Starbucks ( NASDAQ: SBUX) and Coca-Cola ( NYSE: KO) have a whole lot alike. Besides providing caffeinated beverages to a parched globe, both business likewise have shareholder-friendly reward plans– and their supplies have actually underperformed the stock exchange over the in 2015. Coca-Cola’s overall return over that duration is simply 8.7%, while Starbucks saw a 20.5% worth decrease rather, and the S&P 500 obtained 28.6%.

To put it simply, these home names include solid reward returns and the pledge of ongoing payment increases for several years to find. And in my eyes, the reports of Starbucks’ and Coke’s death have actually been considerably overemphasized. The top-shelf top quality supplies get on fire sale now.

If you’re trying to find a great dividend stock to buy today, you ought to take into consideration increasing down on Coca-Cola and Starbucks. Below’s why.

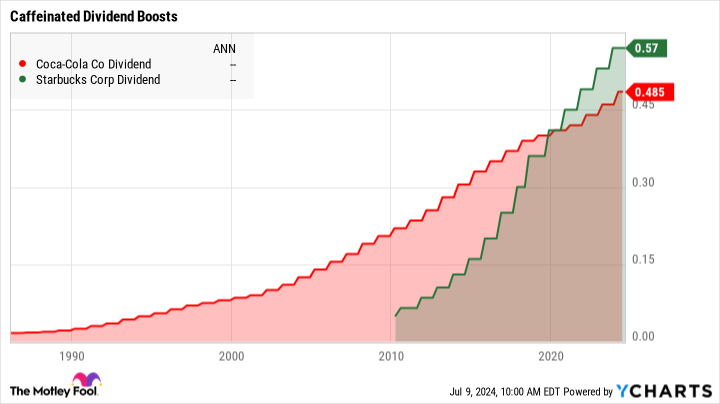

A common background of reward rises

As you can see in the graph above, Starbucks and Coca-Cola remain in the practice of boosting their reward payments each year.

Coca-Cola’s reward development background is dramatically much longer, covering numerous years. This lasting development offers capitalists with a complacency and predictability, which is specifically appealing for those looking for secure revenue. If Coke has actually elevated its payments via thick and slim for 63 years (which it did), the firm promises to proceed increasing those quarterly reward checks no matter slumps and organization difficulties in the future.

On the other hand, the eco-friendly Starbucks line might be much shorter however likewise features a much steeper development trajectory. After beginning its reward repayments in the springtime of 2010, Starbucks has actually swiftly raised its payments. This lively plan fad shows the firm’s vibrant development and solid monetary wellness.

Coca-Cola provides a much more constant and traditionally dependable reward, which may be more effective for conventional capitalists that seek lasting security most of all else. On the various other hand, Starbucks’ greater reward development price can interest capitalists that want to tackle a little bit much more run the risk of for the capacity of greater returns.

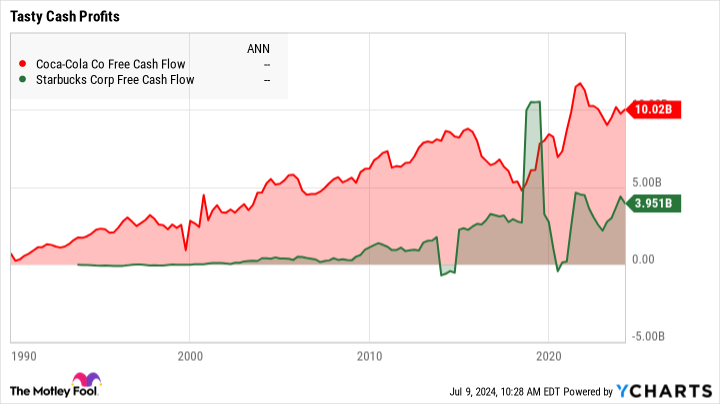

Durable complimentary capital sustaining the payments

The graph over programs you the durable complimentary capital behind those welcoming reward payments. It’s wonderful to see rewards funded by solid capital, and these wonderful business supply that top quality with gusto. Coca-Cola invested 79% of its complimentary capital on reward repayments over the in 2015, and Starbucks’ cash-based payment proportion quit at 63%.

Currently, both Starbucks and Coca-Cola are dealing with substantial organization difficulties. Changing customer choices are constantly an issue, in addition to a perpetual increase of brand-new opponents.

Nevertheless, these business resolve their difficulties in extremely various methods. Starbucks is increasing down on its costs picture, broadening its premium Book shops andpersonalized digital experiences As component of the electronic technique, the firm is utilizing its commitment program to raise client involvement and retention.

Coca-Cola, on the various other hand, is expanding its item profile, relocating past sweet soft drinks right into a wide series of much healthier alternatives like mineral water, teas, and plant-based beverages. It’s likewise spending greatly in lasting product packaging options to attend to expanding ecological issues.

Both business are proactively adjusting to the altering landscape, however their methods mirror their distinct toughness and ultra-familiar brand name identifications.

Carbonated rewards for the long run

With their significant capital and clever methods, both Coca-Cola and Starbucks are readied to maintain those reward repayments streaming for several years to find. These business have durable complimentary capital that not just cover their rewards however likewise leave a lot of area for development and technology.

With its decades-long background of secure rewards, Coca-Cola resembles a trusted close friend that’s constantly there when you require them. You can depend on it to maintain supplying those quarterly checks, come rainfall or sparkle.

Starbucks is an energised family member novice with a fast development fad. It gets on a roll, swiftly increasing its payments and revealing no indications of decreasing.

These business are masters of handling organization difficulties and playing to their toughness. For reward capitalists, the future with Coca-Cola and Starbucks looks brilliant and safe and secure– and their supplies ought to quickly recoup from this year’s cost dip. It’s about time to do something about it and purchase some shares of these marked down sector titans today.

Should you spend $1,000 in Starbucks now?

Prior to you purchase supply in Starbucks, consider this:

The Supply Expert expert group simply recognized what they think are the 10 best stocks for capitalists to purchase currently … and Starbucks had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Take Into Consideration when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $785,556! *

Supply Expert offers capitalists with an easy-to-follow plan for success, consisting of advice on developing a profile, normal updates from experts, and 2 brand-new supply choices every month. The Supply Expert solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

* Supply Expert returns since July 8, 2024

Anders Bylund has no placement in any one of the supplies pointed out. The has settings in and advises Starbucks. The has a disclosure policy.

2 Dividend Stocks to Double Up on Right Now was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.