If compensation prices go down considerably as an outcome of the National Association of Realtors antitrust lawsuit settlement, it’s possibly an existential risk to lots of brokerage firms. Yet which ones and the number of?

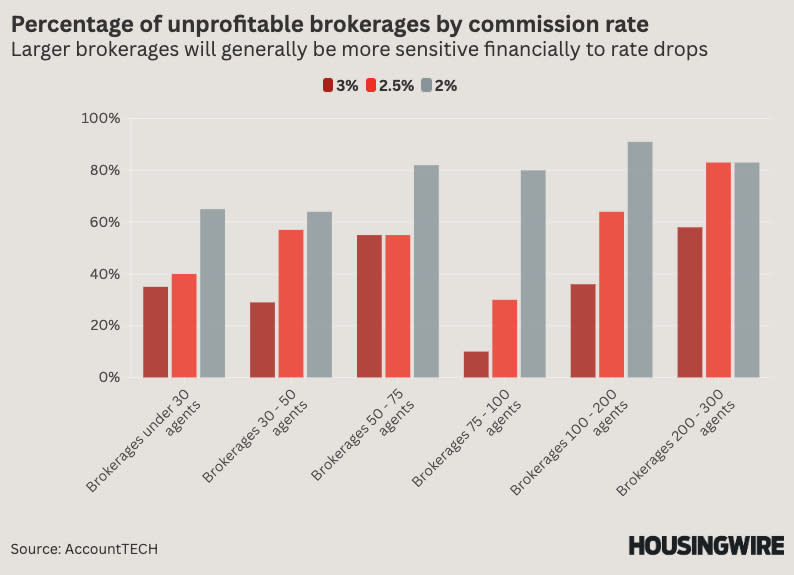

Information from AccountTECH may bring us closer to a response. Based upon an example of 100 brokerage firms of differing dimensions and expenses, the information reveals a basic pattern of bigger brokerage firms being extra conscious a decrease in compensation prices than smaller sized ones.

That’s because lots of big brokerage firms still spend for workplace and center administration.

” You understand that expression they inform you at Weight Watchers– do not consume bread due to the fact that you’re possibly mosting likely to place jam on it?” asked AccountTECH chief executive officer Mark Blagden. “Do not open up a workplace due to the fact that you’re mosting likely to need to team it.”

Blagden’s research study splits the example by representative matter at brokerage firms and afterwards uses various compensation prices to their 2023 financials. The compensation divides at the brokerage firms and their expenses are held consistent.

While smaller sized brokerage firms are usually beginning with far better economic ground, they’re likewise much less conscious reduced payments. For brokerage firms with less than 30 representatives, 65% pay at a 3% compensation price while 35% pay at a 2% compensation.

A 30 portion factor decline is absolutely remarkable, however, for brokerage firms with a representative matter in between 75 and 100 representatives, 90% pay at a 3% compensation and just 20% pay at a 2% compensation, 70 portion factor decline.

Larger brokerage firms are currently battling, though it’s reasonable to claim they have extra sources at their disposal to. For brokerage firms with a representative matter in between 200 and 300, just 42% pay at a 3% compensation and it goes down to 17% at 2.5%, according to AccountTech. With a representative matter in between 100 and 200, 64% pay at a 3% compensation, yet that number dives to 9% at a 2.25% compensation.

Blagden states that the 50-to-75-agent brokerage firms remain in the very best setting to receive decreases. He sees the typical compensation now having to do with 2.5%, and 70% of brokerage firms because representative matter variety pay, which is considerably more than various other varieties.

While those brokerage firms do see a decrease to simply 20% at a 2% compensation price, that’s greater than brokerage firms over 50 representatives, and it just goes down listed below 50% at that price.

” Having 75 to 100 representatives appears to be the very best area to be due to the fact that you do not always need to have administration, you do not need to have a great deal of workplaces, you do not need to have a great deal of supervisors, and you can simply take the majority of that down line in regards to earnings,” he claimed.

He included that one of the most impactful means for brokerage firms running at a loss to enter the black is to discard workplace or take a greater split of payments.

While it’s greatly anticipated that payments will certainly go down as an outcome of the brand-new negotiation regulations, various brokerage firms have actually reported various numbers. On its second-quarter revenues telephone call, Compass disclosed that it has actually not seen any type of motion in payments, while Redfin reported that they’ve dropped.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.