Symbiotic has made a notable entry into the decentralized finance (DeFi) house, launching on June 12 with $5.8 million in seed funding from Paradigm and Cyber Fund.

This debut marks a major problem to EigenLayer, a significant participant within the Ethereum restaking sector.

Symbiotic Restaking Protocol Launches

Symbiotic’s launch follows a Might 15 dedication from Lido co-founders and Paradigm. The venture, secretly backed by Lido executives Konstantin Lomashuk and Vasiliy Shapovalov by way of Cyber Fund, goals to disrupt the present restaking narrative dominated by EigenLayer.

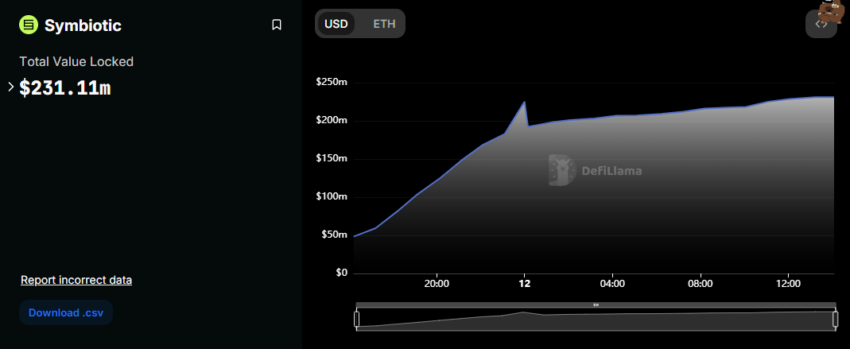

With a formidable Whole Worth Locked (TVL) of $231.11 million shortly after launch, Symbiotic advertises itself as “a generalized shared safety system enabling decentralized networks to bootstrap highly effective, totally sovereign ecosystems.” The TVL metric measures the general exercise and recognition of a DeFi venture, giving insights into how a lot capital is being utilized inside a DeFi ecosystem.

“Amongst different issues, it broke each doable and conceivable document, reaching over $200M in TVL in only a few hours,” said Alessandro Mazza.

Learn extra: Ethereum Restaking: What Is It And How Does It Work?

The assist from Paradigm comes within the wake of a choice by EigenLayer co-founder Sreeram Kannan to go for funding from Andreessen Horowitz (a16z) as a substitute. Undeterred, and as DeFi battled alongside the “restaking narrative” type between Ethereum and Lido, the enterprise capital agency approached Symbiotic. Paradigm can also be the largest backer of Lido.

Lido is Ethereum’s largest liquid staking protocol on TVL, with DefiLlama showing a TVL of $33.6 billion at press time. EigenLayer ranks second, with a TVL of $18.78 billion.

EigenLayer ascended the ranks comparatively rapidly, with its presence threatening Lido. Its development got here on the expense of Lido as some customers withdrew their stake from Lido to funnel extra belongings into the newer restaking platform. This has sparked hypothesis that Lido backing EigenLayer’s competitor, Symbiotic, is a technique to keep up its dominance.

Lido Forays Into Restaking House Via Symbiotic

Lido is a powerhouse within the decentralized finance (DeFi) sector. It gives a protocol the place customers stake their ETH and obtain Lido Staked ETH (stETH) tokens for varied makes use of. EigenLayer is a more moderen service wherein customers restake belongings like ETH and stETH to assist safe different networks in trade for extra rewards.

Amid dominance battles, the Lido stake-taking platform has been grappling with the restaking narrative, threatening to sidestep its grip on decentralized finance with EigenLayer on the frontline.

The Lido DAO consortium, composed of LDO token-holders, manages the Lido protocol. They make selections on technique and key upgrades. In a brand new initiative, Lido has partnered with Mellow Finance. This platform permits customers to generate yield by depositing into restaking “vaults.” These vaults are constructed utilizing Symbiotic’s expertise. This initiative provides merchants entry to superior restaking instruments, serving to Lido reclaim its dominance with stETH.

Learn extra: The Final Information to Lido Staked ETH (stETH)

EigenLayer solely accepts ETH, EIGEN, and some ETH derivatives. In distinction, Symbiotic accepts any crypto asset primarily based on Ethereum’s ERC-20 token customary. With Symbiotic’s launch, EigenLayer’s dominance could face stronger competitors, resulting in a extra selective market presence.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.