Information reveals that Bitcoin lively addresses have plunged, however the transaction depend has been round an all-time excessive (ATH). Right here’s why this can be so.

Bitcoin Energetic Addresses And Transaction Rely Have Diverged Just lately

In keeping with the most recent weekly report from Glassnode, the Bitcoin community has been displaying a divergence in its activity-related metrics just lately. The symptoms in query are the Energetic Addresses and the Transaction Rely.

First, the Energetic Addresses retains observe of the distinctive variety of addresses collaborating in some transaction exercise on the blockchain each day. This metric’s worth is basically analogous to the lively consumer depend for the community.

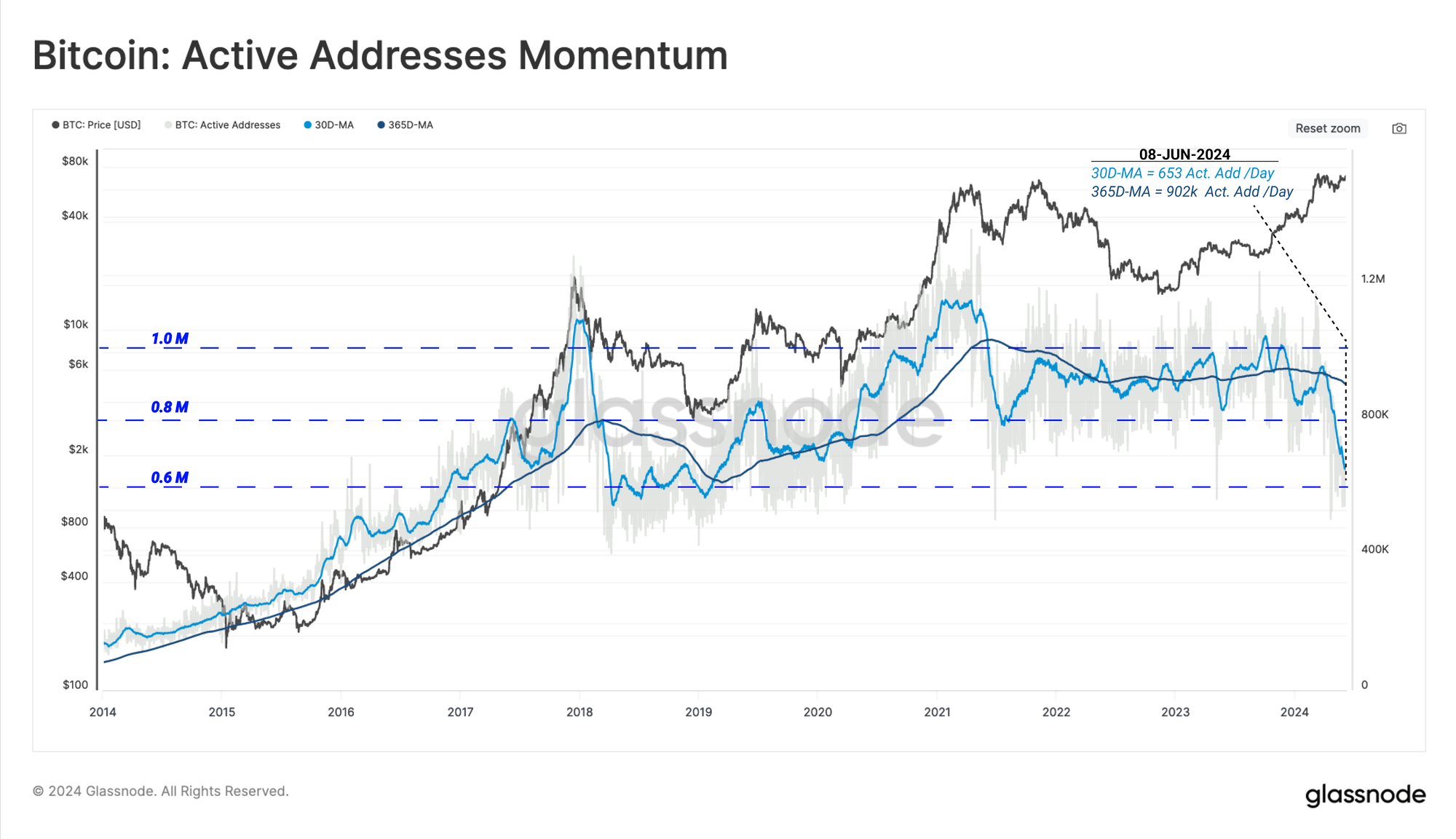

The chart beneath reveals how the Energetic Addresses metric has modified in worth for Bitcoin over the previous decade.

The worth of the metric seems to have plunged in latest weeks | Supply: Glassnode's The Week Onchain - Week 24, 2024

As is seen within the graph, the 30-day transferring common (MA) of the Bitcoin Energetic Addresses has been sharply taking place over the previous couple of months. This may suggest that fewer customers are actually probably collaborating in community transaction exercise.

The market momentum has been robust on this interval, nonetheless, and as is seen within the chart, earlier such bullish durations noticed the indicator rising as a substitute. Thus, the development has deviated for this cycle.

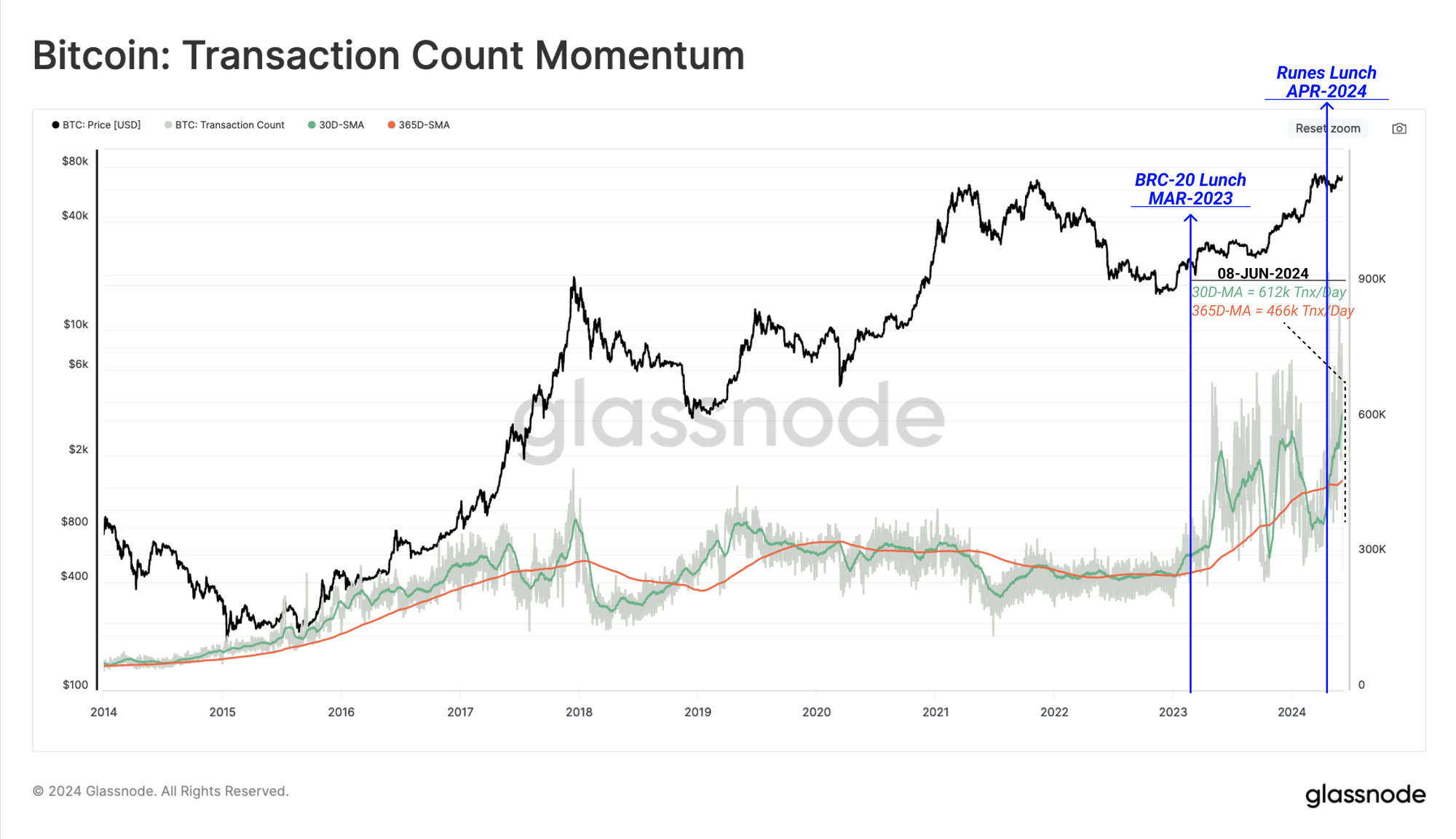

The opposite metric of curiosity right here, the Transaction Rely, measures the entire variety of transfers happening on the community each day. Here’s a chart that reveals how this metric has carried out just lately:

Appears like the worth of the indicator has been on the rise just lately | Supply: Glassnode's The Week Onchain - Week 24, 2024

Curiously, whereas the Energetic Addresses have seen a decline in worth, the Transaction Rely has shot up as a substitute. The metric’s 30-day MA worth is round 612,000 per day, close to the ATH.

The truth that the 2 indicators have gone reverse methods would imply that, though fewer addresses are lively now, the variety of transfers every handle has individually been making has blown up.

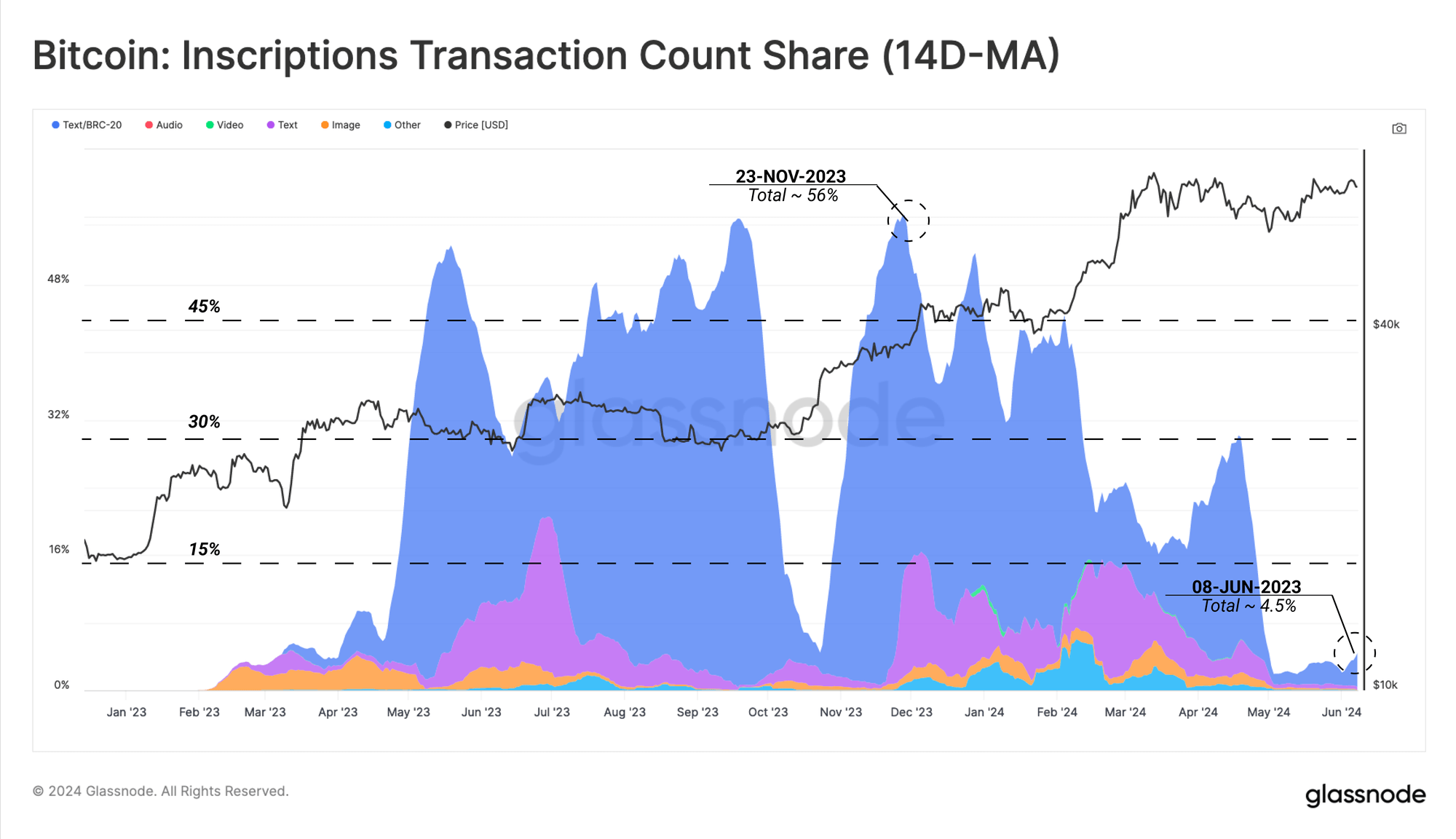

Now, what’s behind this development? The analytics agency has recognized a curious correlation between the Energetic Addresses sample and the Transaction Rely share of the Bitcoin Inscriptions.

The Inscriptions, which give a technique to inscribe knowledge onto Satoshis (Sats), the smallest unit of BTC, had loved reputation since early 2023 till just lately.

The information for the Transaction Rely of the Inscriptions since their inception | Supply: Glassnode's The Week Onchain - Week 24, 2024

The chart reveals that the Transaction Rely share of the Inscriptions collapsed beginning mid-April, matching the decline within the Energetic Addresses.

As for what’s behind the downfall of the as soon as extremely widespread Inscriptions, knowledge would level in direction of the emergence of the Runes on the community. In brief, the Runes protocol permits customers to introduce fungible tokens on the community via a distinct mechanism from the Inscriptions.

The Runes launched alongside the fourth Halving, which is round when the Inscriptions fell off.

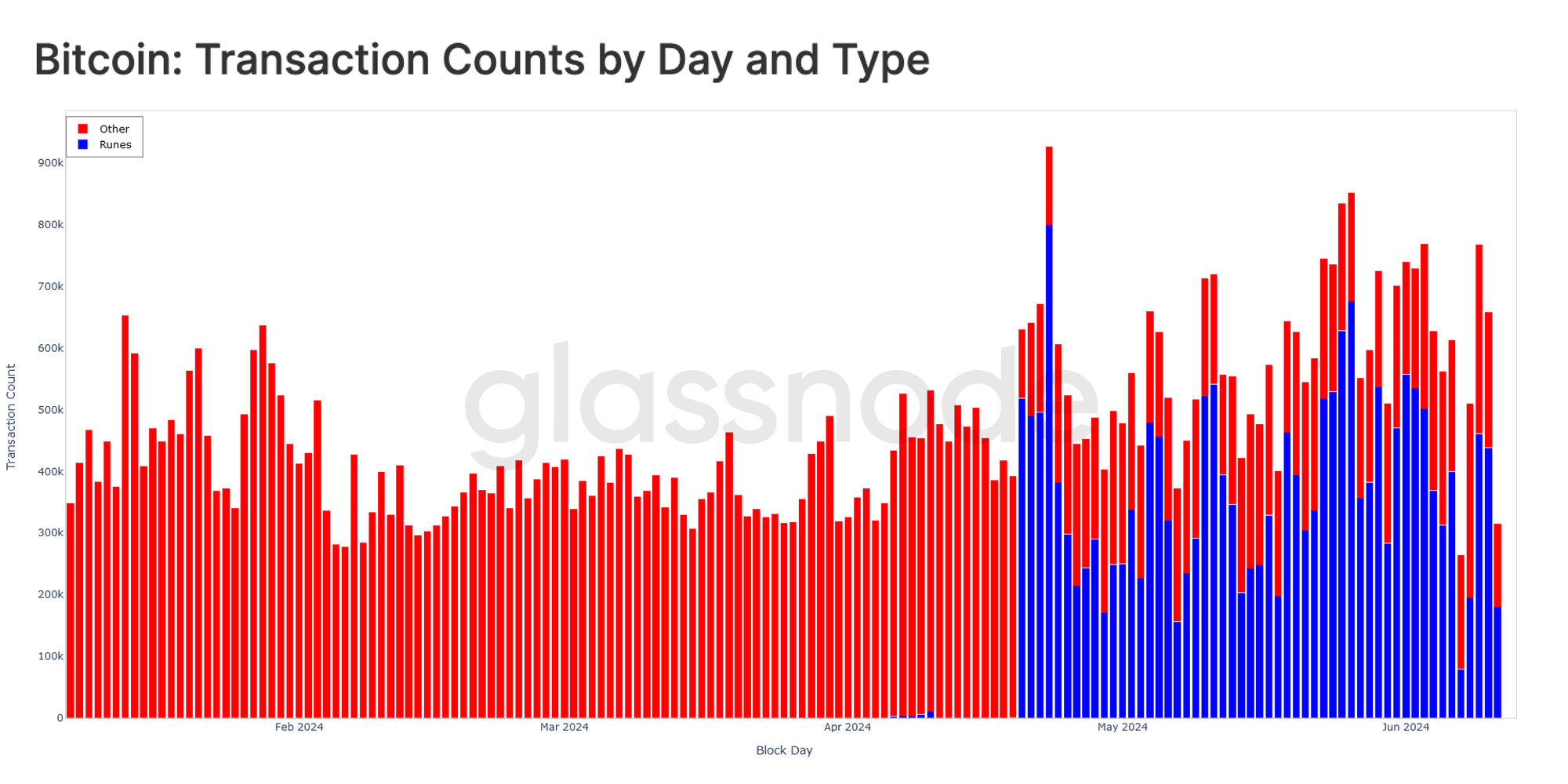

The Transaction Counts for Runes and all different forms of transactions | Supply: Glassnode's The Week Onchain - Week 24, 2024

The Runes protocol makes use of handle reuse, which implies the identical handle turns into concerned in a number of transactions. Thus, it’s simple to see why the protocol’s launch has accelerated the divergence between the Energetic Addresses and Transaction Rely.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $69,600, down greater than 2% over the previous week.

The value of the asset has risen in the course of the previous day | Supply: BTCUSD on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.