We’re well right into Q4, and financiers are placing their profiles for the coming year. As constantly, the trick is recognizing supplies positioned to provide strong returns, and Financial institution of America has actually highlighted solid selections for those looking for high-growth possibilities.

BofA’s experts aren’t restricting their emphasis to simply one component of the marketplace; they are looking throughout markets at a varied team of supplies– and they are looking ‘under the hood’ to locate shares that prepare to leap.

With that said in mind, we transformed to the TipRanks data source to examine 2 of Financial institution of America’s newest supply choices, both of which existing solid upside– consisting of one with a prospective gain of almost 390%.

As a matter of fact, the financial titan isn’t the just one backing these names; both supplies are ranked as ‘Solid Buys’ by the wider expert agreement. Allow’s take a more detailed look and discover what the positive outlook is everything about.

Monster Rehabs ( GROAN)

We’ll start on the planet of biotherapeutics, where Monster Rehabs is establishing brand-new immunotherapy medicines especially created to lower the typical and extreme negative effects commonly related to cancer cells therapy. The firm has actually developed an exclusive advancement system, referred to as killer, to craft conditionally triggered particles that promote both the flexible and inherent features of the body immune system. With this method, Monster has actually efficiently progressed 2 medicine prospects right into scientific tests.

Both items are INDUKINE particles, an exclusive advancement, and are created to precisely turn on in growth cells while continuing to be non-active in outer cells, a function meant to lower the incident of undesirable off-target results while taking full advantage of the anti-tumor immune action. Monster’s objective is to develop anti-cancer medicines with greater tolerability degrees than existing therapies.

Monster’s lead medicine prospect, WTX-124, is being established to deal with strong lumps and is under examination as both a monotherapy and in mix with Keytruda. The firm is enlisting clients in a Stage 1 open-label, multicenter research– a first-in-human test of the medicine. At the ASCO Yearly Satisfying in June 2024, the firm shared brand-new acting arise from the monotherapy dose-escalation arm, together with very early information from the mix arm. The most up to date information highlighted WTX-124’s scientific task and its total tolerability in clients. Dosage acceleration in the mix research area is recurring, with upgraded information anticipated by year-end.

The firm’s 2nd prospect, WTX-330, is concentrated on dealing with innovative or metastatic strong lumps as a monotherapy. Early information from its Stage 1 test, additionally offered at ASCO, revealed appealing results in clients with innovative strong lumps or Non-Hodgkin Lymphoma. Monster strategies to launch additional updates later on in this quarter.

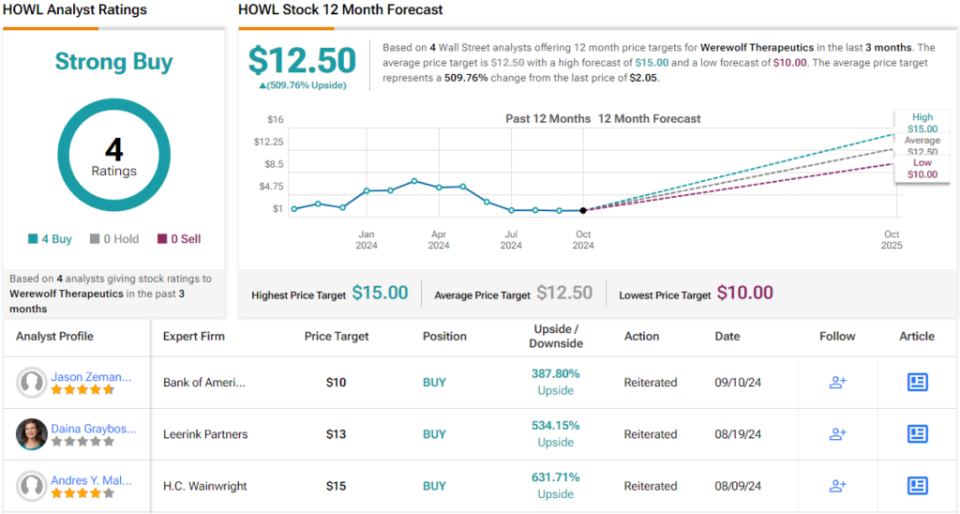

In Spite Of a 47% decrease in the supply cost this year, could this provide a prime acquiring chance? Financial institution of America’s 5-star expert, Jason Zemansky, definitely assumes so.

” Regardless of a probably favorable seminar, Monster Rehabs shares have actually been pushed given that ASCO. In our sight, this has actually had much less to do with problems regarding the WTX-124 information, which perhaps included assistance to a motivating, albeit early, scientific account. Instead, our team believe the pullback has actually been driven extra by affordable anxieties connected to ‘124’s size and period of actions. We acknowledge the problems yet feel they are exaggerated; past the cautions of contrasting (particularly) early-stage efficiency information, we believe financiers are ignoring the extra important security updates that not just establish Monster’s IL-2 property apart yet which additionally even more verify its system– the major worth motorist of the tale, in our sight,” the expert believed.

Looking in advance, Zemansky sees solid capacity for financiers, mentioning, “Ahead of a driver abundant 12mos– a number of with the ability of driving a re-rating– we see engaging near-term benefit capacity and chance on weak point.”

Taken with each other, these remarks back up Zemansky’s Buy score on shout, while his $10 cost target factors towards an excellent ~ 390% upside prospective for the following one year. (To enjoy Zemansky’s record, visit this site)

On The Whole, there are 4 current expert testimonials on document for Monster, every one of which declare, leading to a consentaneous Solid Buy agreement score. The shares are valued at $2.05, with a typical cost target of $12.50, also more than Financial institution of America’s telephone call, recommending a prospective ~ 510% gain over the following one year. (See shout supply projection)

Ibotta, Inc. ( IBTA)

From biotech we’ll conform to customer technology with a consider Ibotta, a buying benefits firm. Based in Denver, Colorado, Ibotta offers and takes care of a direct-to-consumer application that enables buyers to assert cash-back benefits on a wide array of online and in-person acquisitions. The application makes it very easy for individuals to assert benefits basically anywhere. A lengthy listing of merchants, largely grocers, get involved, consisting of significant names such as Publix, Buck General, Costco, Jewel-Osco, Kroger, Meijer, Walmart, and Whole Foods. Past the grocery store market, chains like Home Depot, Lowes, and Kohl’s additionally get involved, as does Amazon.

Ibotta was established in 2011, and previously this year, after 13 years in service, the firm went into the general public markets with an IPO. The general public offering saw 6.56 million shares take place the marketplace by both the firm and a number of personal investors, with a preliminary cost of $88 per share. This cost was well over the approximated IPO variety of $76 to $84. In total amount, the occasion elevated $577 million. Ibotta straight offered 2.5 million shares, understanding profits of $220 million.

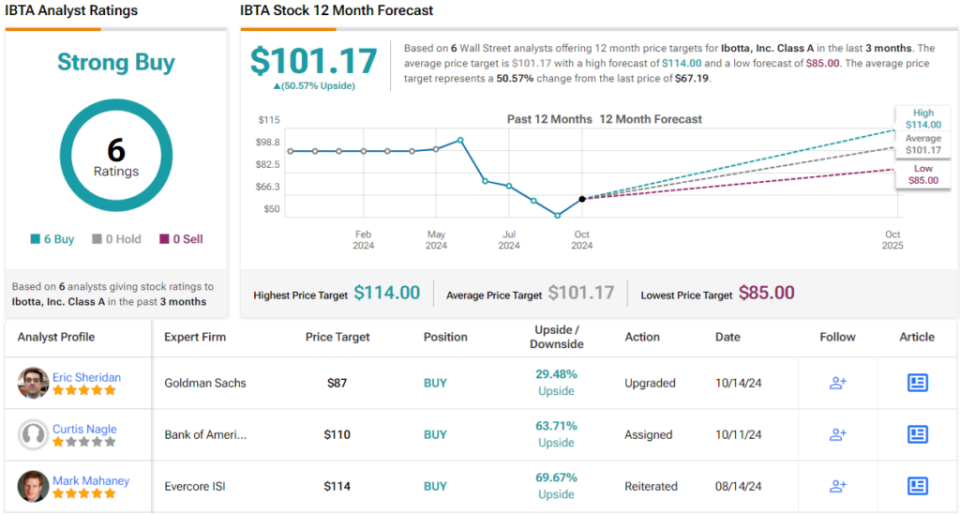

Given that going public, Ibotta’s supply has actually dipped by almost 32%. In action, the firm started a $100 million share bought program in August to aid sustain the share cost.

On the monetary side, Ibotta has actually launched 2 collections of revenues outcomes given that the IPO. One of the most current, launched in August and covering 2Q24, revealed a leading line of $87.9 million, up ~ 14% year-over-year and defeating the projection by $2.15 million. Near the bottom line, the firm’s non-GAAP EPS of 68 cents per share was 5 cents per share listed below assumptions.

In his insurance coverage of this supply for Financial institution of America, expert Curtis Nagle sees this supply as a prospective development chance for financiers. He goes over the firm’s varied impact in its particular niche, keeping in mind: “As CPG brand names concentrate on methods to effectively provide worth to customers and boost vols, we see Ibotta as a prime recipient. Ibotta collaborates with ~ 2,400 brand names and is the only electronic promos co. that provides complete base of the channel acknowledgment (connections acquisition to individual, location, time, and so on) and is paid just when a promo results in an acquisition. We see Ibotta as an extremely appealing choice to various other kinds of advertising and marketing and promos where ROAS is a lot more challenging to gauge.”

Nagle takes place to price IBTA as a Buy, and enhances that with a $110 cost target recommending a ~ 64% share gratitude on the 1 year perspective. (To enjoy Nagle’s record, visit this site)

Overall, this recently public supply has actually made its Solid Buy expert agreement score by grabbing 6 favorable testimonials from the Road. The supply is valued at $67.19 and its $101.17 typical target cost suggests a 1 year benefit capacity of ~ 51%. (See IBTA supply projection)

To locate excellent concepts for supplies trading at appealing assessments, browse through TipRanks’ Finest Supplies to Purchase, a device that joins every one of TipRanks’ equity understandings.

Please note: The viewpoints shared in this short article are only those of the included experts. The material is meant to be made use of for informative functions just. It is extremely essential to do your very own evaluation prior to making any type of financial investment.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.