Chainlink (LINK) jumped to $16.21 on June 12. Hours later, the worth retraced, suggesting the preliminary hike was a false breakout.

Nonetheless, curiosity within the decentralized Oracle community’s native token heightened as buying and selling quantity soared above $450 million over the previous 24 hours.

Quantity Rises, Community Underrated

As of this writing, the LINK worth trades at $15.55, a ten.65% lower within the final seven days. Chainlink’s surge on Wednesday was pushed by the Client Worth Index (CPI) consequence, which noticed inflation drop under the anticipated forecasts.

Because of this, the broader crypto market—LINK inclusive—posted notable beneficial properties. Nonetheless, the upswing was short-lived, as Bitcoin (BTC), alongside different altcoins, erased a few of these beneficial properties.

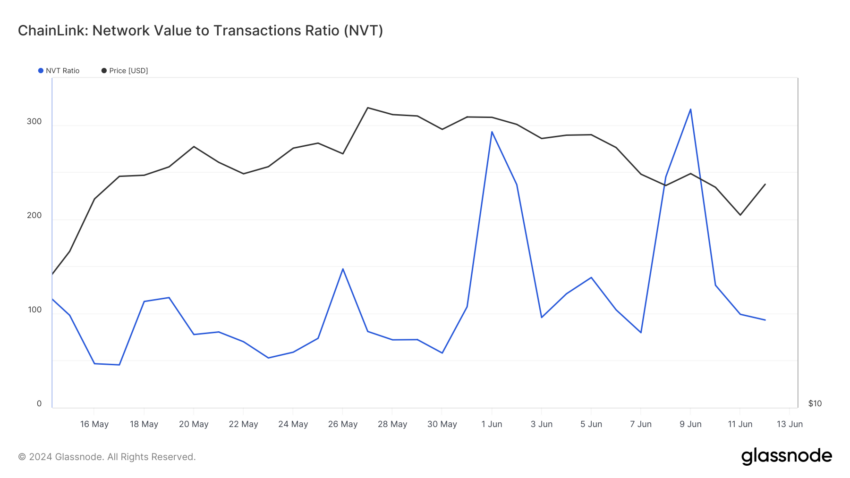

Regardless of the decline, LINK appears near a place which will drive one other uptrend. The Community Worth to Transaction (NVT) Ratio reveals proof of this. One other proof is mirrored within the Market Worth to Realized Worth (MVRV) Ratio.

- Community Worth to Transaction (NVT) Ratio: This metric outcomes from dividing the market cap by the amount transacted on-chain. With the result, one can inform if a community is undervalued or overvalued.

- Market Worth to Realized Worth (MVRV) Ratio: That is the ratio between a cryptocurrency’s market worth and its realized worth. It makes use of the extent of profitability to inform whether or not the worth has hit an area prime or is near the underside. As such, merchants can use it to identify potential accumulation and distribution ranges.

Learn extra: Methods to Purchase Chainlink (LINK) With a Credit score Card: A Step-by-Step Information

In line with information from Glassnode, Chainlink’s NVT Ratio fell to 93.04. Usually, a excessive NVT Ratio implies that the market cap is outpacing the expansion of the transaction quantity. Oftentimes, because of this the community is overvalued and coincides with the premium worth of a token.

Nonetheless, for the reason that ratio was low for LINK, transaction quantity has outperformed the venture’s market cap. Due to this fact, the token is undervalued because the community effectively handles many transactions.

Chainlink Presents a Probability to Purchase

Additional, on-chain information offered by Santiment reveals that the 30-day MVRV ratio was -9.02%. This adverse studying implies that if LINK holders promote on the present worth, the common return will end in a loss across the aforementioned area.

Nonetheless, historic information proves that the decline could also be a chance zone for market members to scoop LINK at decrease costs.

Because the chart under reveals, LINK’s worth bounces as soon as the MVRV Ratio closes between -6% and -21%. For instance, the token’s worth elevated from $12.96 to $18.77 in lower than two weeks. This occurred between Could 15 and 28. At the beginning of the run, Chainlink’s MVRV ratio was -6.45%.

One other situation occurred in April when the metric was -21.37%. Throughout that interval, LINK went from $13.08 to $15.62.

Learn extra: Chainlink (LINK) Worth Prediction 2024/2025/2030

LINK Worth Prediction: Revival May Be Dicey

Contemplating the historic evaluation and LINK’s present state, mentioning {that a} worth improve could also be shut is just not misplaced. If validated, the worth of LINK will slowly transfer up the chart. As well as, this may increasingly lead the token to $17.70 inside every week or two.

In a extremely bullish market situation, the worth of LINK might rally above $18.57. Nonetheless, indications from the liquidation heatmap might invalidate this prediction.

- Liquidation heatmap: This indicator predicts the place large-scale liquidations might happen. Merchants can use the heatmap to establish excessive areas of liquidity (normally coloured in yellow). Moreover, the focus of potential excessive liquidity areas can appeal to costs towards the area.

In line with Coinglass, a magnetic liquidity zone exists at $15.04, suggesting that LINK’s worth might fall to that area if the uptrend will get rejected.

At this level, bulls stand to lose $174,610. To keep away from such losses, merchants might must set appreciable stop-loss targets above the potential liquidation worth.

Disclaimer

According to the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.