Boeing (BACHELOR’S DEGREE) made 2 huge actions late Monday evening to fortify its annual report as the firm encounters a very hard time in advance.

Initially, Boeing participated in an arrangement to secure $10 billion in additional debt from a consortium of financial institutions led by Financial institution of America Stocks, Citibank, Goldman Sachs, and JPMorgan. 2nd and a lot more significantly, the firm submitted a combined rack enrollment with the SEC to offer up to $25 billion in brand-new financial debt protections, ordinary shares, chosen supply, and various other share offerings.

Previously, the Wall Street Journal reported Boeing would pursue a $10 billion stock offering using the declaring, resources stated. Boeing stated it had $10.3 billion in money and protections accessible at the end of September.

Boeing shares closed over 2% on Tuesday.

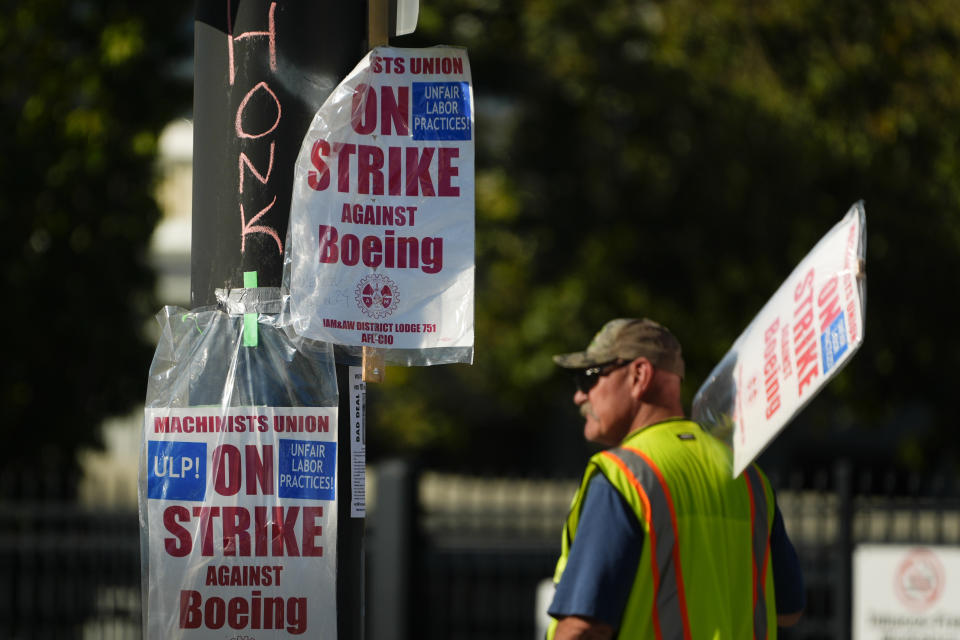

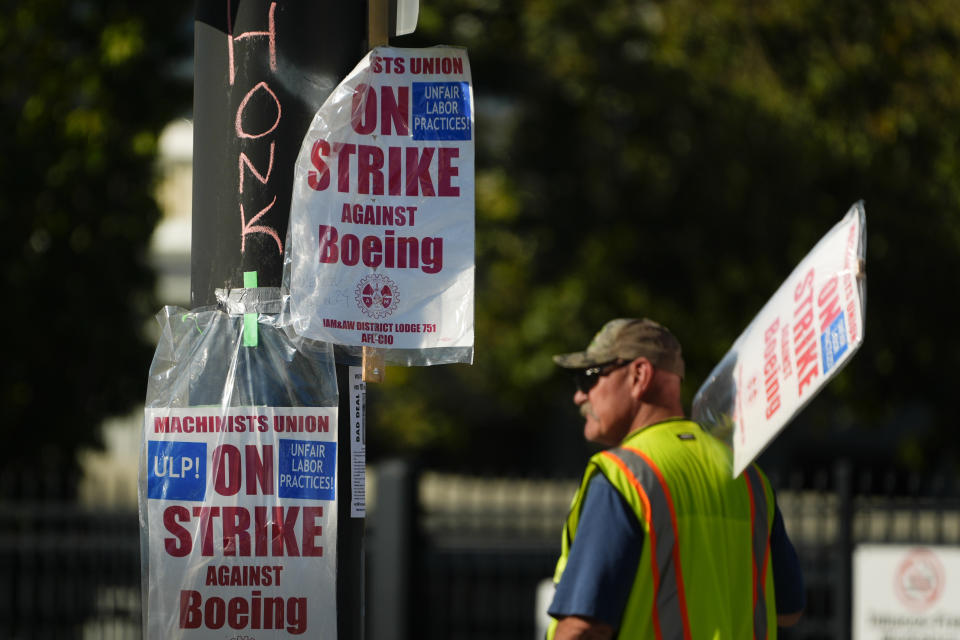

The brand-new debt contract and financial debt and supply offerings come as the firm is stuck in a labor disagreement with its biggest organized labor and as the firm tries to increase manufacturing of its business jets after a mid-air door blowout of an Alaska Airlines 737 Max jet and countless circumstances of whistleblowers declaring manufacturing problems with the 787 Dreamliner widebody jet.

On Friday, Boeing released preliminary third quarter financials as the scenario at the planemaker was obtaining a lot more alarming. Boeing stated it anticipates to report a GAAP loss per share of $9.97, with running capital of -$ 1.3 billion. The firm will certainly additionally finish manufacturing of its 767 vessel jet and press back the launch of its upcoming 777X widebody jet.

The firm will certainly take $5 billion in pre-tax fees, with $3 billion originating from the airlines department and $2 billion originating from its protection organization.

New chief executive officer Kelly Ortberg additionally introduced the firm would certainly give up 10% of its workforce, or around 17,000 staff members, throughout all the departments to fortify its monetary placement.

” Our organization remains in a challenging placement, and it is difficult to overemphasize the obstacles we encounter with each other. Past browsing our existing setting, recovering our firm needs hard choices and we will certainly need to make architectural modifications to guarantee we can remain affordable and supply for our clients over the long-term,” Ortberg composed in a memo to employees.

The discharges, which come as very early as following month, will certainly happen as Boeing’s labor disagreement with the International Organization of Machinists (IAM) gets in a 2nd month. After the union elected down a first proposition, both sides have actually been working out via a moderator ahead to a bargain; nevertheless an arrangement has actually been evasive.

Presently, both sides are not working out, and Boeing withdrawed its most current deal after the IAM decreased to elect on it. The price of the strike thus far has actually been significant for both Boeing and the employees, with one profession team estimating the total cost is nearing $5 billion.

” Also if the strike is solved today, there will certainly be a requirement for added liquidity as distributions will certainly be affected right into 2025,” stated Third Bridge expert Peter McNally in a note to financiers. “In spite of the greatest quarterly distributions for the year, Q3 still saw Boeing lose on capital.”

Boeing will certainly have even more to state on strike prices and the resulting organization results when it launches complete 3rd quarter monetary outcomes on Oct. 23.

Pras Subramanian is a press reporter for Yahoo Financing. You can follow him on Twitter and on Instagram

Go Here for the most recent stock exchange information and thorough evaluation, consisting of occasions that relocate supplies

Review the most recent monetary and organization information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.