Girls’s plus-size attire retailer Torrid Holdings (NYSE:CURV) can be reporting earnings tomorrow after the bell. Here is what to anticipate.

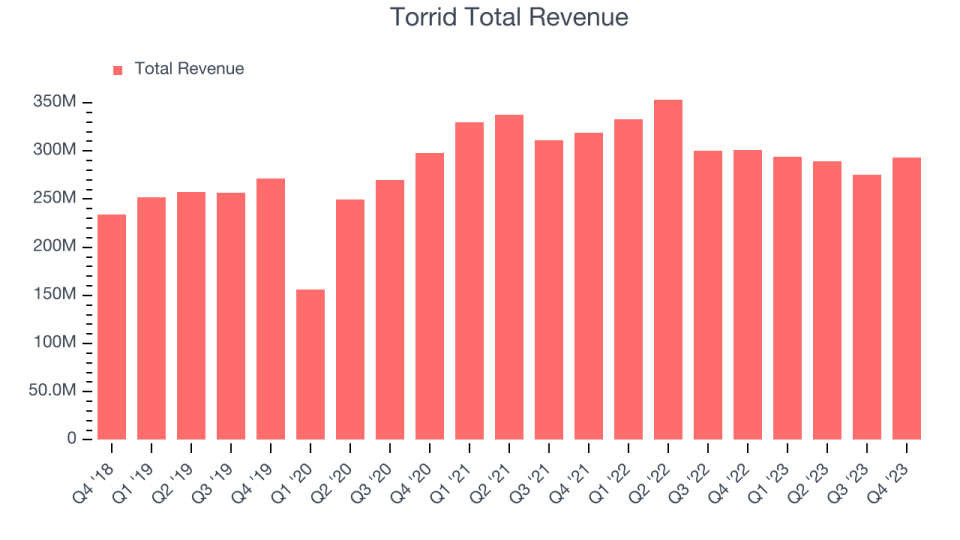

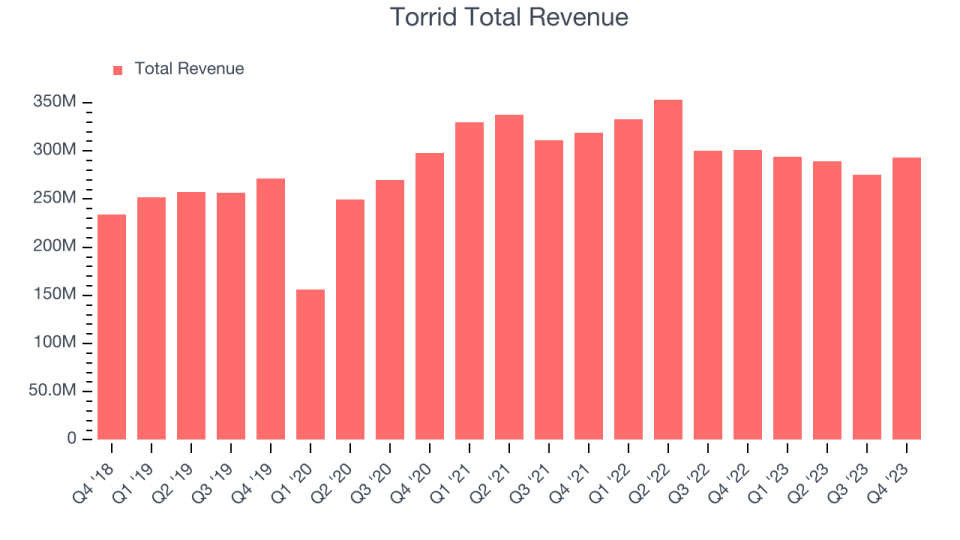

Torrid beat analysts’ income expectations by 6.3% final quarter, reporting revenues of $293.5 million, down 2.6% yr on yr. It was a strong quarter for the corporate, with a formidable beat of analysts’ income and earnings estimates.

Is Torrid a purchase or promote going into earnings? Read our full analysis here, it’s free.

This quarter, analysts expect Torrid’s income to say no 4.5% yr on yr to $280.5 million, bettering from the 11.8% lower it recorded in the identical quarter final yr. Adjusted earnings are anticipated to return in at $0.08 per share.

Nearly all of analysts protecting the corporate have reconfirmed their estimates over the past 30 days, suggesting they anticipate the enterprise to remain the course heading into earnings. Torrid has solely missed Wall Avenue’s income estimates as soon as over the past two years, exceeding top-line expectations by 4% on common.

Torrid’s friends within the attire retailer phase, some have already reported their Q1 outcomes, giving us a touch as to what we are able to anticipate. Hole delivered year-on-year income development of three.4%, beating analysts’ expectations by 3.1%, and Abercrombie and Fitch reported revenues up 22.1%, topping estimates by 5.8%. Hole traded up 29.3% following the outcomes whereas Abercrombie and Fitch was additionally up 17.1%.

Learn our full evaluation of Gap’s results here and Abercrombie and Fitch’s results here.

Traders within the attire retailer phase have had regular fingers going into earnings, with share costs flat over the past month. Torrid is up 12.7% throughout the identical time and is heading into earnings with a median analyst value goal of $5.4 (in comparison with the present share value of $6.49).

When an organization has additional cash than it is aware of what to do with, shopping for again its personal shares could make a whole lot of sense–so long as the worth is correct. Fortunately, we’ve discovered one, a low-priced inventory that’s gushing free money movement AND shopping for again shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.