Over the last couple of months, altcoin costs have actually gone down 30% to 70%, leading experts to cross out the opportunity of an altcoin period. However when furnished with brand-new info, BeInCrypto discovers that points might will alter.

This evaluation clarifies the reasoning behind the idea while using understandings right into the possible stimulants.

Very Early Days However the Indicators Have Actually Shown Up

Altcoin period remains in a market stage where non-Bitcoin (BTC) cryptocurrencies sign up a constant rise in worth while surpassing the primary coin.

Among the signs confirming this duration is TOTAL2, which is the crypto overall market cap, omitting BTC. When this market cap boosts, it offers support to the possible boost in the costs of altcoins.

Nonetheless, a reduction suggests that Bitcoin is controling the marketplace. At press time, the overall altcoin market cap stands at $940.37 billion– a 4.87% boost in the last 24 hr. The very same market cap had actually at first visited 23.26% in between June 6 and July 8.

Find Out More: Which Are the very best Altcoins to Purchase July 2024

If the sign’s worth remains to boost, the altcoin period will certainly be better. The last time such took place was in between February and March. During that time, the worth of TOTAL2 went from $753.83 billion to $1.24 trillion within a month.

Adhering to the current modification, experts on X appear to be transforming their position, preferring the supremacy of altcoins. Among them is Michaël van de Poppe, owner of MN Trading.

” The Altcoin market capitalization has actually gotten to an essential greater duration assistance degree and discovers assistance below. It’s still very early in the week, however if today proceeds this higher fad, after that the indications will certainly begin to boost.” van de Poppe opined on X.

Bitcoin Supremacy Goes Back, May Open Doors for Altcoins

In addition to point of views, an additional variable that establishes if altcoins’ time to beam is below is Bitcoin’s supremacy. For the cycle to be confirmed, the BTC.D needs to reduce.

Utilizing the regular graph, we observe that the BTC.D dropped from 62.69% in March 2021 to 40.89% in May of the very same year. Background reveals that this was around the very same duration numerous altcoins strike their all-time highs in the last advancing market.

Today, the supremacy has actually dropped from 55.04% to 54.68%, showing that some altcoins have actually started to outmatch BTC.

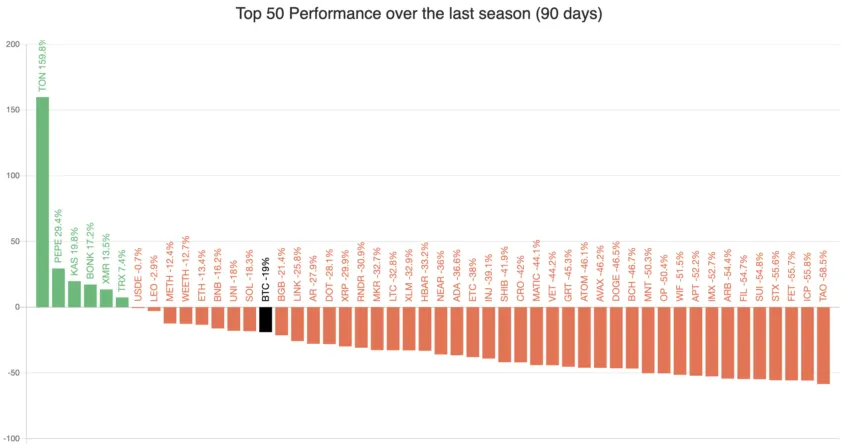

For this to mirror the efficiency received 2021, a minimum of 75% of the leading 50 altcoins need to do far better than Bitcoin.

According to information from Blockchaincenter, just a few cryptocurrencies, consisting of meme coins, have actually done that. A few of them consist of Toncoin (LOT), Pepe (PEPE), Kaspa (KAS) and Bonk (BONK).

Because of this, the Altcoin Period Index over the last 90 days continues to be at 29. Nonetheless, this is a renovation from the checking out a couple of days back when it was 25.

Ought to the index remain to strike greater worths, altcoins will certainly obtain closer to retesting their all-time highs, placing BTC on the back foot while doing so.

Find Out More: What Are Altcoins? An Overview to Option Cryptocurrencies

Ethereum, Solana’s Function Essential

In Addition, it is very important to state that Ethereum (ETH) has actually constantly worked as a driver for promoting altcoin supremacy.

Within the last couple of months, ETH has actually underperformed contrasted to BTC. Nonetheless, the upcoming authorization of the place Ethereum ETFs might stimulate a noteworthy boost in ETH’s worth.

If this holds true, various other altcoins might sign up with the possible rally. In Capo of Crypto’s instance, the upgrade on the ETH ETFs, along with the main applications for Solana ETFs by VanEck and 21Shares, is why the expert is favorable on altcoins.

” Offering stress from the German Federal government is being soaked up. All place Ethereum ETF candidates have actually submitted upgraded S-1s. VanEck & & 21Shares have actually formally submitted 19b-4s for place Solana ETFs. I’m favorable for the following couple of weeks, particularly on altcoins.” Capo of Crypto wrote.

Based upon the evaluation over and market belief, altcoins appear like they are established for a large pump. Nonetheless, investors require to watch out.

If marketing stress strikes the marketplace once again, the walk can be revoked. Additionally, if Ethereum does not obtain remarkable inflows right into the ETFs, the cryptocurrencies might have a hard time to leap.

Please Note

According to the Count on Job standards, this rate evaluation short article is for educational functions just and ought to not be thought about monetary or financial investment guidance. BeInCrypto is dedicated to precise, impartial coverage, however market problems undergo alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.