Online reputation and search platform Yext (NYSE:YEXT) reported results in line with analysts’ expectations in Q1 CY2024, with revenue down 3.5% year on year to $95.99 million. The company expects next quarter’s revenue to be around $98.2 million, in line with analysts’ estimates. It made a non-GAAP profit of $0.05 per share, down from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy Yext? Find out in our full research report.

Yext (YEXT) Q1 CY2024 Highlights:

-

Acquired Hearsay Systems, a leading digital client engagement platform for financial services

-

Revenue: $95.99 million vs analyst estimates of $96.33 million (small miss)

-

EPS (non-GAAP): $0.05 vs analyst expectations of $0.06 (13% miss)

-

Revenue Guidance for Q2 CY2024 is $98.2 million at the midpoint, roughly in line with what analysts were expecting

-

The company dropped its revenue guidance for the full year from $401 million to $395 million at the midpoint, a 1.5% decrease (but raised adjusted EBITDA and EPS guidance)

-

Gross Margin (GAAP): 77.6%, down from 78.5% in the same quarter last year

-

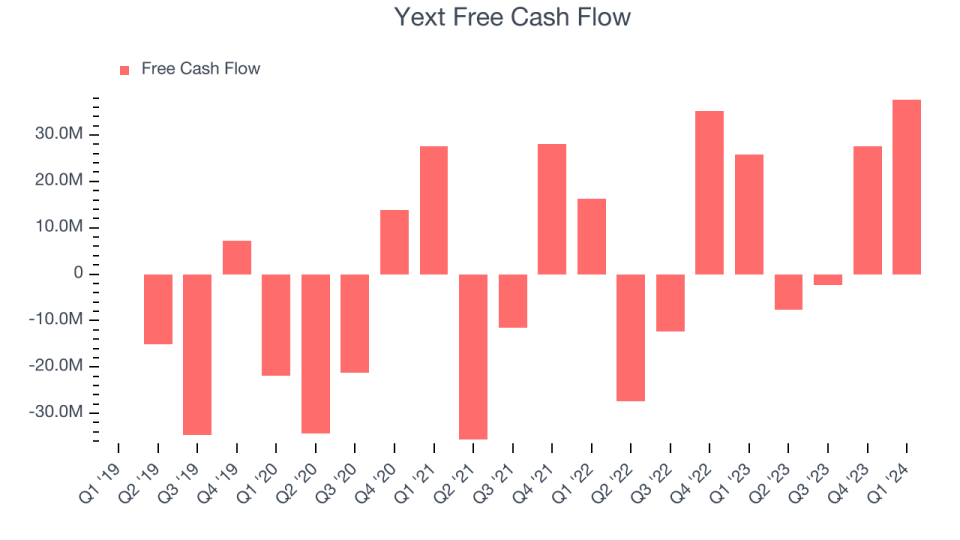

Free Cash Flow of $37.66 million, up 36.4% from the previous quarter

-

Billings: $69.29 million at quarter end, down 4.8% year on year

-

Market Capitalization: $648.8 million

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Listing Management Software

As the number of places that keep business listings (such as addresses, opening hours and contact details) increases, the task of keeping all listings up-to-date becomes more difficult and that drives demand for centralized solutions that update all touchpoints.

Sales Growth

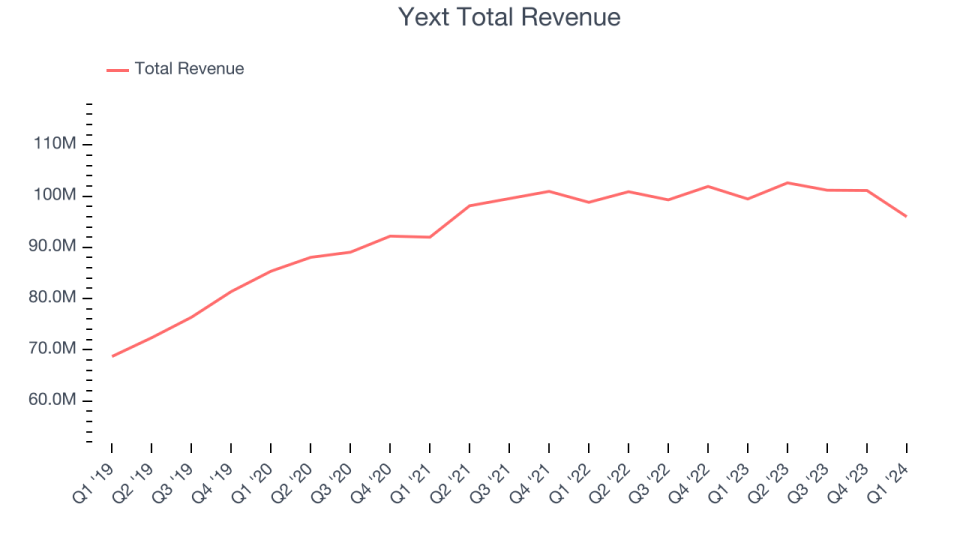

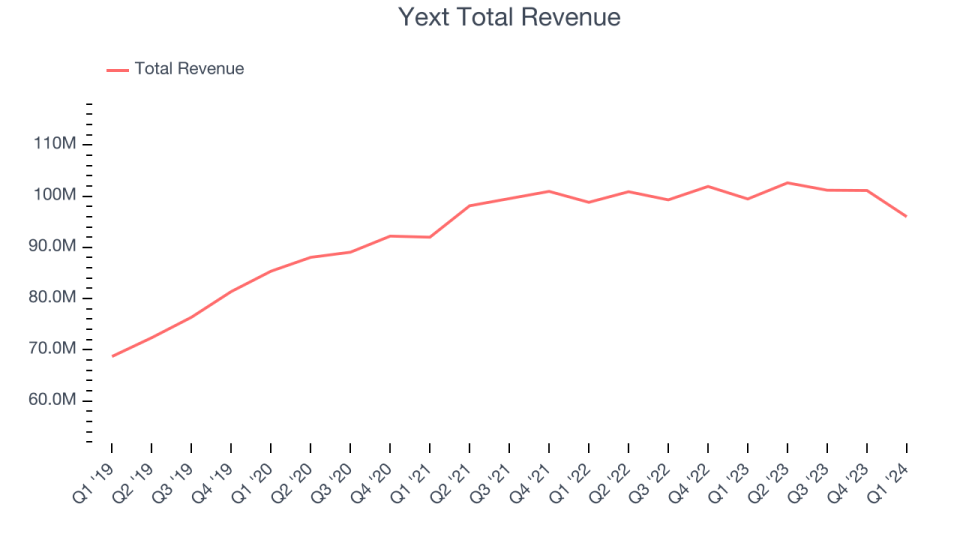

As you can see below, Yext’s revenue growth has been unimpressive over the last three years, growing from $91.99 million in Q1 2022 to $95.99 million this quarter.

This quarter, Yext’s revenue was down 3.5% year on year, which might disappointment some shareholders.

Next quarter, Yext is guiding for a 4.3% year-on-year revenue decline to $98.2 million, a further deceleration from the 1.7% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 2% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

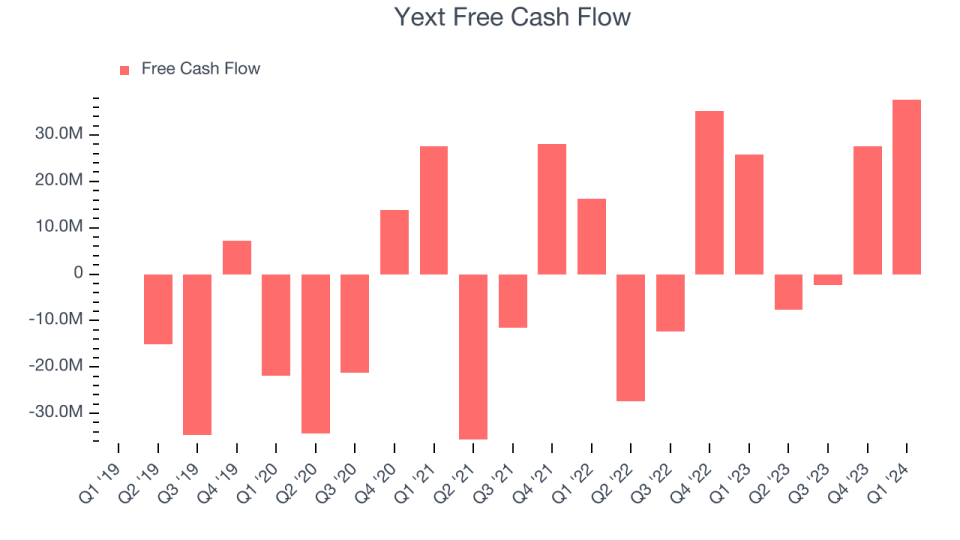

If you’ve followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. Yext’s free cash flow came in at $37.66 million in Q1, up 46% year on year.

Yext has generated $55.29 million in free cash flow over the last 12 months, a decent 13.8% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Yext’s Q1 Results

We were impressed by how strongly Yext blew past analysts’ billings expectations this quarter. On the other hand, its full-year revenue guidance was lowered and below expectations and its revenue also missed Wall Street’s estimates. Overall, this was a bad quarter for Yext. The company is down 13.9% on the results and currently trades at $4.35 per share.

Yext may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.