Earnings outcomes usually point out what course an organization will take within the months forward. With Q1 now behind us, let’s take a look at Purple Robin (NASDAQ:RRGB) and its friends.

Sit-down eating places provide a whole eating expertise with desk service. These institutions span numerous cuisines and are famend for his or her heat hospitality and welcoming ambiance, making them excellent for household gatherings, particular events, or just unwinding. Their intensive menus vary from appetizers to indulgent desserts and wines and cocktails. This house is extraordinarily fragmented and competitors consists of every thing from publicly-traded corporations proudly owning a number of chains to single-location mom-and-pop eating places.

The 14 sit-down eating shares we observe reported an okay Q1; on common, revenues missed analyst consensus estimates by 0.9%. Valuation multiples for a lot of progress shares haven’t but reverted to their early 2021 highs, however the market was optimistic on the finish of 2023 on account of cooling inflation. The beginning of 2024 has been a special story as blended indicators have led to market volatility, and whereas a number of the sit-down eating shares have fared considerably higher than others, they collectively declined, with share costs falling 1.5% on common for the reason that earlier earnings outcomes.

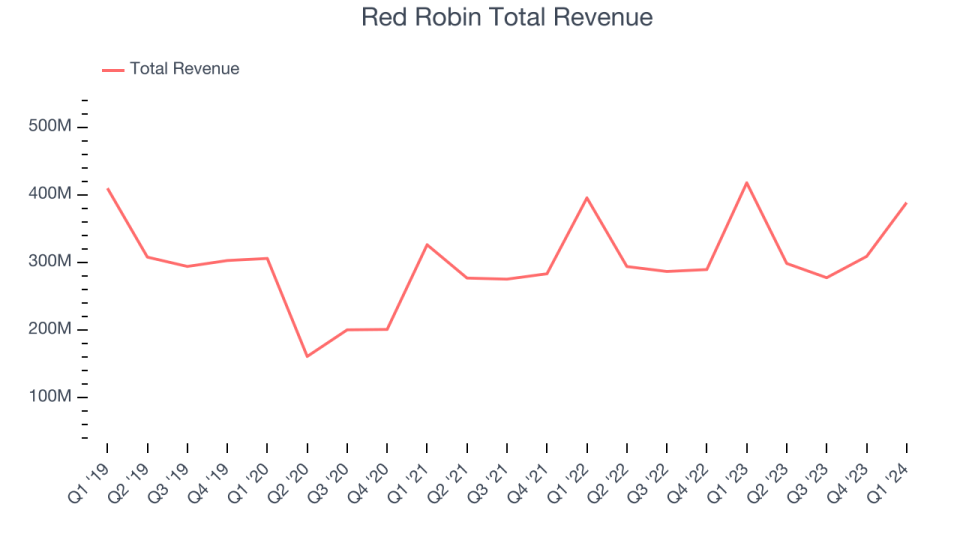

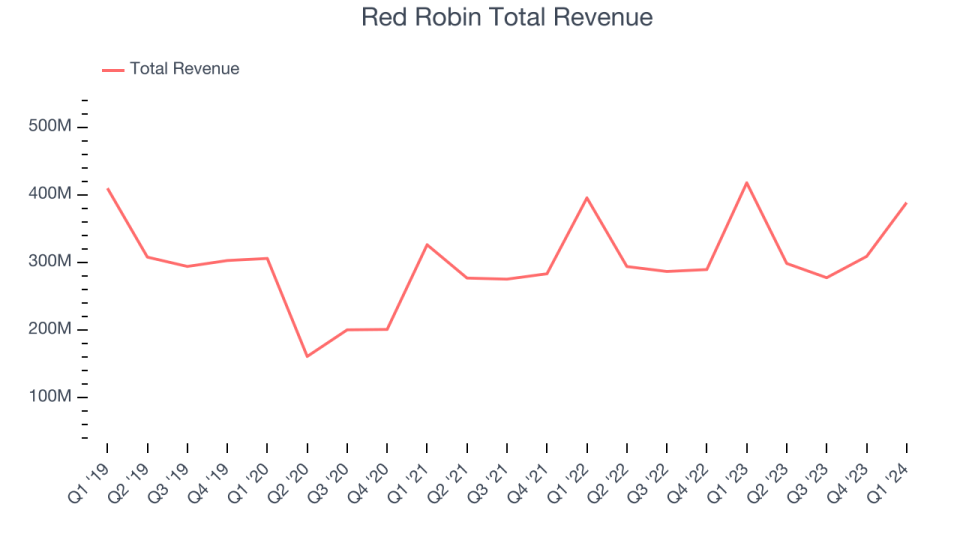

Purple Robin (NASDAQ:RRGB)

Recognized for its bottomless steak fries, Purple Robin (NASDAQ:RRGB) is a series of informal eating places specializing in burgers and common American fare.

Purple Robin reported revenues of $388.5 million, down 7% yr on yr, falling wanting analysts’ expectations by 1.1%. It was a blended quarter for the corporate: Purple Robin beat analysts’ gross margin expectations. Its full-year income and adjusted EBITDA steering was maintained and got here in increased than Wall Road’s estimates. Alternatively income and EPS missed analysts’ expectations.

Purple Robin delivered the slowest income progress of the entire group. The inventory is up 18.3% for the reason that outcomes and at present trades at $8.

Read our full report on Red Robin here, it’s free.

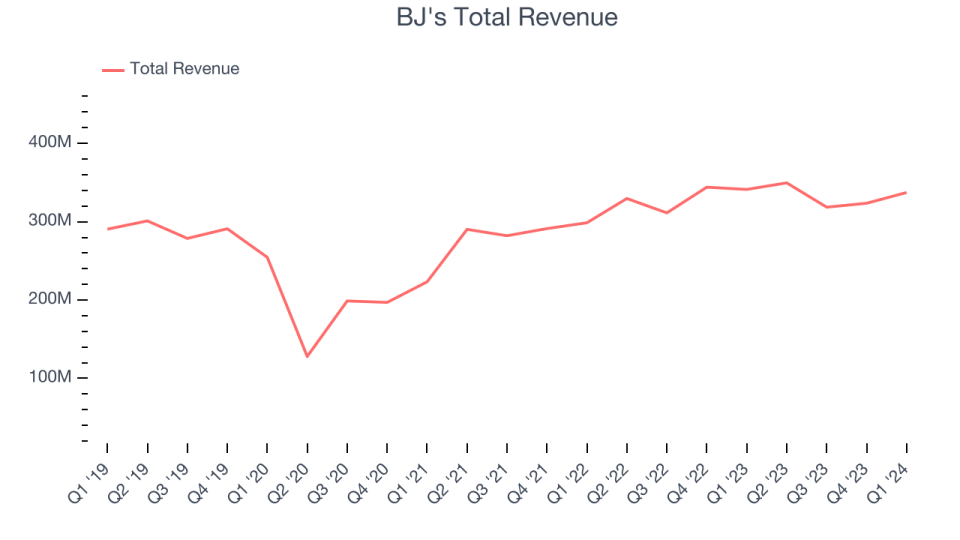

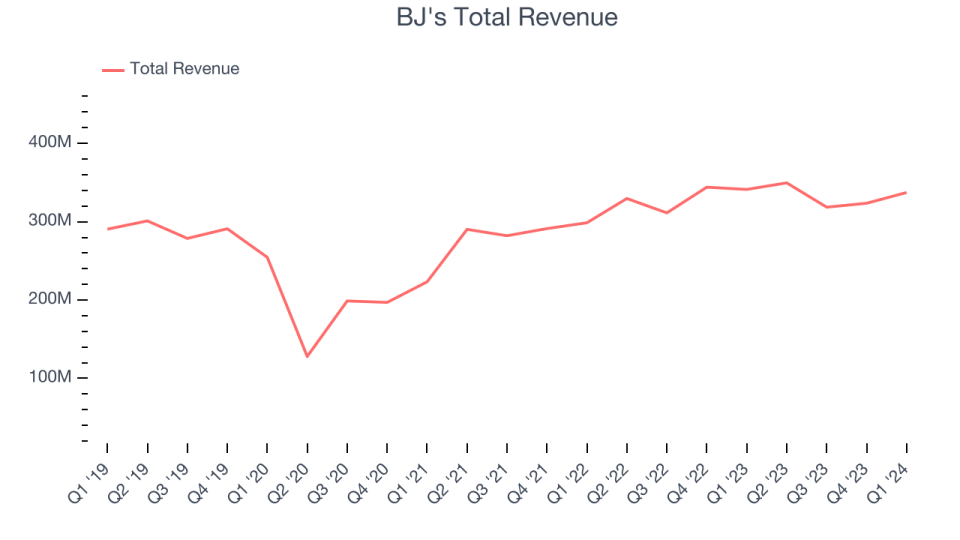

Greatest Q1: BJ’s (NASDAQ:BJRI)

Based in 1978 in California, BJ’s Eating places (NASDAQ:BJRI) is a series of eating places whose menu options traditional American dishes, usually with a twist.

BJ’s reported revenues of $337.3 million, down 1.2% yr on yr, according to analysts’ expectations. It was an distinctive quarter for the corporate, with a formidable beat of analysts’ earnings and gross margin estimates.

The inventory is up 8.2% for the reason that outcomes and at present trades at $35.41.

Is now the time to purchase BJ’s? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Dine Manufacturers (NYSE:DIN)

Working a franchise mannequin, Dine Manufacturers (NYSE:DIN) is an off-the-cuff restaurant chain that owns the Applebee’s and IHOP banners.

Dine Manufacturers reported revenues of $206.2 million, down 3.5% yr on yr, falling wanting analysts’ expectations by 2%. It was a weak quarter for the corporate, with a miss of analysts’ earnings and gross margin estimates.

The inventory is down 13.6% for the reason that outcomes and at present trades at $37.72.

Read our full analysis of Dine Brands’s results here.

First Watch (NASDAQ:FWRG)

Based mostly on a nautical reference to the primary work shift aboard a ship, First Watch (NASDAQ:FWRG) is a series of breakfast and brunch eating places whose menu is heavily-focused on eggs and griddle gadgets similar to pancakes.

First Watch reported revenues of $242.4 million, up 14.7% yr on yr, falling wanting analysts’ expectations by 1.1%. It was a robust quarter for the corporate, with a formidable beat of analysts’ gross margin estimates and a good beat of analysts’ earnings estimates.

The inventory is down 25.8% for the reason that outcomes and at present trades at $18.65.

Read our full, actionable report on First Watch here, it’s free.

Brinker Worldwide (NYSE:EAT)

Based by Norman Brinker in Dallas, Texas, Brinker Worldwide (NYSE:EAT) is an off-the-cuff restaurant chain that operates below the Chili’s, Maggiano’s Little Italy, and It’s Simply Wings banners.

Brinker Worldwide reported revenues of $1.12 billion, up 3.4% yr on yr, falling wanting analysts’ expectations by 0.1%. It was a really robust quarter for the corporate, with a formidable beat of analysts’ gross margin estimates and optimistic earnings steering for the complete yr.

The inventory is up 37.2% for the reason that outcomes and at present trades at $68.1.

Read our full, actionable report on Brinker International here, it’s free.

Be a part of Paid Inventory Investor Analysis

Assist us make StockStory extra useful to buyers like your self. Be a part of our paid person analysis session and obtain a $50 Amazon reward card to your opinions. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.