A 60 basis factor boost in home mortgage prices in October has actually suffocated home mortgage need, especially for refinancings, according to the current study information from the Home Mortgage Bankers Organization Home Mortgage applications generally lowered 0.1% from one week previously, per the MBA‘s regular applications study for the week finishing Oct. 25. The Marketplace Compound Index, a procedure …

Read More »Housing

Home sales agreements got last month as reduced home loan prices assisted customers

A step of real estate agreement task leapt 7.4% in September as customers benefited from reduced home loan prices and greater stock. The Pending Home Business Index, which tracks agreement finalizings on existing homes, climbed to 75.8 from a month previously and signed up the highest possible analysis considering that March, according to the National Organization of Realtors. An analysis …

Read More »United States home mortgage prices raise to 6.73%, greatest considering that late July

( Bloomberg)– United States home mortgage prices increased to the highest degree considering that July, causing a 5th straight once a week decrease in refinancing task. A Lot Of Review from Bloomberg The agreement price on a 30-year set home mortgage increased 21 basis indicate 6.73% in the week finished Oct. 25, according to Home loan Bankers Organization information launched …

Read More »October tasks report will certainly affect Fed plan, home loan prices course

Work information for October is readied to be launched Friday, and it will certainly go a lengthy method in identifying the course for home loan prices, which have actually risen up in the previous month. At HousingWire’s Mortgage Rates Center on Tuesday, the typical price for 30-year adjusting car loans was 6.72%. That’s up 10 basis factors (bps) from one …

Read More »Political election anxiousness is delaying the real estate market, representatives and home loan loan providers claim

Realty representative Crystal Bonin had actually aided her customers placed in a number of deals on premium homes around Baton Rouge, La., when suddenly, they quit their search. The factor? They were bothered with the political election, and what it could indicate for the future of the partner’s IT organization. To listen to various other market professionals inform it, tales …

Read More »The unforeseen stamina of home rates this year

We track stock and home sales really carefully, so the greatest shock this year has actually been the resiliency of home prices. Offered the ruthless mortgage prices, normally weak property buyer need, and the year’s increasing supply of unsold homes, I have actually been anticipating home rates to decline a little bit in the 2nd fifty percent of this year. …

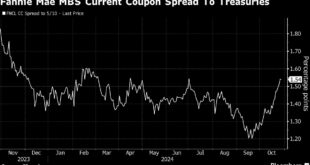

Read More »Janus, Columbia Eye Beaten-Down Home Mortgage Financial Debt Ahead of Elections

( Bloomberg)– Expanding chaos in the bond market and worries of climbing United States rising cost of living are striking firm home mortgage bonds specifically hard. To financiers at Janus Henderson and Columbia Threadneedle Investments, this weak point might provide chances to acquire the safety and securities. Many Review from Bloomberg Spreads, or danger costs, on lately generated firm home …

Read More »Industrial realty sector fears over greater tax obligations as political election impends

By Michelle Conlin NEW YORK CITY (Reuters) – The united state industrial realty sector is promoting tax obligation alleviation and rewards promoted by previous Republican politician Head of state Donald Trump to proceed in the following management, as the field deals with rising misbehaviors, document job prices, and raised prices of funding. Industrial realty is particularly susceptible to greater tax …

Read More »Bulk of home mortgage lending institutions most likely profited in Q3

The favorable pattern lines that saw almost 80% of home mortgage lending institutions turn a profit in the 2nd quarter most likely proceeded via the 3rd quarter, according to Marina Walsh, the Home Mortgage Bankers Organization‘s vice head of state of sector evaluation. Though the study on industry performance report for the 3rd quarter has actually not yet been released, …

Read More »Home loan market ought to enhance to $2.3 trillion(!) in 2025, MBA claims

One of the most tough duration for the home mortgage sector seems in the rearview mirror, as the Mortgage Bankers Association (MBA) projections $2.3 trillion in source quantity for 2025– standing for a durable 28.5% development over 2024. ” We remain in a far better location currently than a year back. Allow’s maintain that in mind when we take a …

Read More » Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.