Completion of a revenues period can be a fun time to find brand-new supplies and analyze exactly how business are dealing with the present company atmosphere. Allow’s have a look at exactly how Reynolds (NASDAQ: REYN) et cetera of the family items supplies got on in Q2.

Family items supplies are typically steady financial investments, as most of the sector’s items are vital for a comfy and practical space. Just recently, there’s been an expanding focus on environmentally friendly and lasting offerings, showing the progressing customer choices for eco mindful alternatives. These patterns can be double-edged swords that profit business that introduce promptly to benefit from them and harm business that do not spend sufficient to satisfy customers where they wish to be when it come to patterns.

The 10 family items supplies we track reported a sufficient Q2. En masse, incomes defeated experts’ agreement price quotes by 1% while following quarter’s income support was 0.5% over.

Broad view, the Federal Get has a double required of rising cost of living and work. The previous had actually been running warm throughout 2021 and 2022 yet cooled down in the direction of the reserve bank’s 2% target since late. This motivated the Fed to reduce its plan price by 50bps (half a percent) in September 2024. Offered current work information that recommends the United States economic situation might be tottering, the marketplaces will certainly be examining whether this price and future cuts (the Fed signified even more ahead in 2024 and 2025) are the best steps at the correct time or whether they’re insufficient, far too late for a macro that has actually currently cooled down.

Luckily, family items supplies have actually been durable with share costs up 5% usually considering that the most up to date revenues outcomes.

Reynolds (NASDAQ: REYN)

Finest understood for its light weight aluminum foil, Reynolds (NASDAQ: REYN) is a family items business whose items concentrate on food storage space, food preparation, and waste.

Reynolds reported incomes of $930 million, down 1.1% year on year. This print went beyond experts’ assumptions by 4.2%. On the whole, it was a solid quarter for the business with an outstanding beat of experts’ gross margin and natural income development price quotes.

” Solid retail income efficiency in each of our company systems led to RCP surpassing our classifications throughout the quarter,” claimed Lance Mitchell, Chief Executive Officer and Head Of State of Reynolds Customer Products.

Reynolds supplied the weakest full-year support upgrade of the entire team. Remarkably, the supply is up 3.3% considering that reporting and presently trades at $29.53.

Is currently the moment to acquire Reynolds? Access our full analysis of the earnings results here, it’s free.

Finest Q2: Range Brands (NYSE: SPB)

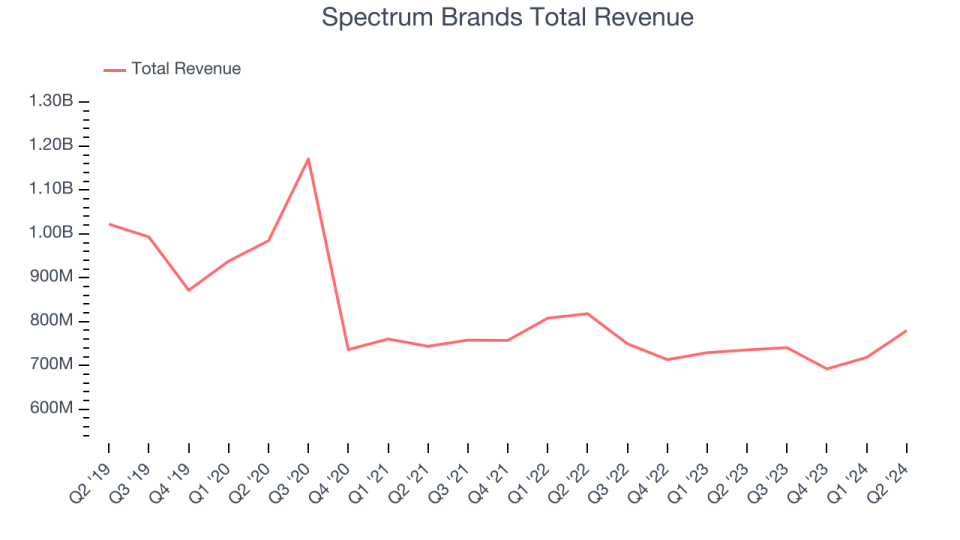

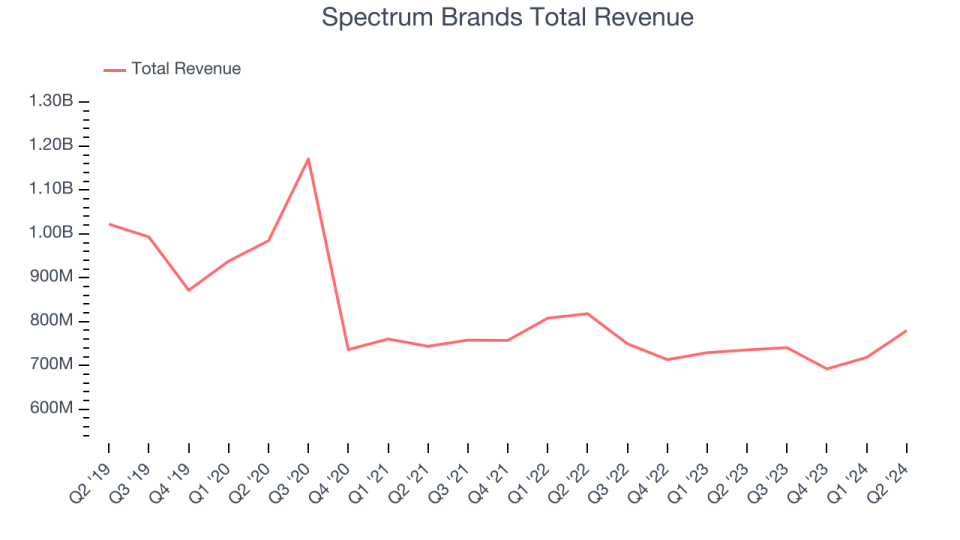

A leader in numerous customer item classifications, Range Brands (NYSE: SPB) is a varied business with a profile of relied on brand names extending home devices, yard treatment, individual treatment, and family pet treatment.

Range Brands reported incomes of $779.4 million, up 6% year on year, surpassing experts’ assumptions by 3.8%. Business had a really solid quarter with an outstanding beat of experts’ natural income development price quotes.

The marketplace appears delighted with the outcomes as the supply is up 13.1% considering that coverage. It presently trades at $92.57.

Is currently the moment to acquire Range Brands? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Kimberly-Clark (NYSE: KMB)

Initially started as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE: KMB) is currently a family items giant understood for individual treatment and cells items.

Kimberly-Clark reported incomes of $5.03 billion, down 2% year on year, disappointing experts’ assumptions by 1.3%. It was a slower quarter as it published a miss out on of experts’ natural income development price quotes and a miss out on of experts’ gross margin price quotes.

As anticipated, the supply is down 3.1% considering that the outcomes and presently trades at $139.62.

Read our full analysis of Kimberly-Clark’s results here.

Church & & Dwight (NYSE: CHD)

Finest understood for its Arm & & Hammer cooking soft drink, Church & & Dwight (NYSE: CHD) is a family and individual treatment items business with a large profile that covers washing cleaning agent to tooth brushes to hair elimination lotions.

Church & & Dwight reported incomes of $1.51 billion, up 3.9% year on year. This number remained in line with experts’ assumptions. Zooming out, it was a sufficient quarter as it likewise created an outstanding beat of experts’ natural income development price quotes yet underwhelming revenues support for the complete year.

The supply is up 1% considering that reporting and presently trades at $101.04.

Read our full, actionable report on Church & Dwight here, it’s free.

Clorox (NYSE: CLX)

Established In 1913 with bleach as the single item offering, Clorox (NYSE: CLX) today is a customer items gigantic whose item profile covers whatever from bleach to skin care to salad clothing to cat trash.

Clorox reported incomes of $1.90 billion, down 5.7% year on year. This outcome missed out on experts’ assumptions by 2.4%. Other than that, it was a solid quarter as it created an outstanding beat of experts’ natural income development price quotes.

Clorox had the weakest efficiency versus expert price quotes and slowest income development amongst its peers. The supply is up 20.3% considering that reporting and presently trades at $161.30.

Read our full, actionable report on Clorox here, it’s free.

Sign Up With Paid Supply Capitalist Study

Assist us make StockStory extra practical to financiers like on your own. Join our paid individual study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.