( Editor’s note: A table published the other day by FreightWaves of essential economic and functional information from Marten had mistakes. That table has actually been eliminated. The coming with table is precise).

Third-quarter profits at Marten Transportation were unfavorable nearly throughout the board, with little indication of a truckload market recuperation noticeable in the numbers.

The business paid; it published web profits of 5 cents per share, below 17 cents in the 3rd quarter of 2023 and 10 cents per share in the 2nd quarter. According to SeekingAlpha, the agreement projection was for Marten to make 8 cents per share in the 3rd quarter.

However past that, the numbers suggested of a truckload provider for which practically all metrics were wearing away, not enhancing.

Begin with running proportion. Companywide, it was 97.9% for the quarter, compared to 92.8% in the matching quarter of 2023 and 95.3% sequentially from the 2nd quarter of 2024.

The Truckload sector at Marten (NASDAQ: MRTN) published an OR internet of gas for the quarter of 100.2%, 300 basis factors even worse than a year earlier and 140 bps even worse than in the 2nd quarter.

Devoted’s OR internet of gas burnt out to 95.1%. That’s a tremendous 870 bps even worse than in the 3rd quarter of in 2014, and a 500-bps damage from this year’s 2nd quarter.

Marten does not hold a teleconference with experts. FreightWaves has actually connected to the business for remark.

In previous quarterly profits launches, Exec Chairman Randolph Marten has actually kept in mind that the business has actually not been going after prices down a gliding market. That was not pointed out in this quarter’s discourse from Marten.

In both the 2nd- and third-quarter profits launches, Randolph Marten was estimated as claiming: “We are concentrated on decreasing the products market’s effect on our procedures while buying and placing our procedures to maximize successful natural development possibilities, with reasonable payment for our costs solutions, throughout each of our organization procedures wherefore follows in the products cycle as the marketplace approaches balance.”

However in the second-quarter declaration, that was adhered to by his statement that “We have actually not accepted price decreases because last August.” That was not in the third-quarter declaration.

The earlier affirmations recommend Marten might have been transforming its back on some organization as a result of prices it viewed as illogical and perhaps unlucrative.

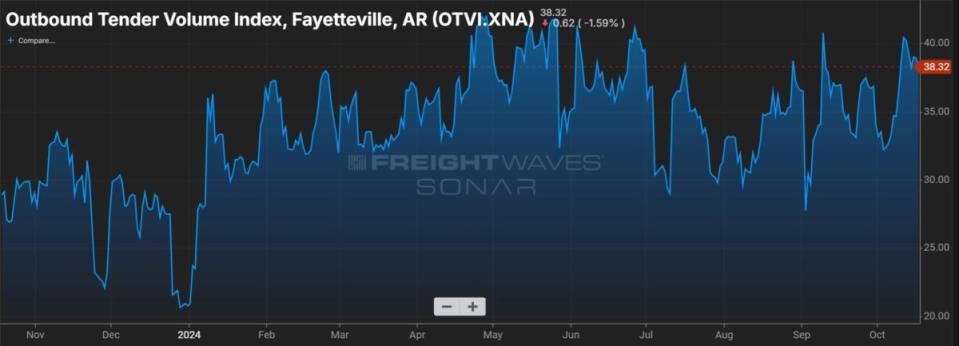

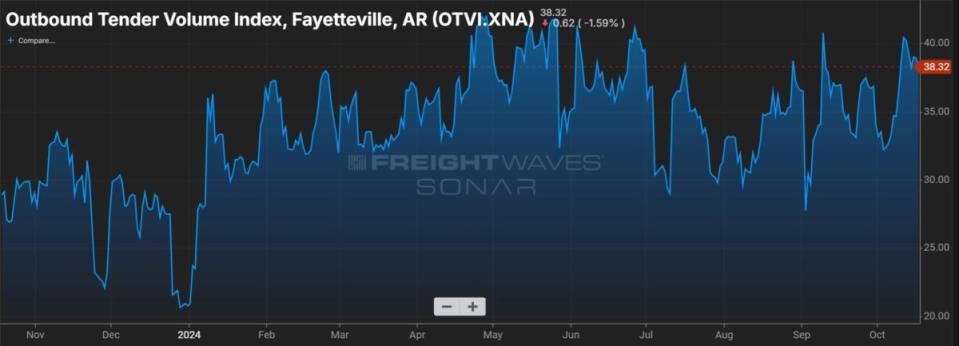

There are tips within the profits record that has actually happened, considered that general quantities in the trucking market have actually stayed reasonably stable, per the Outbound Tender Quantity Index in Finder. However that hasn’t occurred at Marten.

As an example, complete miles driven in the Truckload sector were 39.29 million. That is down nearly 3% from the number in the 2nd quarter however simply 0.5% from the 3rd quarter a year earlier.

However in the Devoted sector, where decreasing prices that would certainly be the basis for a longer-term offer may be even more of a deterrent for Marten to stay clear of the low-rate quandary, the decrease was steeper. Complete miles driven in the Devoted team were down 5.9% simply from the 2nd quarter and a tremendous 19.6% from a year earlier.

That falloff in organization might lag the sharp decrease in the variety of tractors in the Devoted sector. The overall was down nearly 20% from a year earlier, to 1,296 from 1,619. Tractors in Devoted were down 6.2% sequentially.

Truckload tractors were down a little bit greater than 6% sequentially and nearly 1% from a year earlier, recommending a substantial cleanup in tools simply in the July-to-September duration.

In his remarks this quarter in a ready declaration, Randolph Marten indicated one quarterly favorable: The 3rd quarter was the initial because the 4th quarter of 2022 throughout which the consolidated Truckload and Devoted complete price per mile has actually enhanced from the previous quarter.

However the particular number is not revealed in the profits.

What was not up sequentially was integrated income for Truckload and Dedicated. The split on that particular in the 3rd quarter was $108.4 million for Truckload and $75 million for Devoted. The previous quarter, the split was $112.6 million and $81.3 million.

However the exec chairman likewise looked onward. Marten stated there is “enhanced passion by our clients to protect committed capability.”

And while some metrics in the profits record recommended a service provider that has actually diminished, Marten mentioned development in the Devoted sector at his name business. He stated the business has brand-new committed programs that have actually included 149 vehicle drivers to the Marten rankings, up from 133 a quarter previously. The brand-new Devoted solutions are anticipated to be “considerably in solution by the end of the year.”

Marten’s supply rate responded adversely to the profits information. At roughly 10:45 a.m. EDT, when the S&P 500 had actually squeezed out a gain of concerning 0.25%, Marten’s supply was down approximately 2.75% to $16.23, a decrease of 46 cents.

The 52-week reduced at Marten is $15.33, videotaped April 19. Ever since the rate of Marten supply is up around 6.8%.

However in the previous 52 weeks, Marten’s supply is down around 16.1% while the S&P 500 is up 35.6%.

Marten entertains in various other truckload supplies that have actually been delaying the more comprehensive market index. In the previous 52 weeks, per Barchart, Heartland (NASDAQ: HTLD) is down 21.2% and Pam (NASDAQ: PTSI) is down 16.5%. However Werner (NASDAQ: WERN) is down nearly 1% while Agreement Logistics (NYSE: CVLG) is up around 21.4%.

The 5-cent profits per share number at Marten is much less than what the business pays in quarterly rewards, which presently stands at 6 cents.

The 6-cent reward has actually held because the initial quarter of 2022. Marten likewise paid a 50-cents-per-share unique reward in December 2020.

The previous couple of years have actually taken a toll on Marten’s money available. At the end of the 3rd quarter of 2022, when the solid post-pandemic products market was beginning to decline, Marten had money available of $71.4 million, up from the $57 million it carried hand at the close of 2021.

However in the current profits record, money available was to $42.9 million, after the business liquidated 2023 at $52.2 million.

Complete operating income at Marten for the quarter was $237.4 million, below $280 million a year previously. The nine-month income overall was $733.4 million, below $863.2 million in the initial 9 months of 2023.

Expenditures did drop too in the quarter, going down to $233 million from $262.3 million a year previously.

One factor for reduced expenditures: monitoring income decreases. Marten submitted notification with the Stocks and Exchange Compensation last month that it was cutting salaries for six top managers.

More articles by John Kingston

Trucking and marijuana testing find their way to the Supreme Court

TriumphPay gets back to a positive EBITDA

AB5 notches another win: Supreme Court won’t hear Postmates/Uber case

The article Marten’s earnings and almost all other key operating metrics down showed up initially on FreightWaves.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.