-awaited pivot in financial plan currently resembles an opportunity.

” Fed’s newest forecasts are maintaining financiers mindful. Less price cuts than expected are taxing riskier properties. Political unpredictability in Europe and a more powerful USD are pressing BTC down,” a preferred account on X wrote.

Crypto markets remain to really feel the warm of these macro occasions. Today is vital as Fed Chair Jerome Powell prepares to deal with Congress on July 9 and 10.

Please Note

In accordance with the Count on Task standards, this rate evaluation post is for informative objectives just and ought to not be thought about economic or financial investment recommendations. BeInCrypto is devoted to exact, impartial coverage, however market problems undergo alter without notification. Constantly perform your very own research study and talk to a specialist prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.