Allow’s go into the family member efficiency of Wayfair (NYSE: W) and its peers as we untangle the now-completed Q2 online retail revenues period.

Customers ever before climbing need for ease, choice, and rate are nonreligious engines underpinning ecommerce fostering. For several years before Covid, ecommerce infiltration as a portion of total retail would certainly expand 1-2% every year, however in 2020 fostering sped up by 5%, getting to 25%, as enhanced focus on ease drove customers to structurally purchase even more online. The rise in acquiring created lots of on-line merchants to swiftly expand their logistics frameworks, preparing them for more development in the years in advance as customer buying routines remain to change online.

The 6 online retail supplies we track reported a slower Q2. En masse, incomes defeated experts’ agreement quotes by 0.6% while following quarter’s earnings advice was 1.3% listed below.

Broad view, the Federal Book has a twin required of rising cost of living and work. The previous had actually been running warm throughout 2021 and 2022 however cooled down in the direction of the reserve bank’s 2% target since late. This motivated the Fed to reduce its plan price by 50bps (half a percent) in September 2024. Provided current work information that recommends the United States economic situation can be tottering, the marketplaces will certainly be analyzing whether this price and future cuts (the Fed indicated even more ahead in 2024 and 2025) are the best actions at the correct time or whether they’re insufficient, far too late for a macro that has actually currently cooled down.

Thankfully, on-line retail supplies have actually executed well with share rates up 18% generally considering that the most recent revenues outcomes.

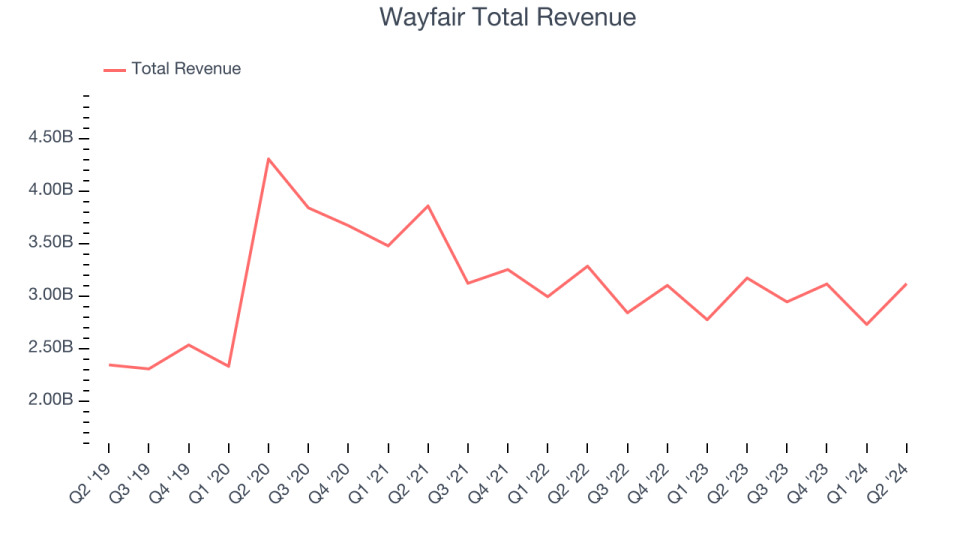

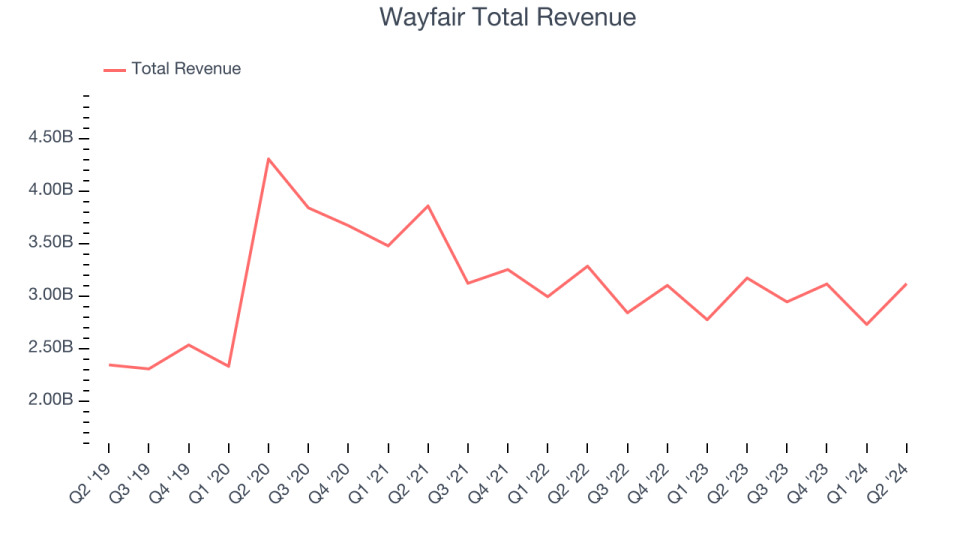

Weakest Q2: Wayfair (NYSE: W)

Introduced in 2002 by owner Niraj Shah, Wayfair (NYSE: W) is a leading online merchant for mass market home products in the United States, UK, Canada, and Germany.

Wayfair reported incomes of $3.12 billion, down 1.7% year on year. This print disappointed experts’ assumptions by 2%. In general, it was an unsatisfactory quarter for the firm with a miss out on of experts’ customer quotes and sluggish earnings development.

” Q2 was a vibrant quarter that caused an additional duration of share gain, in the middle of ongoing macro headwinds that are pushing the methods clients are going shopping the group. Consumers stay careful in their investing on the home, and our bank card information recommends that the group improvement currently mirrors the size of the top to trough decrease the home equipping room experienced throughout the terrific monetary situation,” claimed Niraj Shah, CHIEF EXECUTIVE OFFICER, founder and co-chairman, Wayfair.

Wayfair provided the weakest efficiency versus expert quotes and slowest earnings development of the entire team. The firm reported 22 million energetic customers, up 0.9% year on year. Surprisingly, the supply is up 2.2% considering that reporting and presently trades at $55.60.

Read our full report on Wayfair here, it’s free

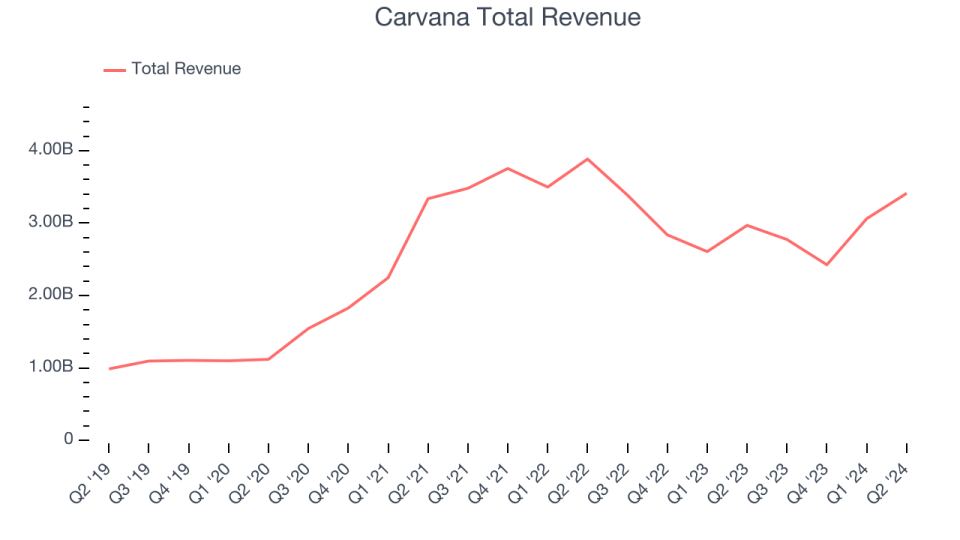

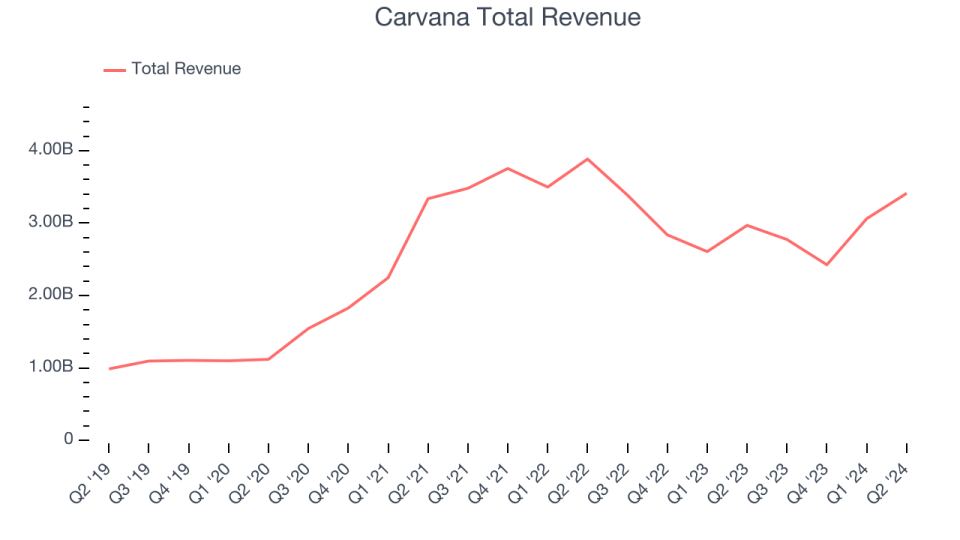

Finest Q2: Carvana (NYSE: CVNA)

Recognized for its glass tower automobile vending devices, Carvana (NYSE: CVNA) gives a practical auto buying experience by providing an online system for trading utilized cars and trucks.

Carvana reported incomes of $3.41 billion, up 14.9% year on year, outmatching experts’ assumptions by 4.6%. Business had a combined quarter as earnings development unfortunately delayed.

Carvana attained the greatest expert approximates defeat amongst its peers. The marketplace appears delighted with the outcomes as the supply is up 34.5% considering that coverage. It presently trades at $179.24.

Is currently the moment to purchase Carvana? Access our full analysis of the earnings results here, it’s free.

Coupang (NYSE: CPNG)

Established In 2010 by Harvard Organization Institution trainee Bom Kim, Coupang (NYSE: CPNG) is a South Oriental shopping titan frequently described as the “Amazon of South Korea”.

Coupang reported incomes of $7.32 billion, up 25.4% year on year, in accordance with experts’ assumptions. It was a softer quarter as it published a miss out on of experts’ customer quotes.

Surprisingly, the supply is up 19.1% considering that the outcomes and presently trades at $24.62.

Read our full analysis of Coupang’s results here.

Revolve (NYSE: RVLV)

Introduced in 2003 by software application designers Michael Mente and Mike Karanikolas, Revolve Team (NASDAQ: RVLV) is a future generation style merchant that leverages social networks and an area of style influencers to drive its retailing technique.

Revolve reported incomes of $282.5 million, up 3.2% year on year. This outcome exceeded experts’ assumptions by 1.9%. In addition to that, it was a combined quarter as it additionally created a respectable beat of experts’ customer quotes however sluggish earnings development.

The firm reported 2.58 million energetic customers, up 4.8% year on year. The supply is up 38.5% considering that reporting and presently trades at $24.34.

Read our full, actionable report on Revolve here, it’s free.

Crunchy (NYSE: CHWY)

Established by Ryan Cohen that later on ended up being understood for his participation in GameStop, Chewy (NYSE: CHWY) is an on-line merchant focusing on family pet food, materials, and medical care solutions.

Chewy reported incomes of $2.86 billion, up 2.6% year on year. This print satisfied experts’ assumptions. Much more generally, it was a weak quarter as it logged sluggish earnings development.

The supply is up 12.6% considering that reporting and presently trades at $29.08.

Read our full, actionable report on Chewy here, it’s free.

Sign Up With Paid Supply Financier Study

Assist us make StockStory a lot more valuable to financiers like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.