Arbitrum’s (ARB) worth drop beneath $1 might have offered a chance that has not appeared for a while. As of this writing, the token’s worth was $0.94, a 56.90% lower in 90 days.

Nonetheless, in keeping with knowledge discovered on-chain and the technical perspective, ARB might erase a few of these losses.

Whales Are Shopping for Arbitrum Once more

One metric fueling the bullish prediction is the motion of whales. Whales are entities or people that maintain a considerable amount of a token. Due to this huge provide of tokens owned, whales can considerably affect market costs.

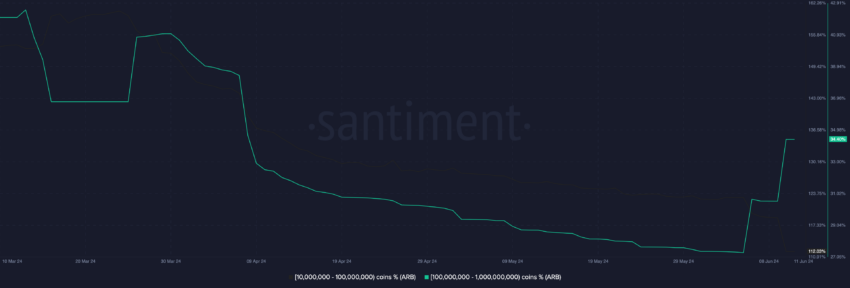

Based on the on-chain analytic platform Santiment, addresses holding 100 million to 1 billion ARB tokens have amassed extra since June 5. As an example, the availability of this cohort was 27.19% on the aforementioned date.

Nonetheless, the ratio has elevated to 34.40. Particularly, whales bought 251.79 million Arbitrum tokens on June 10. The distinction on this provide signifies that Arbitrum’s worth might start a gradual motion up the charts.

Learn Extra: Arbitrum (ARB) Worth Prediction 2024/2025/2035

Some weeks again, BeInCrypto reported how ARB flashed a purchase sign. Nonetheless, indicators at the moment steered that the timing was off. Therefore, the bullish bias couldn’t be validated.

This time, the situation could also be totally different. That is due to the focus of Arbitrum’s giant holders.

Information from IntoTheBlock reveals that 88% of ARB holders are dropping cash on the present worth, whereas solely 4% of the whole holders are making beneficial properties.

Moreover, 83% of holders personal the token in giant numbers. The excessive focus of ARB amongst whale addresses signifies that elevated accumulation might drive increased costs.

However, a widespread sell-off by these addresses might trigger a major worth lower. Contemplating the rise in shopping for strain, ARB might strategy the important thing resistance degree that it reached on Might 21.

ARB Worth Prediction: A Rebound Could also be Shut

From a technical perspective, the every day chart reveals the Cash Movement Index (MFI) studying dropping to 12.69. The MFI makes use of worth and quantity to measure the shopping for and promoting strain round a cryptocurrency.

When the Cash Movement Movement Index is beneath 20.00, it signifies that the cryptocurrency is oversold. Conversely, a studying above 80.00 suggests the token is overbought.

Subsequently, the MFI studying as of this writing, signifies that ARB is oversold. As well as, ARB is on the assist ground of $0.94. Therefore, the worth might bounce off the lows to the resistance degree place at $1.12.

As well as, the Relative Energy Index (RSI) aligns with the prediction backed by the MFI. The RSI, as an oscillator, measures momentum.

It additionally reveals if a cryptocurrency is oversold or overbought. When the studying is beneath 30, it signifies that a token is oversold. Nonetheless, a studying above 70 signifies an overbought situation.

Learn Extra: Purchase Arbitrum (ARB) and All the pieces You Have to Know

As of this writing, the RSI was 33.21. This reinforces the notion that ARB is across the oversold area. Therefore, the worth might bounce and commerce at $1.12 within the quick time period. In a extremely bullish situation, ARB might rise to $1.24.

Nonetheless, this bullish thesis could also be invalidated if promoting strain will increase. If this occurs, ARB might slip beneath $0.90. One other issue that may have an effect on ARB’s worth is Ethereum (ETH).

ETH and ARB strongly correlate due to Arbitrum’s layer-2 operation on the Ethereum blockchain. Ought to ETH’s worth leap, ARB might observe. However, an extra lower in ETH’s worth might ship ARB down the charts.

Disclaimer

In keeping with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.