Vogue conglomerate Oxford Industries (NYSE:OXM) can be reporting earnings tomorrow after market shut. This is what to search for.

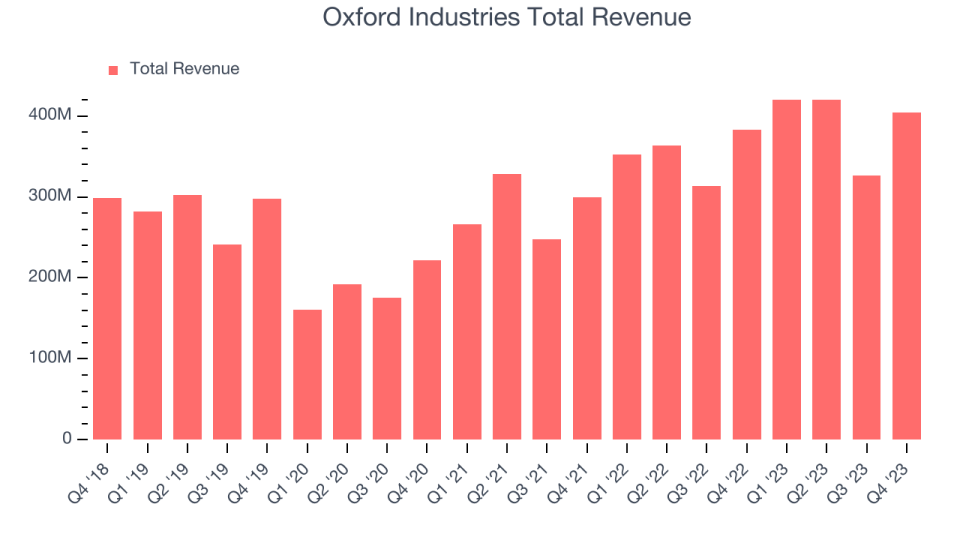

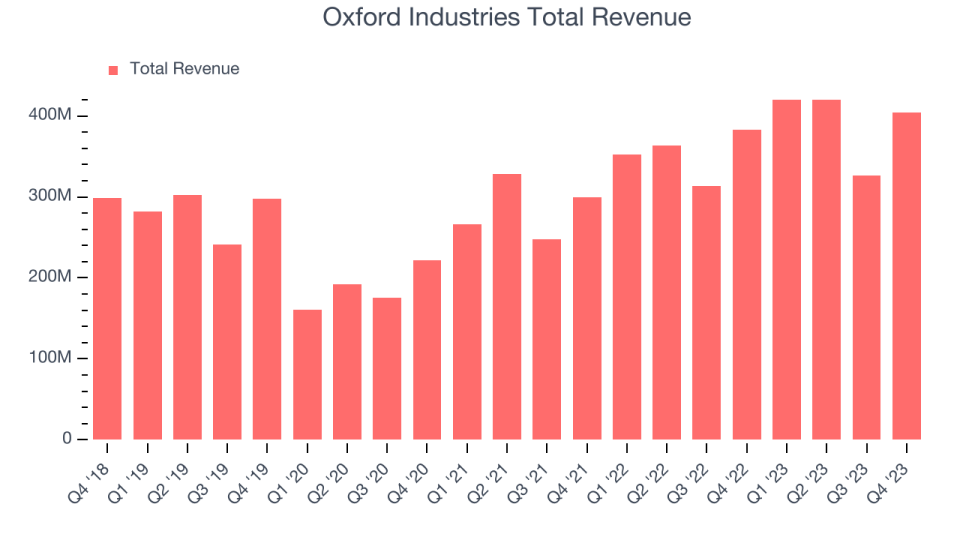

Oxford Industries met analysts’ income expectations final quarter, reporting revenues of $404.4 million, up 5.7% 12 months on 12 months. It was a weaker quarter for the corporate, with a miss of analysts’ working margin estimates and underwhelming earnings steerage for the total 12 months.

Is Oxford Industries a purchase or promote going into earnings? Read our full analysis here, it’s free.

This quarter, analysts predict Oxford Industries’s income to say no 3.6% 12 months on 12 months to $404.8 million, a reversal from the 19.1% enhance it recorded in the identical quarter final 12 months. Adjusted earnings are anticipated to return in at $2.68 per share.

The vast majority of analysts masking the corporate have reconfirmed their estimates during the last 30 days, suggesting they anticipate the enterprise to remain the course heading into earnings. Oxford Industries has missed Wall Avenue’s income estimates 3 times during the last two years.

Taking a look at Oxford Industries’s friends within the attire, equipment and luxurious items section, some have already reported their Q1 outcomes, giving us a touch as to what we will anticipate. Figs posted flat year-on-year income, beating analysts’ expectations by 1.6%, and Kontoor Manufacturers reported a income decline of 5.4%, topping estimates by 3.8%. Figs traded down 4.4% following the outcomes whereas Kontoor Manufacturers was up 5.7%.

Learn our full evaluation of Figs’s results here and Kontoor Brands’s results here.

Progress shares have been fairly unstable because the begin of 2024, and whereas among the attire, equipment and luxurious items shares have fared considerably higher, they haven’t been spared, with share costs down 2.8% on common during the last month. Oxford Industries is down 6.6% throughout the identical time and is heading into earnings with a mean analyst worth goal of $107 (in comparison with the present share worth of $101.8).

At present’s younger traders possible haven’t learn the timeless classes in Gorilla Recreation: Choosing Winners In Excessive Expertise as a result of it was written greater than 20 years in the past when Microsoft and Apple have been first establishing their supremacy. But when we apply the identical ideas, then enterprise software program shares leveraging their very own generative AI capabilities could be the Gorillas of the long run. So, in that spirit, we’re excited to current our Particular Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.