Structure items producer Simpson (NYSE: SSD) will certainly be introducing incomes outcomes tomorrow after the bell. Right here’s what you require to recognize.

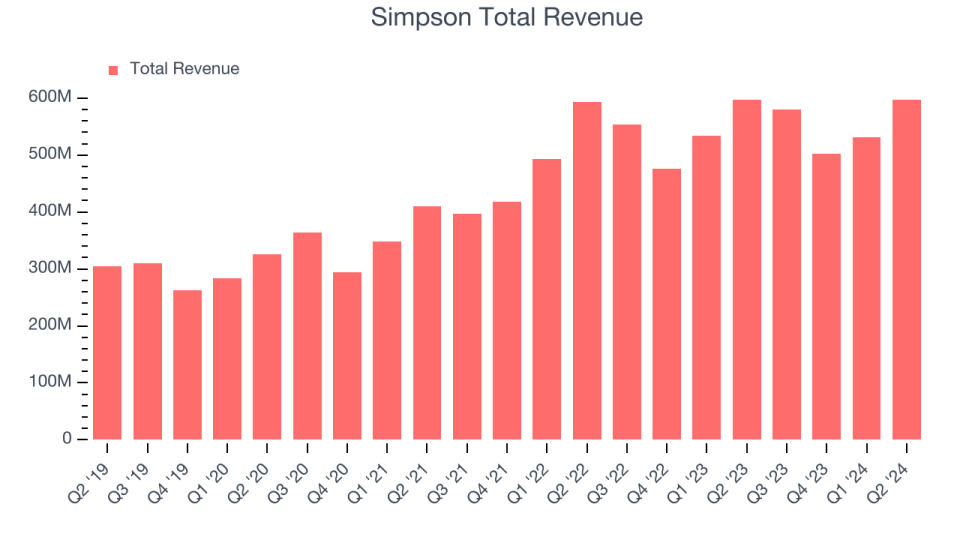

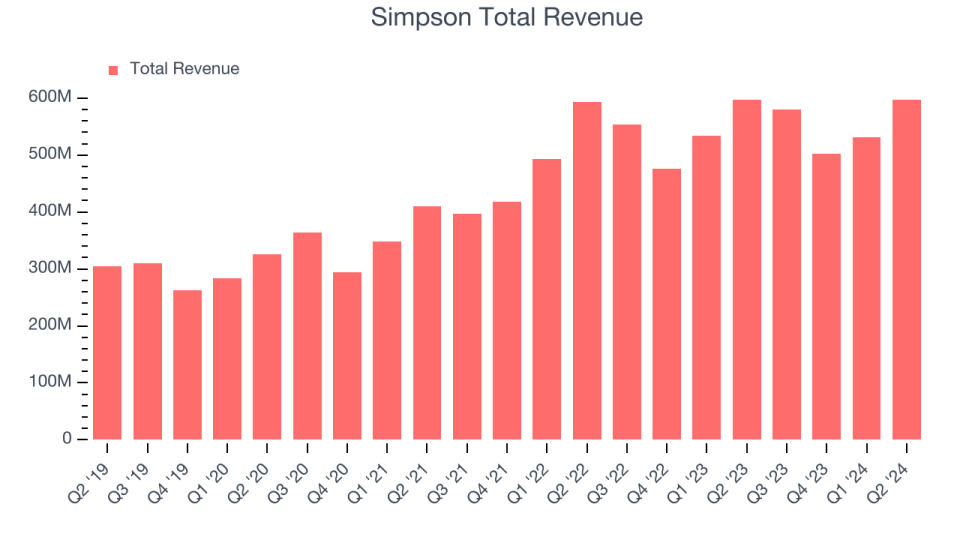

Simpson missed out on experts’ earnings assumptions by 1.3% last quarter, reporting earnings of $597 million, level year on year. It was a frustrating quarter for the business, with a miss out on of experts’ incomes quotes.

Is Simpson a buy or market entering into incomes? Read our full analysis here, it’s free.

This quarter, experts are anticipating Simpson’s earnings to expand 1.9% year on year to $591.1 million, slowing down from the 4.8% boost it videotaped in the exact same quarter in 2015. Changed incomes are anticipated ahead in at $2.42 per share.

Most of experts covering the business have actually reconfirmed their quotes over the last thirty day, recommending they expect business to persevere heading right into incomes. Simpson has actually missed out on Wall surface Road’s earnings approximates 3 times over the last 2 years.

Checking out Simpson’s peers in the structure items sector, some have actually currently reported their Q3 results, offering us a tip regarding what we can anticipate. AZZ provided year-on-year earnings development of 2.6%, conference experts’ assumptions, and Insteel reported a profits decrease of 14.7%, disappointing quotes by 7.5%. AZZ traded down 5.2% complying with the outcomes while Insteel was likewise down 7.4%.

Review our complete evaluation of AZZ’s results here and Insteel’s results here.

There has actually declared belief amongst capitalists in the structure items sector, with share rates up 3.3% typically over the last month. Simpson is down 1% throughout the exact same time and is heading right into incomes with an ordinary expert rate target of $192.33 (contrasted to the present share rate of $190.08).

Today’s young capitalists likely have not review the classic lessons in Gorilla Video game: Choosing Victors In High Modern Technology since it was created greater than twenty years back when Microsoft and Apple were very first developing their preeminence. Yet if we use the exact same concepts, after that venture software application supplies leveraging their very own generative AI capacities might well be the Gorillas of the future. So, because spirit, we are thrilled to provide our Unique Free Record on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.