SPRINGFIELD, Ill.– Jessica Hurley considered the pile of clinical costs in her bag as she held among her double infants, blue from absence of oxygen, in the neonatal critical care unit.

She hoped that the young boys, Perry and Kinser– birthed too soon at 32 weeks– would certainly endure.

Regarding a month had actually passed considering that a distressing distribution in which she would certainly brought to life Kinser normally, after that Perry using cesarean area. She and her hubby, Jimmy, had 2 various other youngsters, ages 2 and 13, to take care of. In addition to that was an additional resource of fear: Exactly how would certainly they pay for the placing expenses of the birth? And why were the costs currently so high when they had insurance policy?

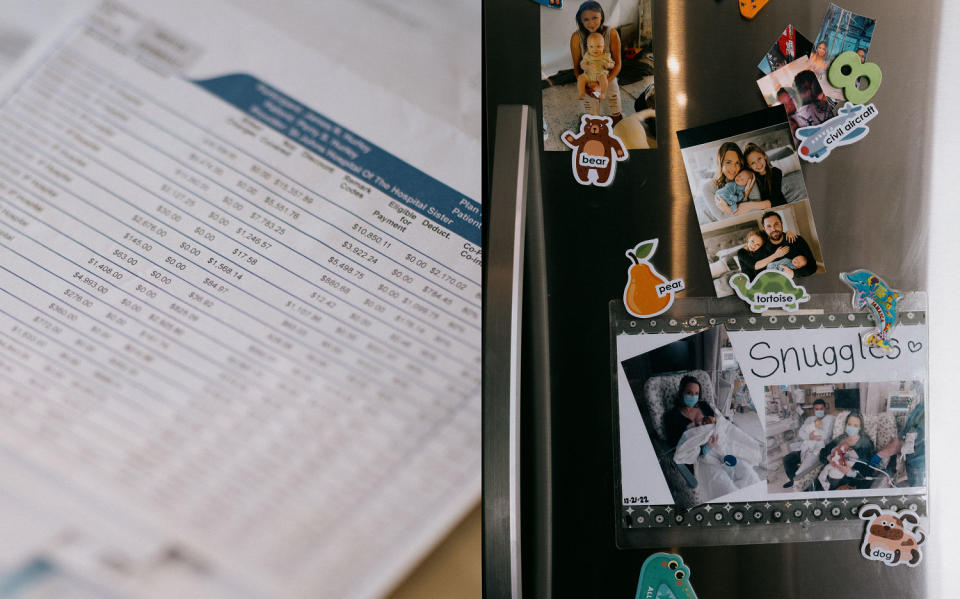

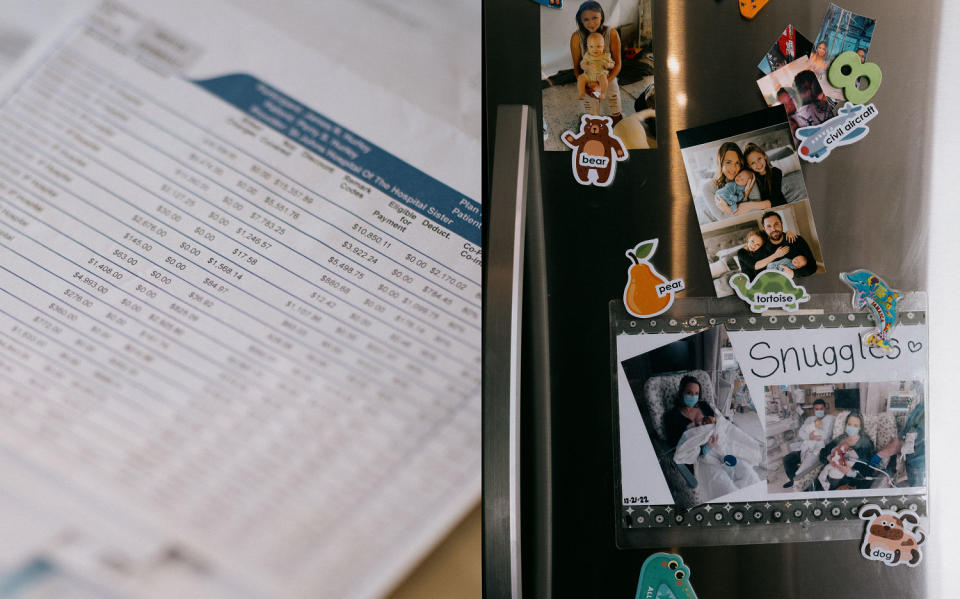

” I was obtaining costs from the laboratory, I was obtaining costs from the medical facility, I was obtaining costs from the clinical team, I was obtaining costs from radiology,” Jessica stated. “It was a permanent task attempting to figure it out, and I’m attempting to maintain my infants to life.”

The Hurleys’ earnings was too expensive to get Medicaid in Illinois, where they live. Yet their insurance policy strategy– offered with Jimmy’s union– has an out-of-pocket optimum of $28,500 for in-network solutions.

That placed them in a susceptible group of middle-class households: those that gain way too much for Medicaid however can not pay for or accessibility insurance policy prepares that completely cover expensive births.

That team has actually been left by the significant healthcare reforms of the last couple of years. Developments to Medicaid for brand-new moms and dads that numerous states have actually established considering that 2022 do not relate to them. The Not A Surprise Act, which worked the exact same year, hasn’t totally stopped shock costs. And the Affordable Treatment Act still enables high out-of-pocket expenses.

In meetings, greater than 20 specialists on clinical financial debt, insurance policy and healthcare plan indicated systemic failings in the personal insurance policy system that trigger households like the Hurleys to obtain gigantic costs after giving birth. High deductibles– the quantity individuals need to pay prior to their insurance policy begins to cover a share of their clinical expenses– are a main problem. Over half of private-sector employees with insurance policy with their tasks had high deductibles in 2014 (at the very least $3,200 for a household, under the internal revenue service interpretation), compared to simply over a 3rd in 2014, according to the Bureau of Labor Statistics.

The danger of building up clinical financial debt throughout giving birth is for that reason high for such households, specifically if issues occur. Naturally, maternity is both typical and dangerous. Expectant clients usually see several carriers over 9 months, throughout which time deductibles frequently reset. Distribution and postnatal treatment included costs for moms and dad and infant. And in the very first weeks of a newborn’s life, moms and dads have little time or power to read insurance policy declarations or conflict costs.

” Individuals that actually obtain struck with the greatest out-of-pocket expenses about their earnings are reduced- and middle-income individuals secretive insurance policy,” stated Dr. Nora Becker, a health and wellness financial expert at the College of Michigan.

Kinser Hurley was released from the NICU at 40 days old in January 2023, complied with by Perry at 68 days the following month. Yet that was simply the start of the Hurleys’ battle to reduce their clinical costs– a difficulty that remains to pester them virtually 2 years later on.

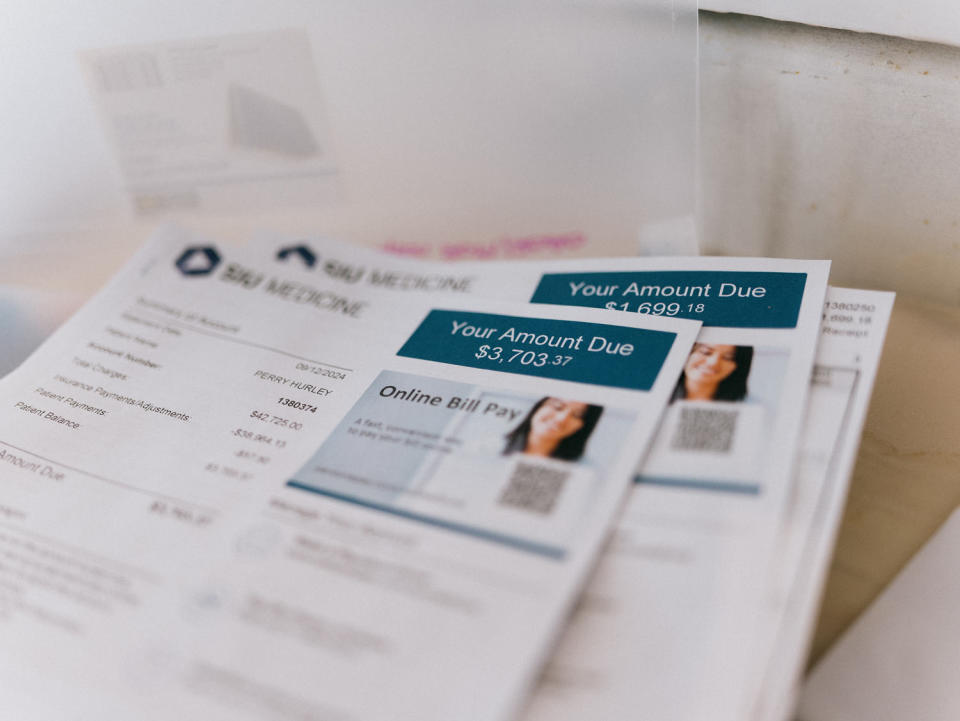

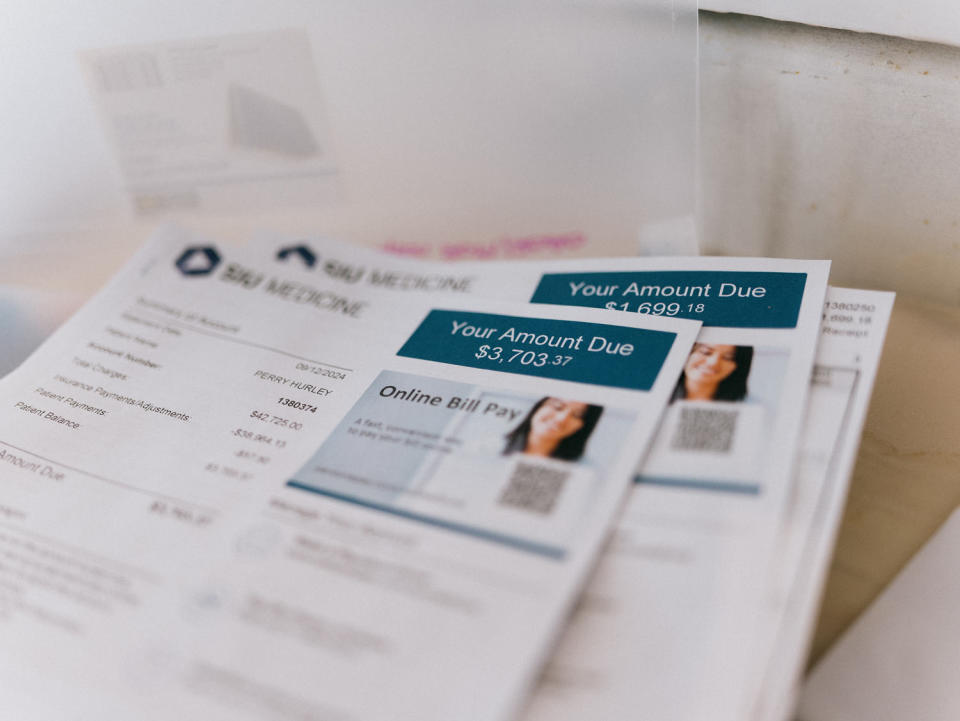

The quantity Jessica owed different carriers for her maternity and distribution and the doubles’ NICU remain completed virtually $38,000– near to a quarter of her household’s earnings.

” I simply seemed like this isn’t reasonable. I’m mosting likely to need to submit personal bankruptcy. They were attempting to inform me I needed to pay all this in a year, which there’s no other way,” she stated.

The Hurleys are among numerous households that talked to NBC Information concerning the clinical financial debt they dealt with after giving birth, despite the fact that they had personal insurance policy. The households shared greater than 180 records that described a puzzle of costs and cases. They all located it virtually difficult to be specific of what they owed and why.

Financial debt has actually intimidated their capability to survive, placing stress on their marital relationships, making it hard to pay for apparel and playthings and urging them to stay clear of clinical check outs.

” It avoids me from mosting likely to the physician since I hesitate of what costs I may obtain,” Jessica stated. “I go if I definitely require to.”

When the ACA does not shield you

Jessica functions as an oral hygienist and Jimmy as a superintendent for an asphalt firm. Their residence in Springfield, Illinois, is embellished with household pictures and messages like “Today I Will Certainly Be Happy and Make Memories.”

On a current mid-day when the youngsters were still at institution and daycare, Jessica crossed her legs on the sofa and sobbed.

” I really feel guilty for having the doubles, and after that I really feel guilty for really feeling guilty since I like them,” she stated. “You resemble, ‘Suppose it simply really did not all take place, these dreadful points?’ Yet after that I resemble, ‘I have these stunning young boys, and they have actually made my 4-year-old so pleased.’ Yet yes, I can see why individuals would not wish to have youngsters.”

The Hurleys’ costs were ultimately recycled and they were provided some economic support from the medical facility. Yet they were still left in charge of virtually $11,500, of which they have actually paid around $3,300.

The household’s high clinical costs stemmed, partially, from the nature of their insurance policy strategy, which had a reduced insurance deductible of $375 however an uncommonly high out-of-pocket optimum– the complete quantity a household needs to pay in a year prior to its strategy covers clinical expenses at 100%. After an insurance deductible is fulfilled, an insurer normally pays a component of succeeding clinical cases (referred to as coinsurance) up until that optimum is gotten to.

The Affordable Treatment Act mandates that insurance providers cover pregnancy treatment and caps the in-network out-of-pocket optimum for a household at $18,900. Yet that restriction does not relate to strategies that are temporary or thought about “grandfathered” since they existed prior to the costs was passed.

The Hurleys’ strategy came under that last group.

The ACA additionally does not protect against insurance provider from rejecting protection for solutions they regard unneeded, though clients can appeal. Jessica’s insurance policy carrier, Central Laborers’ Well-being Fund, rejected protection for an expensive solution that aided the doubles shift from feeding tubes to containers in the NICU. The fund stated it does not react to media queries as an issue of plan.

In addition to that, Kinser and Perry were birthed at the end of 2022, so the household’s yearly protection started over again while the doubles were obtaining treatment. According to a June study, clients whose maternities, distributions or medical facility remains period 2 years pay $1,310 even more, generally, than they would certainly have had all expenses been within the exact same year.

Medical Facility Sis Health And Wellness System, which runs the medical facility where Jessica delivered, stated it does not discuss particular clients however is “devoted to openness and precision in our payment methods.”

SIU Medication, a clinical carrier that companions with the medical facility, minimized Jessica’s costs by around $3,700 after NBC Information connected. SIU stated the price cut was granted to match the price of economic support Jessica obtained from the medical facility.

” People might get economic support, whether they’re guaranteed, and qualification is based upon home earnings and household dimension,” Lauren Crocks, SUI Medication’s interactions supervisor, stated in an e-mail.

To settle their clinical costs, the expense of daycare and Jessica’s decreased earnings from running out operate at completion of maternity, the Hurleys began making minimal settlements on their charge card, which has actually led them to sustain around $18,000 in charge card financial debt considering that the doubles were birthed.

Much Better off on Medicaid

Individuals with insurance policy with their companies pay around $3,600 expense, generally, for prenatal, distribution and postpartum solutions, according to information offered to NBC Information by the Healthcare Price Institute. However, for around a quarter of the births assessed, expenses surpass $5,000.

Those on Medicaid, by comparison, usually have no out-of-pocket expenses, considering that the program forbids cost-sharing, consisting of deductibles, for pregnancy-related solutions with 60 days postpartum.

Expectant individuals across the country get Medicaid if their earnings go to or listed below 138% of the poverty line– as much as $36,000 each year for a household of 3. Yet 34 states and Washington, D.C., have set the threshold for coverage with Medicaid or the Kid’s Medical insurance Program at or over 200%, according to KFF, a not-for-profit wellness brain trust. And all however 2 states have actually embraced Medicaid protection lasting for a year after birth.

Becky Munge, a mommy of 3 in Morton, Illinois, got on Medicaid when she brought to life her very first 2 youngsters and does not remember paying a solitary costs for the healthcare she obtained after that.

Yet that had not been the situation when she had her little girl Jovie in 2021. Adhering to a deadly distribution, Becky entered into heart attack and endured inner blood loss after the elimination of her placenta, which had actually been lodged to her uterine wall surface. She was intubated and went through numerous procedures. As her body organs started to stop working, physicians asked her hubby, Cole, and older youngsters, Gavin and Ava, to state their farewells.

Jovie remained in the NICU, however physicians enabled her to see her mom.

” They desired her to at the very least have the ability to do skin-to-skin if I were to die,” Becky stated.

Becky recouped, and she and Jovie were released within a day of each various other. Yet while she remained in the medical facility, Becky got a bone infection that would inevitably need 9 arm procedures and needed to relearn to stroll after creating extreme weak point in her legs.

The Munges pay $1,300-per-month costs for an insurance coverage strategy with a $3,000 in-network insurance deductible and a $12,500 out-of-pocket optimum.

For the challenging distribution and Jovie’s NICU remain, they end up paying the medical facility $8,000, after insurance policy covered around $1 million in clinical costs.

Independently, Becky obtained therapy for her bone infection and a knee surgical procedure at the Mayo Facility in Rochester, Minnesota. They still deal with virtually $4,000 in the red for the knee surgical procedure after having actually paid around $1,000 for different solutions up until now.

The Mayo Facility stated it does not command over insurance policy protection choices. In a declaration, Blue Cross and Blue Guard of Illinois, the pair’s insurance policy carrier, stated, “we function straight with participants and do not comment openly concerning their situations.”

In prioritizing their clinical costs over various other expenses, the Munges have actually collected around $55,000 in charge card financial debt and drained their pension.

” If we can not regulate the financial debt, since today, we’re mosting likely to need to submit personal bankruptcy,” Becky stated. “That’s a significant hazard over our shoulders.”

Like the Hurleys, the Munges are well middle-class. Cole is a freelance insurance policy representative. Prior to her wellness concerns stopped her from functioning, Becky was an orthodontic aide. The household resides in a three-bedroom, ranch-style home.

” We’re not in destitution, however we’re not abundant whatsoever, and we’re still having a hard time,” Becky stated. “I desire I would certainly earn less cash to make sure that I can obtain even more advantages, since I’m really extra in the red currently.”

The obstacle of a high insurance deductible

Of all the factors a household can deal with clinical financial debt from giving birth, high deductibles are amongst one of the most typical.

” Lots of employees utilized to have zero-deductible healthcare strategies, however that’s much less real today. Most of employer-provided personal medical insurance strategies do have a basic insurance deductible,” stated Dr. Adam Gaffney, an essential treatment medical professional at the Cambridge Health And Wellness Partnership in Massachusetts that investigates clinical financial debt. In the very early 1980s, his research study reveals, just 30% of private insurance plans had deductibles for medical facility remains.

Wesley Bruce and Ashley Perez’s insurance policy strategy had a $7,000 insurance deductible and a $13,000 out-of-pocket restriction when she obtained expectant. They recognized giving birth would certainly be pricey, so they allot cash in a health and wellness interest-bearing account.

Yet they could not expect exactly how complicated their clinical requirements would certainly be. Their twin women, Isla and Juno, were birthed too soon in June, each with an opening in her heart, and invested approximately a month in the NICU. The pair’s insurance policy really did not cover some specialized treatment throughout Perez’s maternity, and they end up responsible for greater than $10,000 in total amount.

Bruce, a psychological wellness therapist, and Perez, a Ph.D. prospect in scientific psychology, are still settling trainee financings.

” I simply type of stated: ‘What can we do? We do not have an option,'” Perez stated. “I’m never ever mosting likely to repay every one of our financial debt, so add the medical facility financial debt to it. I do not also understand, simply load it on.”

The pair drained their wellness interest-bearing accounts and obtained contributions from member of the family to pay their clinical costs.

Yet after that in September, a lucky strike: Perez received financial assistance from the medical facility system, Sanford Health and wellness, and their equilibrium went down to no. NBC Information connected to Sanford Health and wellness this month, and the pair was consequently reimbursed around $7,000 that they would certainly currently paid.

” We are devoted to guaranteeing clients obtain top notch treatment despite their capability to pay and offering economic support to those that require it most,” Nick Olson, Sanford Health and wellness’s primary economic policeman, stated in a declaration.

Not-for-profit health centers like the ones run by Sanford Health and wellness are needed by regulation to offer “charity treatment” in the kind of marked down or forgoed expenses. Qualification differs by medical facility, however numerous required that clients have earnings at or listed below 400% of the poverty line. Given that a few of those clients get on Medicaid, it’s vague the amount of individuals gain from the plans.

Becker described the system as the “Wild West.”

Setting up a government need for health centers to offer a minimal limit of economic support can make giving birth extra cost effective, she stated. One more plan on her shopping list: needing companies to supply insurance policy strategies with differing protection based upon individuals’s earnings.

” Basically, we can repair this issue if we as a culture determined that this was a trouble that we intended to take care of,” she stated.

Yet various other modifications, like doing away with deductibles entirely or perhaps setting up global healthcare, really feel not practical, otherwise difficult. And any kind of modifications would certainly come far too late for households currently bewildered with financial debt.

Jessica Hurley’s clinical financial debt is something she had actually attempted all her life to stay clear of– her very own mom battled to repay clinical costs after Jessica’s dad passed away in a vehicle mishap. Regardless of her best shots, she stated, “I located myself in a comparable scenario.”

She’s frightened that an additional clinical emergency situation will certainly land among her member of the family in the medical facility. Currently, she stated, her financial debt has actually led her to postpone attending to wellness concerns that aren’t emergency situations.

Jessica has actually been terminating her very own physical treatment consultations for hip discomfort from her distribution. Recently, she waited numerous days to take Kinser to immediate treatment after he established a breakout on his face and coldlike signs. At the same time, the physician’s workplace maintains phoning call to arrange a follow-up visit for dermatitis on Perry’s feet, however Jessica is attempting to handle it herself by using a lotion and maintaining his socks on.

” Every physician visit– I fret each and every single one– what’s mosting likely to be covered? What’s mosting likely to be readjusted?” she stated. “Am I going to obtain an additional costs?”

This post was created in partnership with the USC Annenberg Center for Health Journalism‘s 2024 National Fellowship Fund for Coverage on Youngster Health.

This post was initially released on NBCNews.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.