( Reuters) – united state family wide range increased last quarter to $163.8 trillion, a fresh document, driven by gains in property worths in addition to an increase in the securities market, information from the Federal Book revealed on Thursday. The total assets of houses and non-profits since completion of June covered the $161 trillion reported for the initial quarter, …

Read More »Housing

Brief Vendors Ditch European Realty Supplies as Cycle Bottoms

( Bloomberg)– Brief vendors are shutting extra bearish bank on European building firms as a result of assumptions dropping rate of interest will certainly sustain supply evaluations. The Majority Of Review from Bloomberg Brief passion as a portion of complimentary float in the industry decreased by one more 10 basis indicate 2.3% in August, according to an evaluation from UBS …

Read More »China to Cut Fees on $5 Trillion Home Loans as quickly as September

( Bloomberg)– China is positioned to reduce rate of interest on greater than $5 trillion of impressive home loans as very early as this month, according to individuals knowledgeable about the issue, as it speeds up a transfer to lower the loaning expenses for numerous households to stimulate intake. The Majority Of Review from Bloomberg Some financial institutions are making …

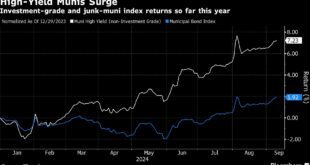

Read More »Opulent Property Deals Boom in High-Flying Scrap Muni Market

( Bloomberg)– Premium realty growths are touching the municipal-bond market, resulting in a multitude of supposed deluxe dust offers and sustaining returns for financiers going to handle the threat. A Lot Of Check Out from Bloomberg This year, state and neighborhood financial debt purchasers have actually aided fund a vacation-home golf territory in Florida, a hotel near Zion National forest …

Read More »Home loan prices are dropping, yet will sales expand?

Price in the United States If you were lucky sufficient to acquire the normal united state home in June 2022, you most likely secured around $1,400 a month in home loan settlements. Due mainly to higher mortgage rates, that very same home today would certainly set you back regarding $2,175 a month. So it’s not a surprise that home sales …

Read More »HUD concerns ‘substantial’ upgrade to produced real estate safety and security requirements

produced home The U.S. Department of Housing and Urban Development (HUD) on Wednesday introduced updates to its manufactured real estate building and safety and security requirements, a relocate called one of the most substantial such updates in 3 years as the division looks for to update the functions of these homes to drive need. The brand-new requirements, arranged to be …

Read More »Real estate rising cost of living the ‘just actual standout shock’ of August CPI record

The most up to date Customer Cost Index (CPI) record launched Wednesday revealed that real estate rising cost of living still isn’t alleviating. According to information from the Bureau of Labor Stats, sanctuary prices, the most significant factor to general rising cost of living, ticked up 0.5% month over month in August, greater than July’s 0.4% boost. On a yearly …

Read More »Also as rising cost of living decreases, real estate costs are verifying persistent

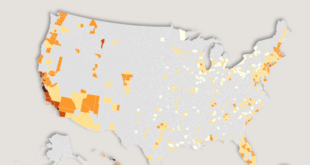

home rates level with the remainder of the year Altos Research study Raised mortgage rates have actually prevented the real estate market, however underlying financial variables are most likely to aid thrust them downward in the coming months. The Customer Rate Index (CPI) for August revealed a small year-over-year gain of 2.5%, which is the most affordable annualized development number …

Read More »Home costs saw uncommon torpidity this summertime

UNITED STATE home-price appreciation remained to reduce in July, a pattern that is anticipated to proceeded via following summertime, according to CoreLogic information launched today. National home costs were practically level compared to June and increased 4.3% year over year in July. Stationary costs throughout the usually hectic summertime home-buying period are uncommon, CoreLogic reported, as this was just the …

Read More »United States 30-Year Home Mortgage Price Slides to Lowest Considering That February 2023

( Bloomberg)– United States home loan prices glided recently to the most affordable degree because February 2023, pushing property buyers and stimulating a pick-up in refinancing applications in welcome information for the realty market. Many Review from Bloomberg The agreement price on a 30-year set home loan went down 14 basis indicate 6.29% in the week finished Sept. 6, noting …

Read More » Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.