Vehicle and commercial components seller Genuine Components (NYSE: GPC) satisfied Wall surface Road’s income assumptions in Q3 CY2024, with sales up 2.5% year on year to $5.97 billion. Its non-GAAP revenue of $1.88 per share was 22.5% listed below experts’ agreement price quotes.

Is currently the moment to get Genuine Components? Find out in our full research report.

Genuine Components (GPC) Q3 CY2024 Emphasizes:

-

Earnings: $5.97 billion vs expert price quotes of $5.95 billion (in line)

-

Readjusted EPS: $1.88 vs expert assumptions of $2.43 (22.5% miss out on)

-

EBITDA: $582.1 million vs expert price quotes of $563.7 million (3.3% beat)

-

Monitoring decreased its full-year Adjusted EPS support to $8.10 at the navel, a 13.8% reduction

-

Gross Margin (GAAP): 36.8%, in accordance with the exact same quarter in 2015

-

Totally Free Capital Margin: 6%, below 8.3% in the exact same quarter in 2015

-

Locations: 10,700 at quarter end, up from 10,000 in the exact same quarter in 2015

-

Same-Store Sales were level year on year (0.5% in the exact same quarter in 2015) (miss out on)

-

Market Capitalization: $19.94 billion

Firm Review

Greatly targeting the specialist client, Genuine Components (NYSE: GPC) markets car and commercial components such as batteries, belts, bearings, and maker liquids.

Vehicle Components Merchant

Autos are complicated devices that require upkeep and periodic repair work, and car components merchants deal with the specialist technician along with the diy (DO IT YOURSELF) fixer. Service automobiles might require changing liquids, components, or devices, and these shops have the components and devices or these work. While shopping competitors provides a danger, these shops have an upper hand because of the mix of wide and deep option along with know-how given by sales affiliates. An additional modification imminent can be the boosting infiltration of electrical cars.

Sales Development

A business’s lasting efficiency can provide signals regarding its service top quality. Also a poor service can radiate for a couple of quarters, however a top-tier one expands for many years.

Genuine Components is among the bigger business in the customer retail sector and take advantage of a widely known brand name that affects customer acquiring choices. Nevertheless, its range is a double-edged sword since it’s tougher to locate step-by-step development when you have actually currently passed through the marketplace.

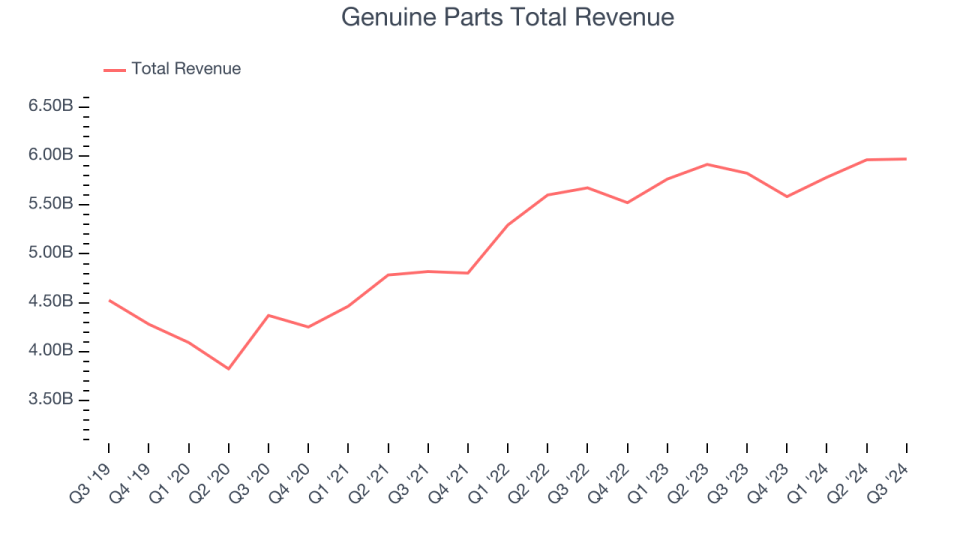

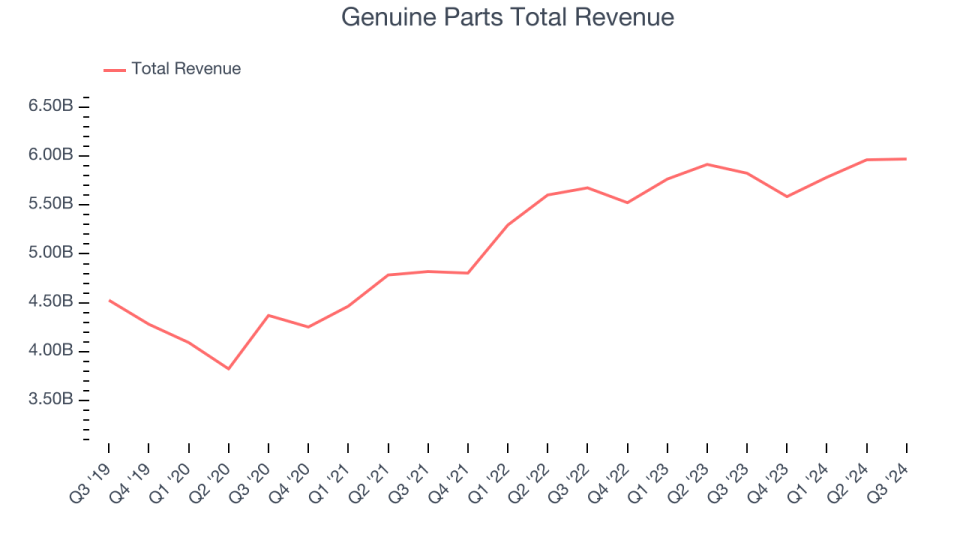

As you can see below, Genuine Components’s 5.5% annualized income development over the last 5 years (we contrast to 2019 to stabilize for COVID-19 effects) was lukewarm, however to its credit history, it opened up brand-new shops and enhanced sales at existing, developed areas.

This quarter, Genuine Components expanded its income by 2.5% year on year, and its $5.97 billion of income remained in line with Wall surface Road’s price quotes.

Looking in advance, sell-side experts anticipate income to expand 3.7% over the following twelve month, a minor slowdown versus the last 5 years. Some tapering is all-natural offered the size of its income base, and we still believe its development trajectory is eye-catching.

Today’s young capitalists likely have not check out the classic lessons in Gorilla Video game: Choosing Champions In High Innovation since it was created greater than two decades back when Microsoft and Apple were initial developing their superiority. However if we use the exact same concepts, after that business software application supplies leveraging their very own generative AI abilities might well be the Gorillas of the future. So, because spirit, we are delighted to offer our Unique Free Record on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Shop Efficiency

Variety Of Shops

A merchant’s shop matter frequently establishes just how much income it can create.

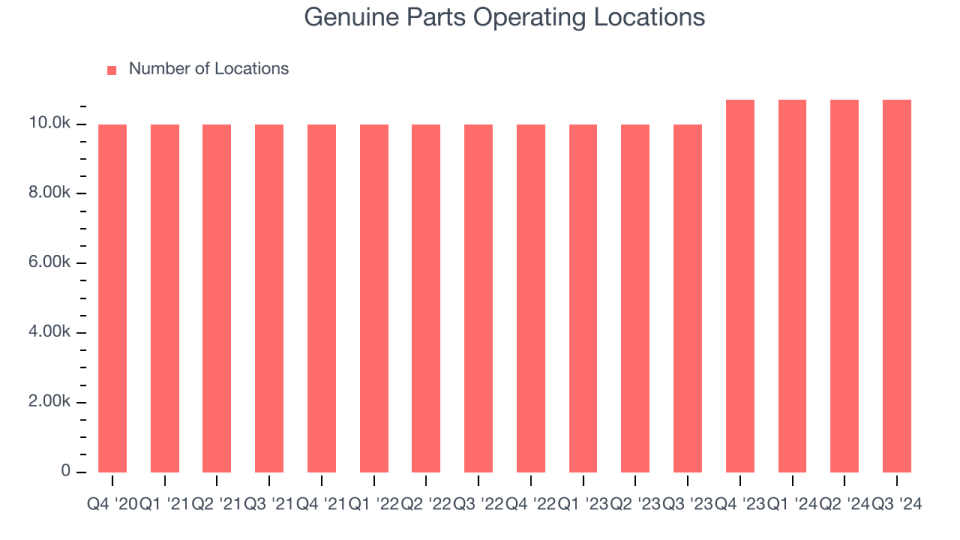

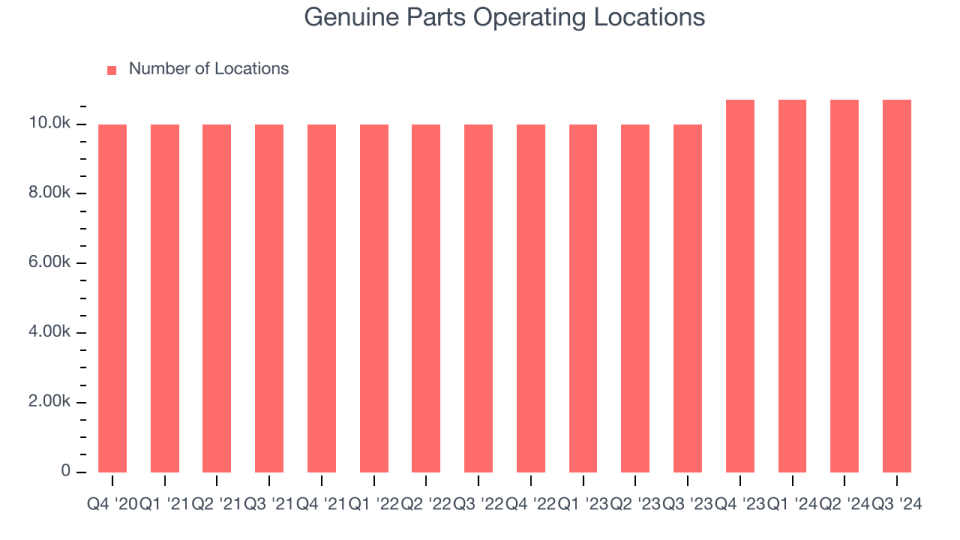

Genuine Components showed off 10,700 areas in the current quarter. Over the last 2 years, it has actually opened up brand-new shops at a fast clip and balanced 3.5% yearly development, amongst the fastest in the customer retail field.

When a seller opens up brand-new shops, it typically suggests it’s spending for development since need is higher than supply, specifically in locations where customers might not have a shop within affordable driving range.

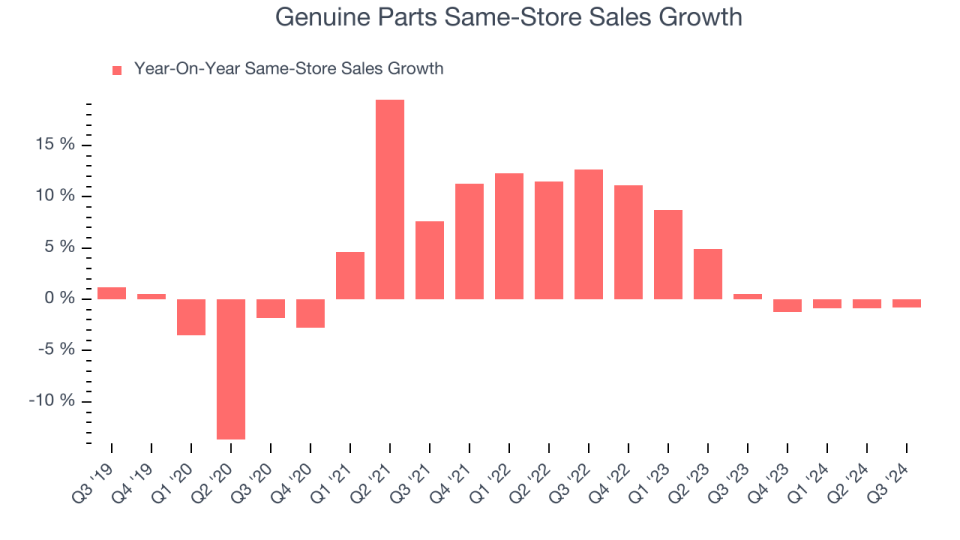

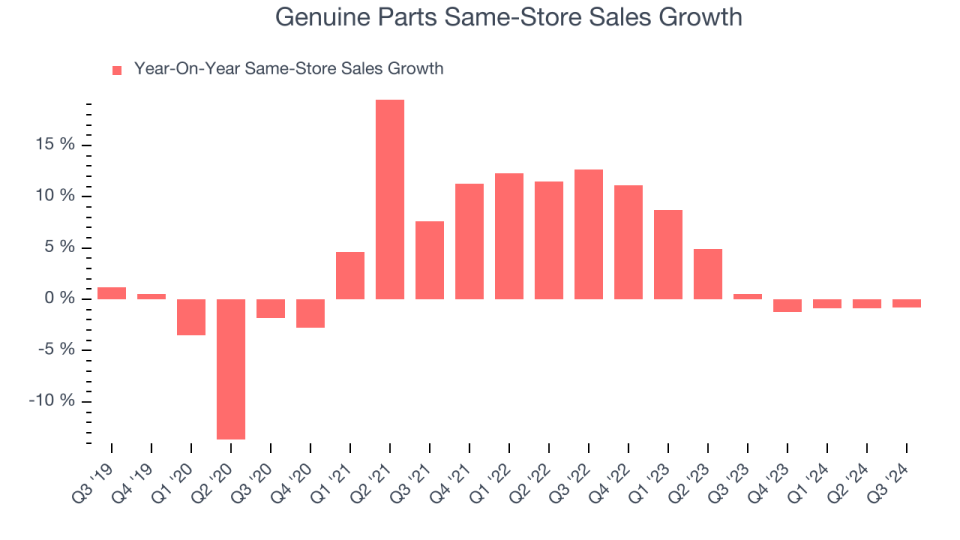

Same-Store Sales

A business’s shop base just paints one component of the image. When need is high, it makes good sense to open up a lot more. However when need is reduced, it’s sensible to shut some areas and make use of the cash in various other methods. Same-store sales is a sector step of whether income is expanding at those existing shops and is driven by client sees (frequently called web traffic) and the ordinary costs per client (ticket).

Genuine Components’s need has actually been healthy and balanced for a seller over the last 2 years. Usually, the business has actually expanded its same-store sales by a durable 2.7% each year. This efficiency recommends its rollout of brand-new shops can be valuable for investors. When a seller has need, even more areas must assist it get to a lot more clients and increase income development.

In the current quarter, Genuine Components’s year on year same-store sales were level. This efficiency was basically in accordance with the exact same quarter in 2015.

Secret Takeaways from Genuine Components’s Q3 Outcomes

It was excellent to see Genuine Components defeated experts’ EBITDA assumptions this quarter. We were likewise pleased its gross margin exceeded Wall surface Road’s price quotes. On the various other hand, its exact same shop sales was available in listed below assumptions. Looking in advance, the business’s EPS projection for the complete year missed out on and its EPS missed out on Wall surface Road’s price quotes. In general, this was a softer quarter. The supply traded down 9% to $130.25 quickly adhering to the outcomes.

Genuine Components really did not reveal it’s ideal hand this quarter, however does that develop a possibility to get the supply right now?The most current quarter does issue, however not virtually as high as longer-term basics and appraisal, when determining if the supply is a buy.We cover that in our actionable full research report which you can read here, it’s free

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.