The robotics market is on the verge of a breakthrough pushed by fast developments in synthetic intelligence (AI) and machine studying. By 2030, robots are anticipated to deal with essentially the most tedious, repetitive, and dangerous duties at the moment carried out by people. Not lengthy after, ultra-smart machines are forecast to change into the central mover of the worldwide economic system.

This technological shift, set to realize momentum inside the subsequent 18 months, presents a major alternative for traders to capitalize on the expansion potential of robotics shares. Listed here are three robotics shares in prime positions to profit from this explosive development.

1. Microsoft

Microsoft (NASDAQ: MSFT), a tech large recognized for its software program and cloud computing companies, is making vital strides in robotics. Its Azure cloud platform gives a complete suite of instruments and companies for growing and deploying robotics purposes.

Microsoft’s partnership with OpenAI has led to the event of superior AI fashions, like ChatGPT-4, which can be utilized to create extra clever and adaptable robots. As a consequence of its groundbreaking partnership with OpenAI and massive investments in AI structure, the tech large is extremely prone to be on the middle of the robotics revolution.

Over the previous 5 years, Microsoft’s inventory has risen by 222% and has a hefty ahead price-to-earnings (P/E) ratio of 31.9 as a direct results of this bull run. Due to the skyrocketing demand for cloud-based robotics options, nevertheless, Microsoft ought to be capable to proceed outperforming the S&P 500 by way of 2030 regardless of its lofty valuation.

2. AeroVironment

AeroVironment (NASDAQ: AVAV) is a number one supplier of uncrewed plane methods, uncrewed floor automobiles, loitering munition methods, and high-altitude pseudo-satellites for army and industrial purposes.

The corporate’s multidomain uncrewed methods are used for reconnaissance, surveillance, and precision agriculture. AeroVironment’s experience in autonomous methods and robust partnerships with authorities companies place it effectively to capitalize on the rising demand for autonomous methods in varied industries.

Over the previous 5 years, AeroVironment’s inventory has risen by 223%, pushing its ahead P/E ratio to a large 83.3. Whereas the inventory could appear wildly overvalued primarily based on this metric, its distinctive aggressive place within the hypergrowth robotics area may drive additional market-beating returns within the years forward.

In different phrases, it is most likely not a good suggestion to move over this robotics inventory due to its premium valuation. AeroVironment, in any case, might be a key participant within the coming period of superior robotics.

3. Teradyne

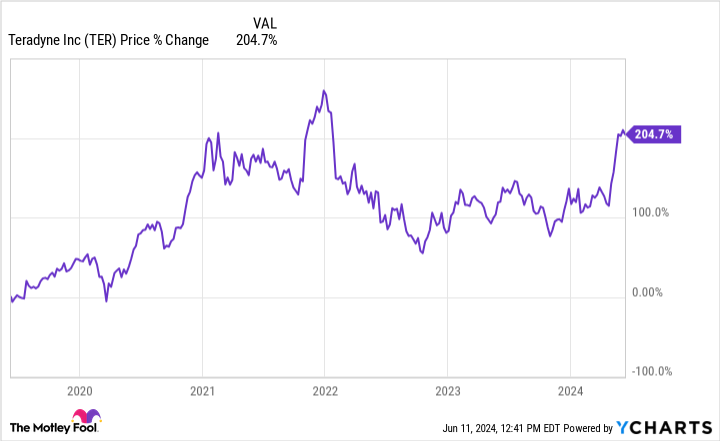

Teradyne (NASDAQ: TER) is a worldwide chief in automated check gear and industrial automation. The corporate’s merchandise are used to check semiconductors, wi-fi merchandise, and digital methods.

Teradyne’s robotics division, Common Robots, is a pioneer in collaborative robots (cobots) designed to work alongside people in manufacturing and different settings. This initiative is designed to usher in an period of versatile manufacturing, providing an economical path towards ever-greater automation.

Over the previous 5 years, Teradyne’s inventory has risen by a blistering 205%, leading to a noteworthy ahead P/E ratio of 45.4. Nonetheless, the rising demand for automation — in response to the parabolic progress of AI — ought to drive Teradyne’s inventory to outperform the S&P 500 over the subsequent a number of years.

That is the transformative potential of the approaching robotics revolution, a seismic shift the worldwide inventory market seems to be underestimating.

Do you have to make investments $1,000 in Microsoft proper now?

Before you purchase inventory in Microsoft, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Microsoft wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $746,217!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

George Budwell has no place in any of the shares talked about. The Motley Idiot has positions in and recommends AeroVironment and Microsoft. The Motley Idiot recommends Teradyne. The Motley Idiot has a disclosure policy.

3 Incredible Robotics Stocks to Buy Hand Over Fist was initially revealed by The Motley Idiot

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.