The 67 million Americans eligible for Medicare make an essential choice every October: Should they make adjustments in their Medicare medical insurance prepare for the following fiscal year?

The choiceis complicated Medicare has a huge selection of insurance coverage alternatives, with big and differing effects for individuals’s wellness and funds, both as recipients and taxpayers. And the choice is substantial– some selections secure recipients out of typical Medicare.

Recipients select an insurance coverage strategy when they turn 65 or end up being qualified based upon certifying persistent problems or specials needs. After the initial sign-up, many recipients can make adjustments just throughout the open registration duration each autumn.

The 2024 open enrollment period, which ranges from Oct. 14 to Dec. 7, notes a possibility to reassess alternatives. Provided the challenging nature of Medicare and the deficiency of objective consultants, nevertheless, discovering dependable info and comprehending the alternatives offered can be tough.

We are health care policy experts that research Medicare, and also we discover it made complex. Among us lately aided a loved one sign up in Medicare for the very first time. She’s healthy and balanced, has accessibility to medical insurance with her company and does not routinely take prescription medicines. Also in this simple situation, the variety of selections were frustrating.

The risks of these selections are even higher for individuals taking care of several persistent problems. There is help available for recipients, yet we have actually discovered that there is significant area for renovation– specifically in making aid offered for everybody that requires it.

The option is complicated, specifically when you are enrolling in the very first time and if you are qualified for both Medicare andMedicaid Insurance providers frequently take part in hostile and occasionally misleading marketing and outreach with brokers and representatives. Pick objective sources to guide you through the process, like www.shiphelp.org. Make certain to begin prior to your 65th birthday celebration for first sign-up, keep an eye out for yearly plan changes, and begin well prior to the Dec. 7 due date for any type of strategy adjustments.

2 courses with several choices

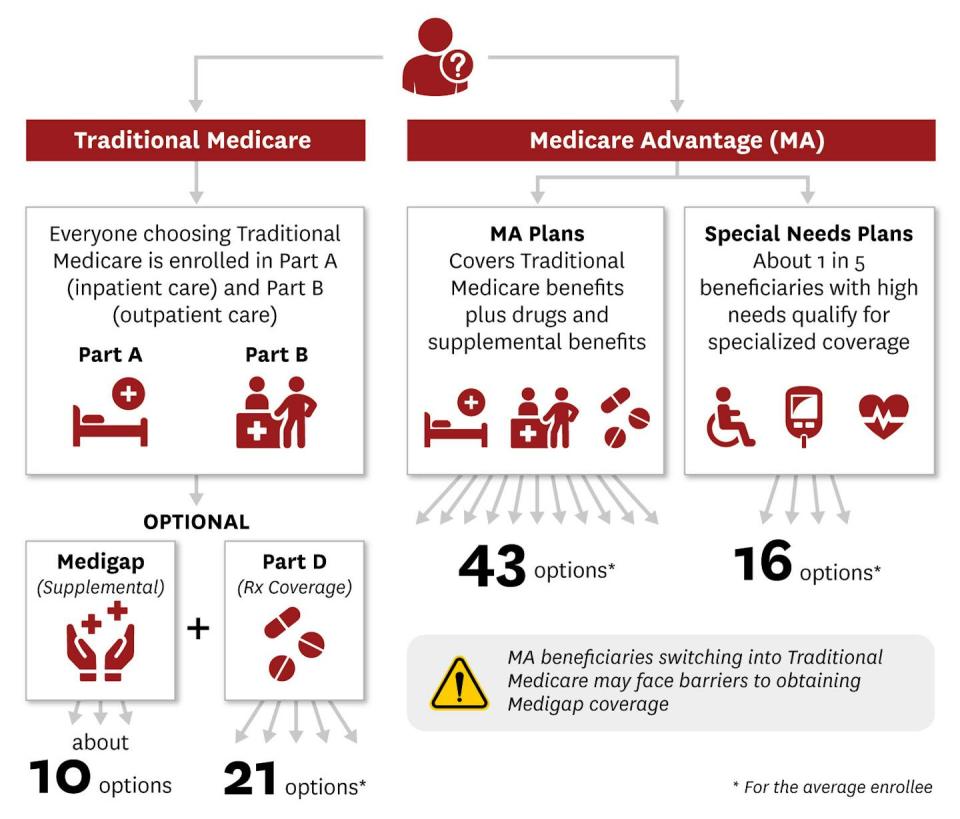

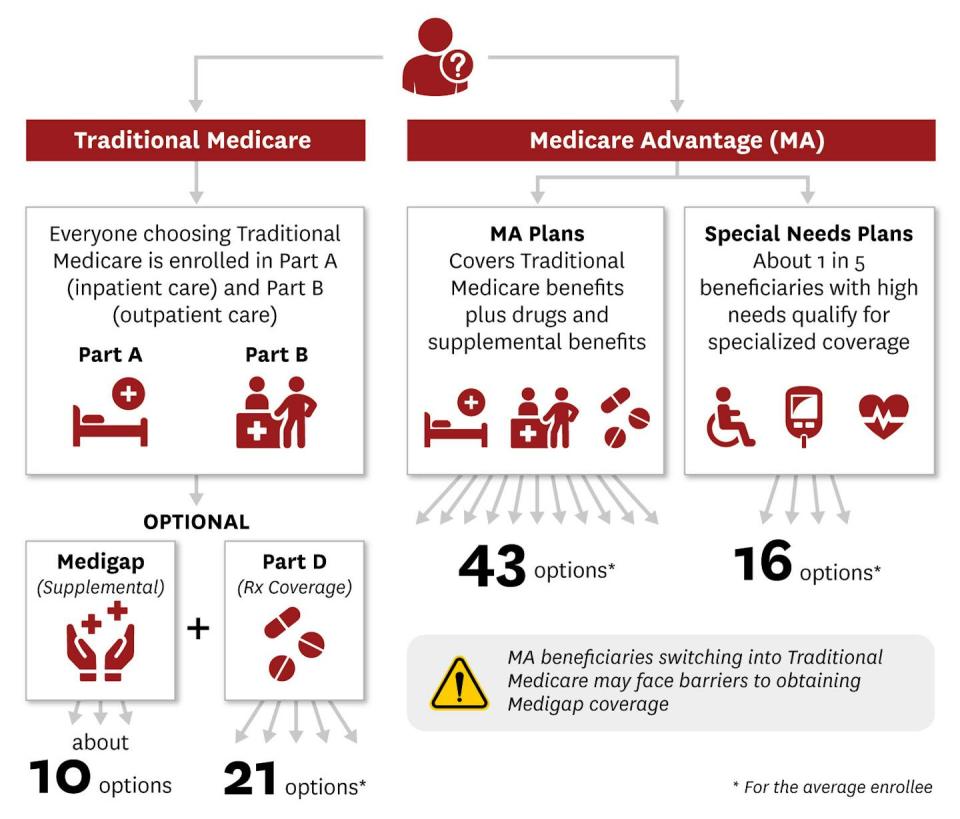

Within Medicare, recipients havea choice between two very different programs They can sign up in either typical Medicare, which is provided by the federal government, or among the Medicare Benefit intends supplied by exclusive insurer.

Within each program are loads of additional selections.

Typical Medicare is an across the country consistent cost-sharing prepare for clinical solutions that enables individuals to select their companies for many sorts of treatment, generally without previous permission. Deductibles for 2024 are US$ 1,632 for healthcare facility prices and $240 for outpatient and clinical prices. People additionally need to contribute beginning on Day 61 for a health center remain and Day 21 for a knowledgeable nursing center remain. This percent is calledcoinsurance After the annual insurance deductible, Medicare pays 80% of outpatient and medical costs, leaving the individual with a 20% copayment. Typical Medicare’s fundamental strategy, called Component A and Component B, additionally has no out-of-pocket optimum.

Individuals registered in typical Medicare can additionally buy supplementary insurance coverage from a personal insurance provider, called Component D, for medicines. And they can buy supplemental coverage, known as Medigap, to reduced or remove their deductibles, coinsurance and copayments, cap prices for Components A and B, and include an emergency situation international traveling advantage.

Component D intends cover prescription medicine prices for around$0 to $100 a month Individuals with reduced revenues might obtain additional monetary aid by enrolling in the Medicare program Part D Extra Help or state-sponsored pharmaceutical assistance programs.

There are 10 standard Medigap plans, additionally called Medicare supplement strategies. Depending on the plan, and the individual’s sex, place and cigarette smoking condition, Medigap usually sets you back from regarding $30 to $400 a month when a beneficiary first enrolls in Medicare.

The Medicare Benefit program enables exclusive insurance firms to pack whatever with each other and supplies several registration alternatives. Compared to typical Medicare, Medicare Benefit intends usually use reduced out-of-pocket prices. They frequently pack supplemental coverage for hearing, vision and oral, which is not part of traditional Medicare.

However Medicare Benefit strategies additionally limit provider networks, implying that individuals that are registered in them can see just particular companies without paying additional. In contrast to typical Medicare, Medicare Benefit enrollees generally go to lower-quality hospitals, nursing facilities, and home health agencies yet see higher-quality primary care doctors.

Medicare Benefit strategies additionally frequently require prior authorization— frequently for important services such as remain at knowledgeable nursing centers, home wellness solutions and dialysis.

Selection overload

Comprehending the tradeoffs in between costs, healthcare gain access to and out-of-pocket healthcare prices can be frustrating.

Though alternatives differ by region, the regular Medicare recipient can select in between as several as 10 Medigap plans and 21 standalone Part D plans, or approximately43 Medicare Advantage plans Individuals that are qualified for both Medicare and Medicaid, or have certain chronic conditions, or remain in a long-term care facility have added sorts of Medicare Benefit intends called Special Needs Plans to select amongst.

Medicare Advantage plans can vary in terms of networks, benefits and use of prior authorization.

Various Medicare Benefit strategies have varying and large impacts on enrollee wellness, consisting of remarkable distinctions in death prices. Scientists discovered a 16% distinction each year in between the most effective and worst Medicare Benefit strategies, implying that for every single 100 individuals in the most awful strategies that pass away within a year, they would certainly anticipate only 84 individuals to pass away within that year if all had actually been registered in the most effective strategies rather. They additionally discovered strategies that set you back even more had reduced death prices, yet intends that had greater government high quality rankings– called “celebrity rankings”– did not always have reduced death prices.

The high quality of various Medicare Benefit strategies, nevertheless, can bedifficult for potential enrollees to assess The federal plan finder web site checklists offered strategies and releases a high quality ranking of one to 5 star for each and every strategy. However in technique, these celebrity rankings do not always represent better enrollee experiences or meaningful differences in quality.

Online carrier networks can also contain errors or consist of companies that are no longer seeing new patients, making it tough for individuals to select strategies that provide accessibility to the companies they favor.

While several Medicare Benefit intends brag regarding their supplemental benefits , such as vision and oral insurance coverage, it’s frequently hard to comprehend exactly how charitable this supplementary insurance coverage is. For example, while many Medicare Benefit intends deal supplementary oral advantages, cost-sharing and insurance coverage can differ. Some strategies do not cover solutions such as extractions and endodontics, that includes origin canals. Many strategies that cover these much more substantial oral solutions need some mix of coinsurance, copayments and annual limits.

Also when info is totally offered, errors are most likely.

Part D beneficiaries often fail to accurately evaluate premiums and expected out-of-pocket costs when making their registration choices. Previous job recommends thatmany beneficiaries have difficulty processing the proliferation of options An individual’s partnership with healthcare companies, monetary scenario and choices are crucial factors to consider. The effects of signing up in one strategy or an additional can be hard to figure out.

The catch: Shut out

At 65, when most recipients very first sign up in Medicare, government guidelines assure that any person can obtainMedigap coverage Throughout this first sign-up, recipients can not be billed a greater costs based upon their wellness.

Older Americans that sign up in a Medicare Benefit strategy yet after that intend to change back to typical Medicare after greater than a year has actually passed shed that warranty. This can efficiently lock them out of enrolling in supplemental Medigap insurance policy, making the initial decision a one-way road.

For the first sign-up, Medigap strategies are “guaranteed issue,” implying the strategy needs to cover preexisting wellness problems without a waiting duration and needs to permit any person to sign up, despite wellness. They additionally need to be “community rated,” implying that the expense of a strategy can not increase as a result of age or ailment, although it can rise because of various other elements such as rising cost of living.

Individuals that sign up in typical Medicare and a supplemental Medigap plan at 65 can anticipate to proceed paying community-rated costs as long as they stay registered, despite what occurs to their wellness.

In many states, nevertheless, individuals that change from Medicare Benefit to typical Medicare do not have as several securities. Many state guidelines allow strategies to refute insurance coverage, enforce waiting durations or charge higher Medigap premiums based upon their expected health prices. Only Connecticut, Maine, Massachusetts and New York warranty that individuals can obtain Medigap strategies after the first sign-up duration.

Misleading marketing

Details regarding Medicare insurance coverage and help picking a strategy is offered yet differs in high quality and efficiency. Older Americans are bombarded with ads for Medicare Benefit intends that they might not be qualified for which consist of misleading statements regarding advantages.

A November 2022 report from the United State Us Senate Board on Money discovered misleading and hostile sales and advertising and marketing methods, consisting of sent by mail sales brochures that indicated federal government recommendation, telemarketers that contacted to 20 times a day, and salesmen that came close to older grownups in the supermarket to inquire about their insurance policy protection.

The Division of Health And Wellness and Human Being Solutions tightened rules for 2024, needing third-party marketing experts to consist of government sources regarding Medicare, consisting of the web site and toll-free contact number, and restricting the variety of get in touches with from marketing experts.

Although the federal government has the authority to examine advertising and marketing products, enforcement is partly depending on whether issues are submitted. Issues can be submitted with the federal government’s Senior Medicare Patrol, a government financed program that protects against and attends to dishonest Medicare tasks.

On the other hand, the variety of individuals registered in Medicare Benefit intends has grown rapidly, increasing given that 2010 and making up more than half of all Medicare beneficiaries by 2023.

Virtually one-third of Medicare recipients seek information from aninsurance broker Brokers market medical insurance intends from several firms. Nonetheless, due to the fact that they receive payment from strategies for sales, and due to the fact that they are not likely to market every choice, a strategy suggested by a broker might not fulfill an individual’s requirements.

Assistance is available − yet fails

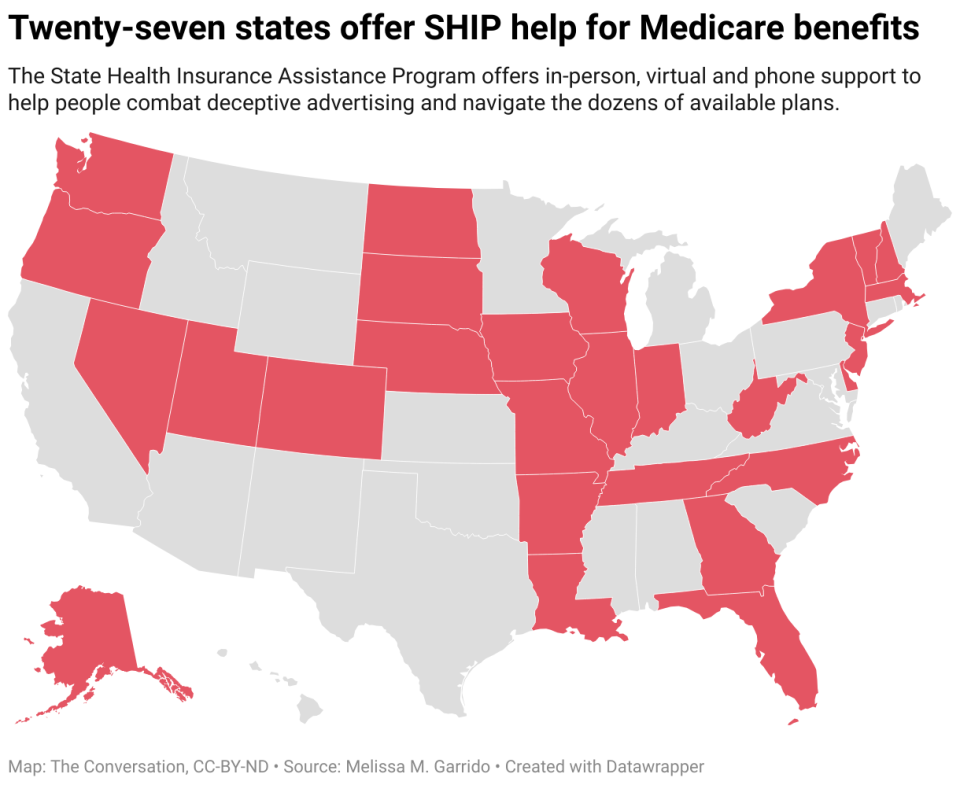

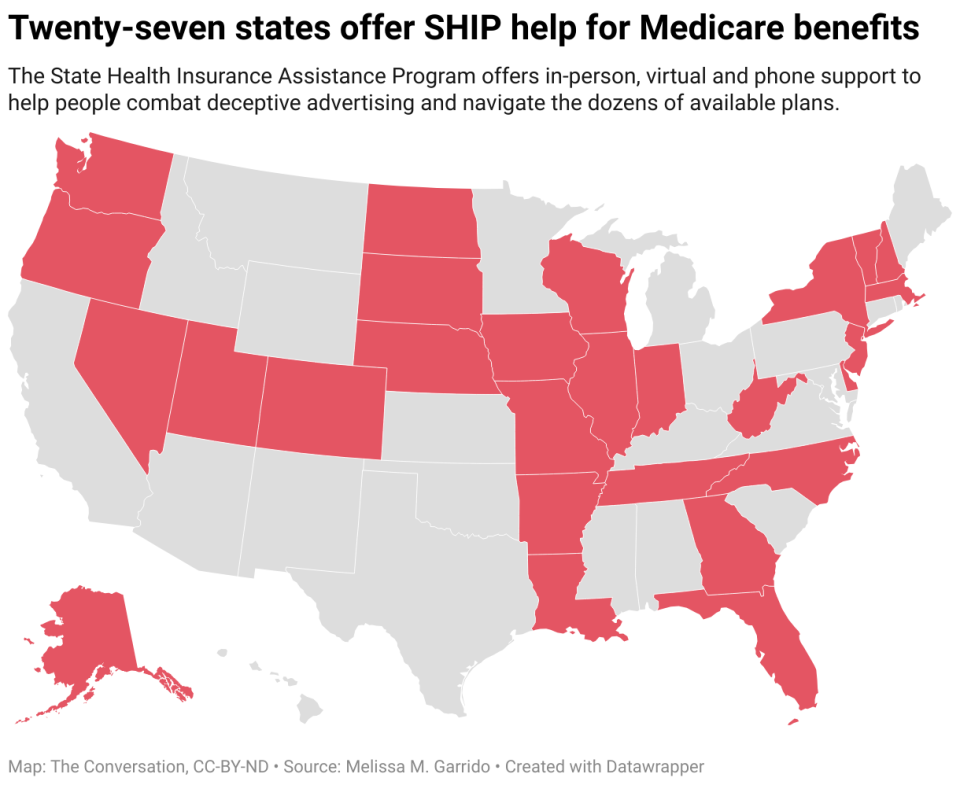

An alternate resource of info is the federal government. It supplies 3 resources of info to aid individuals with picking among these strategies: 1-800-Medicare, medicare.gov and the State Health Insurance Assistance Program, additionally called SHIP.

The SHIP program combats misleading Medicare advertising and misleading brokers by attaching qualified Americans with therapists by phone or personally to assist them select strategies. Many people say they prefer meeting personally with a therapist over phone or web assistance. SHIP team claim they frequently assist individuals understand what’s in Medicare Advantage ads and disenroll from strategies they were routed to by brokers.

Telephone SHIP solutions are offered across the country, yet among us and our associates have actually discovered that in-person SHIP solutions are not offered in some locations. We arranged locations by postal code in 27 states and discovered that although majority of the areas had a SHIP website within the region, locations without a SHIP website included a larger proportion of people with low incomes.

Virtual services are a choice that’s especially beneficial in backwoods and for individuals with minimal wheelchair or little accessibility to transport, yet they need on-line gain access to. Online and in-person solutions, where both a recipient and a therapist can take a look at the very same computer system display, are specifically beneficial for browsing complicated insurance coverage alternatives.

We additionally interviewed SHIP counselors and coordinators from across the U.S.

As one SHIP planner kept in mind, lots of people are not knowledgeable about all their insurance coverage alternatives. For example, one recipient told a coordinator, “I have actually gotten on Medicaid and I’m maturing out of Medicaid. And I do not have a great deal of cash. And currently I need to spend for my insurance policy?” As it ended up, the recipient was qualified for both Medicaid and Medicare as a result of their earnings, therefore needed to pay much less than they believed.

The meetings explained that lots of people are not conscious that Medicare Benefit advertisements and insurance policy brokers might be prejudiced. One counselor said, “There’s a great deal of support (recipients) off the step, if you will, many thanks to those television commercials.”

Several SHIP team therapists stated they would certainly benefit from additional training on coverage options, consisting of for individuals that are qualified for both Medicare and Medicaid. The SHIP program counts greatly on volunteers, and there is often greater demand for services than the offered volunteers can use. Extra therapists would certainly assist fulfill requirements for complicated insurance coverage choices.

The crucial to making an excellent Medicare insurance coverage choice is to use the help available and consider your prices, accessibility to wellness companies, present wellness and drug requirements, and additionally think about exactly how your wellness and drug requirements could transform as time takes place.

This short article becomes part of a periodic collection checking out the united state Medicare system.

Elegance McCormack obtains financing from the Republic Fund and Arnold Ventures.

Melissa Garrido obtains financing from Republic Fund, the Laura and John Arnold Structure, and the National Institutes of Health and wellness for Medicare-related research study, consisting of research study gone over in this item.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.