On Monday, Matthew Sigel, head of electronic possessions research study at VanEck, a significant American financial investment monitoring company based in New york city with $89.5 billion in possessions under monitoring, talked about the present Bitcoin market scenario. As the sixth-largest company people place Bitcoin ETFs, with $497 million in current inflows, VanEck’s evaluation on Bitcoin is specifically notable.

In a note for customers, shared on X, Sigel offers understandings right into the present aspects driving the Bitcoin cost changes. He associates the down stress of the previous days largely to considerable Bitcoin sales by federal government entities and worries over the impending huge circulations from the Mt. Gox estate.

” The Mt Gox trustee presently holds around $8 billion of bitcoins, and they have actually relocated with a goal to disperse regarding $3 billion well worth of the $8 billion,” Sigel clarified. He shared unpredictability relating to whether the lenders, readied to obtain these circulations from very early July, would certainly offer or keep their Bitcoins. “Provided the criterion established by GBTC, we prepare for that a minimum of a quarter of these coins will certainly be held,” he included.

Sigel additionally clarified the effect on the most up to date BTC steps by the United States and German federal governments. According to information from Arkham, Germany has actually sold off over half of the 50,000 BTC at first confiscated from the piracy internet site Movie2k.

This telegramed marketing has actually alarmed the marketplace, and came with a time where the United States federal government additionally lowered their BTC holdings. The last holds a significant 213,297 BTC (around $12 billion). Sigel indicated a considerable transfer of $240 million to Coinbase Prime on June 26th, most likely showing a sale.He additionally talked about the tactical effects of these sales, recommending they were perhaps made throughout a market duration conscious liquidity lacks, such as the United States July fourth vacation.

” This weak cost activity most likely shows spiteful federal government marketing right into what was a reasonably slim July fourth market, with an overhang of even more sales possibly in advance,” he kept in mind. Sigel additionally referenced current conjecture by Trump experts on the facility of a United States federal government tactical Bitcoin get, as reported by Forbes, which might indicate a huge change in national politics.

Why VanEck Stays Careful, However Favorable On Bitcoin

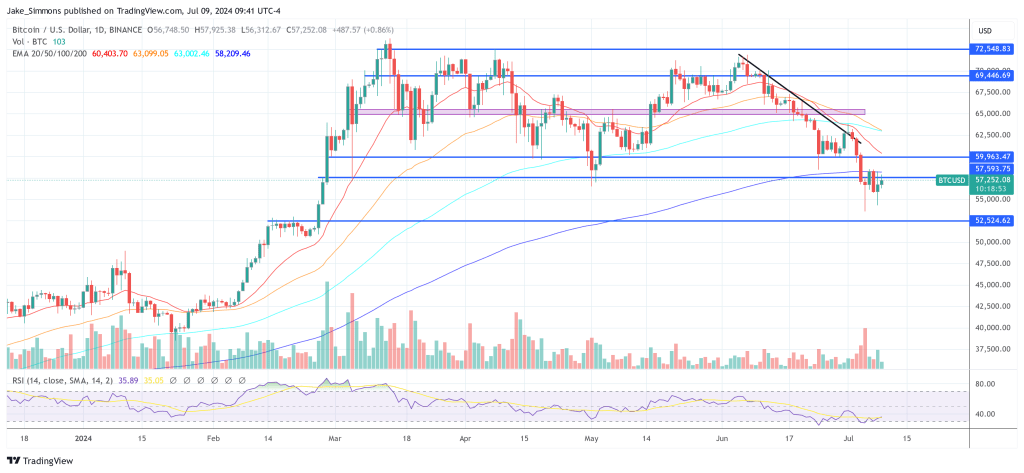

Resolving wider market patterns, Sigel observed that throughout advancing market stages, Bitcoin seldom drops listed below its 200-day relocating standard (MAVG) for greater than 6 weeks. The current federal government sales, nevertheless, might change this pattern if they proceed or are intensified by various other adverse information.

Regardless of these stress, Sigel stays hopeful regarding the macroeconomic problems, pointing out a slowdown in rising cost of living and a prospective soft touchdown for the United States economic situation. “The upcoming political election might militarize fresh all-time highs in BTC as the marketplace rates in 4 even more years of budget deficit and possibly a friendlier United States regulative background under a Trump management,” he guessed.

On a worldwide range, Bitcoin fostering is increasing, specifically in arising and frontier markets. Sigel highlighted current efforts by Kenya, Ethiopia, and Argentina to use government-owned power sources for Bitcoin mining, showing an expanding acknowledgment of BTC’s possible energy and worth.

To conclude, Sigel reasserted VanEck’s financial investment approach, supporting a regimented technique to BTC allowance within varied profiles. “We remain to advise a buck expense balancing approach to acquire Bitcoin, taking into consideration 6% as a sensible placement dimension for BTC & & ETH in the majority of 60/40 benchmarked profiles,” he mentioned.

At press time, BTC traded at $57,252.

Included picture developed with DALL · E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.