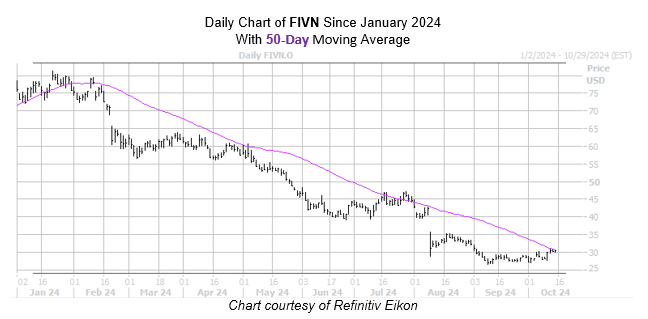

Software program supply Five9 Inc (NASDAQ: FIVN) is up 03.3% to trade at $30.29 today, readied to ending up 4 out of the last 5 sessions greater, consisting of a 6.1% pop on Oct. 10. FIVN currently flaunts a 6.1% gain in the last thirty days, yet this mini rally off multi-year lows has the shares running rashly right into a historically bearish relocating typical

According to the most recent information from Schaeffer’s Elderly Measurable Expert Rocky White, Five9 supply is within one basic inconsistency of its 50-day trendline. For the objective of this research study, White specifies that as the equity trading listed below the relocating typical 80% of the moment over the previous 2 months and shutting southern of the trendline in 8 of the last 10 sessions prior to coming within striking range of it.

Per White’s information, 9 comparable experiences took place in the last 3 years. In the month after these signals, FIVN completed the following month unfavorable 44% of the moment, and balanced a 3.1% loss over this time frame.

Regardless Of a 61.5% year-to-date deficiency and 51.8% year-over-year loss, analyst sentiment stays high, with 17 of 21 covering brokerage firms ranking the safety and security a “acquire” or much better. A relaxing of this positive outlook can tax the shares.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.