Mega-cap development supplies remain to control the wider market and add the mass of gains in the significant indexes like the S&P 500 and Nasdaq Compound Yet the large worth of a few of the biggest business may stun you.

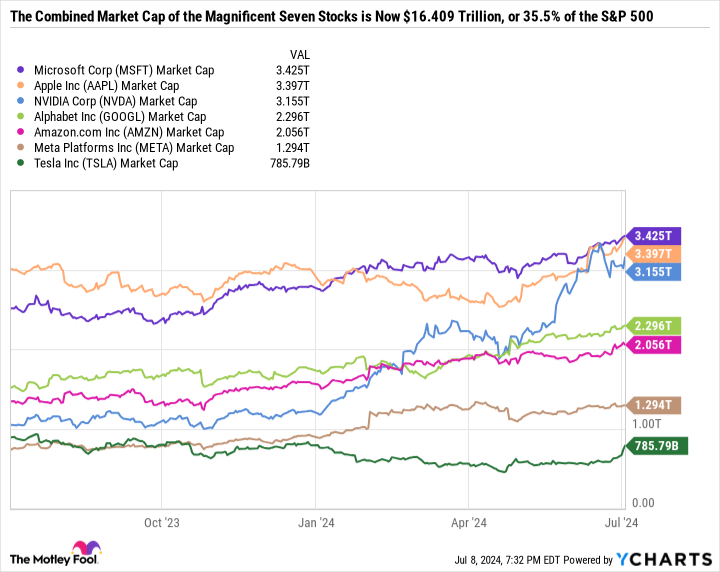

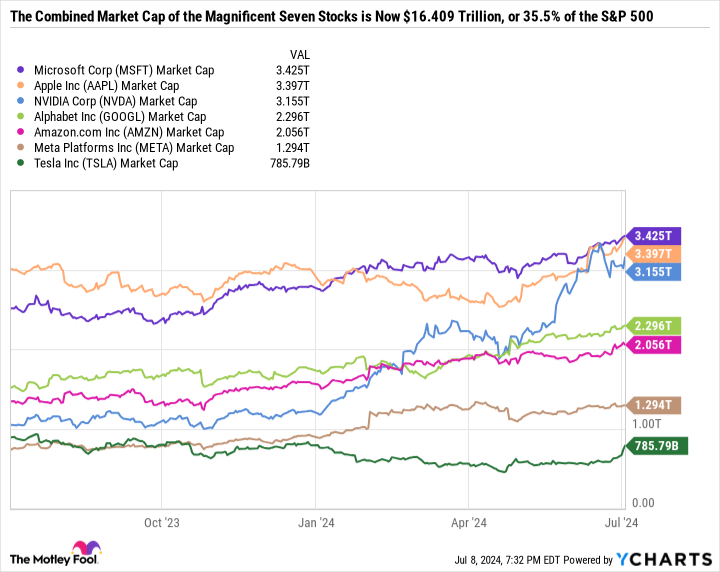

The “Splendid 7” is a term created by Financial Institution of America expert Michael Hartnett to explain 7 industry-leading tech-focused business: Microsoft ( NASDAQ: MSFT), Apple ( NASDAQ: AAPL), Nvidia ( NASDAQ: NVDA), Alphabet ( NASDAQ: GOOGL) ( NASDAQ: GOOG), Amazon ( NASDAQ: AMZN), Meta Systems ( NASDAQ: META), and Tesla ( NASDAQ: TSLA)

These 7 business are currently so important that they compose a mixed 35.5% of the S&P 500. Right here’s what these transforming market characteristics imply for the securities market and just how to place your profile in a manner that matches your threat resistance and aids you accomplish your financial investment goals.

A double-edged sword

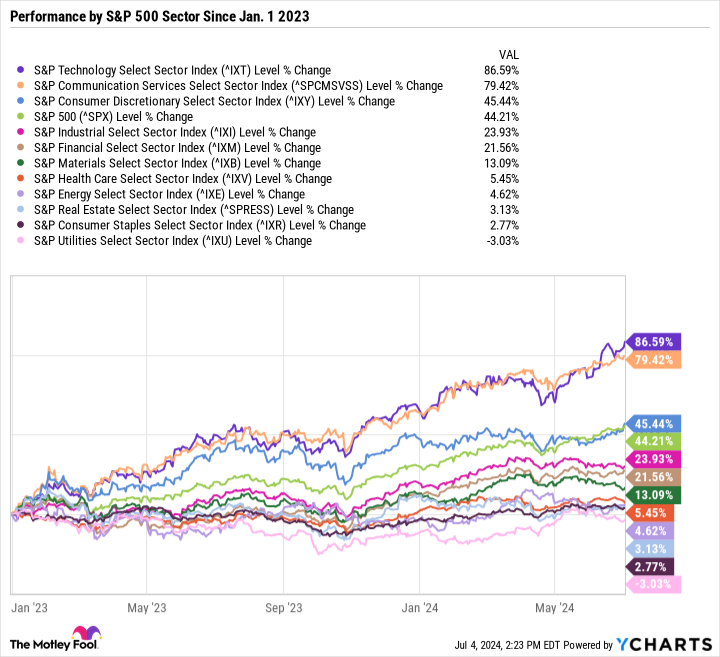

The S&P 500 is up over 44% considering that completion of 2022. The key factor is that the industries including Splendid 7 supplies are outmatching the S&P 500 in its entirety, while the various other 8 industries are underperforming.

Microsoft, Apple, and Nvidia remain in the technology field. Alphabet and Meta Systems lead the interactions field. And Amazon and Tesla remain in the customer optional field.

Big supplies can relocate the marketplace when they set up beast gains, specifically if you consider substantial business that drop outside the Splendid 7– such as Broadcom ( NASDAQ: AVGO), which is now valued at more than $800 billion and is up greater than threefold considering that completion of 2022.

The Splendid 7 are so important that they can solitarily stimulate a supposed adjustment in the S&P 500. A correction is an autumn of 10% to 20% in a significant market index, so a typical decrease of 28% in the Splendid 7 would certainly place the S&P 500 in adjustment area. That mathematics does not also consider substantial supplies like Broadcom that would likely drop in lockstep with a significant sell-off in Nvidia and various other technology supplies.

In this capillary, the Splendid 7’s impact prolongs past their weight in the S&P 500. The team has actually been driving beast gains in the index throughout the previous 18 months approximately, however the bigger it ends up being, the much more at risk the marketplace will certainly be to a growth-driven sell-off.

Assumptions are high

Despite your financial investment time perspective or threat resistance, it is very important to be knowledgeable about the S&P 500’s make-up, specifically when it goes through a substantial remodeling. The index adjustments based upon the economic situation’s advancement and capitalist belief. Simply put, it’s a relocating target, or standard, driven by various styles at various times.

Some financiers could be anxious regarding the marketplace’s fairly pricey price, with the S&P 500’s price-to-earnings (P/E) proportion resting at nearly 29. Also if the marketplace rally is exhausted, placing brand-new resources to function– also at document highs– has actually traditionally been a winning method for financiers.

There’s additionally a situation to be made that the marketplace is worthy of to be much more pricey. If the S&P 500 expands incomes much faster since the weighting of development supplies raises, after that it would certainly stand to reason the P/E proportion ought to be greater too.

Spending is much more regarding where a business is headed than where it is today. Therefore much, mega-cap development supplies have actually primarily supplied on incomes development. As an example, Amazon is still not extremely misestimated in spite of seeing its supply cost greater than dual throughout the previous 18 months.

A high P/E generally indicates that financiers agree to pay a greater cost for a business about its incomes today since they anticipate incomes to be greater in the future. Nevertheless, if development slows down and assumptions boil down, it can bring about a substantial sell-off.

The essential takeaway is that the S&P 500’s assessment has actually ended up being based progressively on future possible incomes, whereas a couple of years earlier, one of the most important business– customer staples titans, financial institutions, and oil and gas companies– were valued much more on their previous incomes. Huge gains might proceed if business supply the development that financiers anticipate, however there might additionally be greater volatility out there.

Develop a profile that’s right for you

Provided the pricey assessment of the S&P 500 and its weak 1.3% returns return, worth- and income-focused financiers might think about incorporating high quality returns supplies and exchange-traded funds (ETFs) right into a varied profile.

As a beginning factor, Coca-Cola ( NYSE: KO) and PepsiCo ( NASDAQ: PEP) profession at discount rates to the S&P 500, are both Returns Kings (with over 50 successive years of returns boosts), and both have returns returns of greater than 3%.

The SPDR Dow Jones Industrial Standard ETF ( NYSEMKT: DIA) mirrors the efficiency of that index and has a 1.8% return and a 23.3 P/E– making it a great choice for individuals wanting to stick to blue chip supplies however via a worth lens.

There are a lot of inexpensive Lead ETFs that can supply a life time of easy earnings, such as the Lead High Returns Return ETF ( NYSEMKT: VYM), Lead Customer Staples ETF ( NYSEMKT: VDC), and the Lead Utilities ETF ( NYSEMKT: VPU) Targeting lower-growth, higher-yield industries can be a reliable method to stabilize a profile that is greatly alloted in development supplies.

Readjusting with the moments

In the beginning glimpse, the marketplace may look misestimated since the S&P 500 has a filled with air P/E proportion. Yet that’s primarily since it is currently greatly heavy in rising mega-cap development supplies.

Lots of pockets of the marketplace are including high quality worth and earnings supplies. Currently is the best time for financiers to carry out a profile testimonial and upgrade their watch listings to guarantee they strike their passive-income objectives while straightening their financial investments with their threat resistance.

Do not miss this 2nd opportunity at a possibly rewarding possibility

Ever before seem like you failed in getting one of the most effective supplies? After that you’ll intend to hear this.

On uncommon events, our professional group of experts problems a “Double Down” stock suggestion for business that they believe will stand out. If you’re fretted you have actually currently missed your opportunity to spend, currently is the very best time to get prior to it’s far too late. And the numbers promote themselves:

-

Amazon: if you spent $1,000 when we increased down in 2010, you would certainly have $22,525! *

-

Apple: if you spent $1,000 when we increased down in 2008, you would certainly have $42,768! *

-

Netflix: if you spent $1,000 when we increased down in 2004, you would certainly have $372,462! *

Now, we’re releasing “Dual Down” informs for 3 unbelievable business, and there might not be an additional opportunity such as this anytime quickly.

* Supply Expert returns since July 8, 2024

Financial Institution of America is an advertising and marketing companion of The Climb, a firm. Suzanne Frey, an exec at Alphabet, belongs to The ‘s board of supervisors. John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The ‘s board of supervisors. Randi Zuckerberg, a previous supervisor of market advancement and spokesperson for Facebook and sis to Meta Operating systems Chief Executive Officer Mark Zuckerberg, belongs to The ‘s board of supervisors. Daniel Foelber has no placement in any one of the supplies discussed. The has placements in and suggests Alphabet, Amazon, Apple, Financial Institution of America, Meta Operatings Systems, Microsoft, Nvidia, Tesla, and Lead Whitehall Funds-Vanguard High Returns Return ETF. The suggests Broadcom and suggests the adhering to alternatives: lengthy January 2026 $395 contact Microsoft and brief January 2026 $405 contact Microsoft. The has a disclosure policy.

35% of the S&P 500 Is Concentrated in the “Magnificent Seven.” Here’s What That Means for Your Portfolio. was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.