Home sales and home costs have actually been enhancing for a number of weeks. Regrettably, this duration can be short lived, since we had solid economic news recently. Paradoxically, a solid work circumstance in the nation drives the bond market to greater prices. After the current lows with mortgage rates today, the 30-year set price leapt back up over 6.5%. It resembles the September re-finance boomlet has actually withdrawed. The acquisition market is slower to react, and the information currently is still revealing the favorable effect of reduced prices of current weeks.

Mortgage rates recuperated up over the last pair days, and it shows exactly how vulnerable this housing market recuperation can be. The reality is that as mortgage rates dropped closer to 6% home costs and home sales have actually been revealing quite evident gains over in 2015. Leading signs, such as cost decreases, have actually peaked. Also the withdrawal price of aggravated home vendors decreased over the last month.

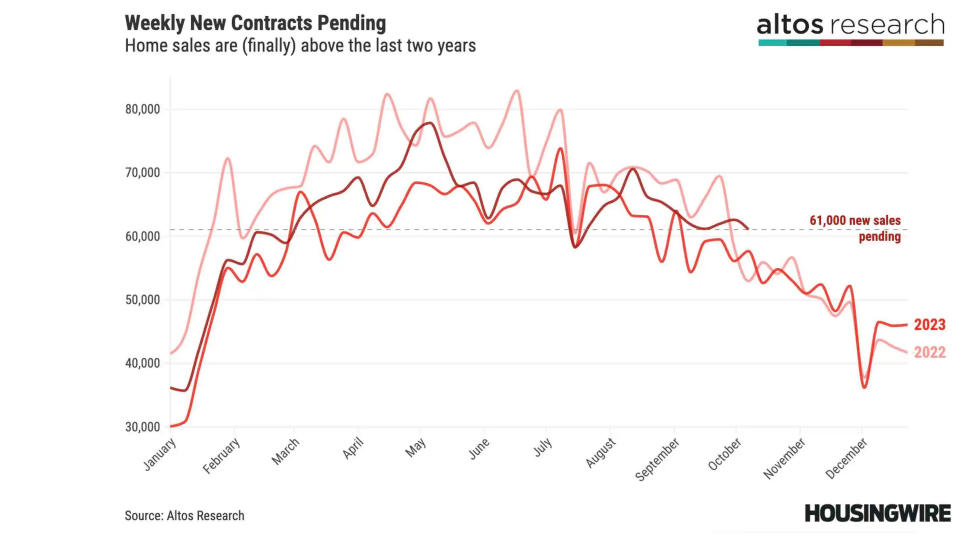

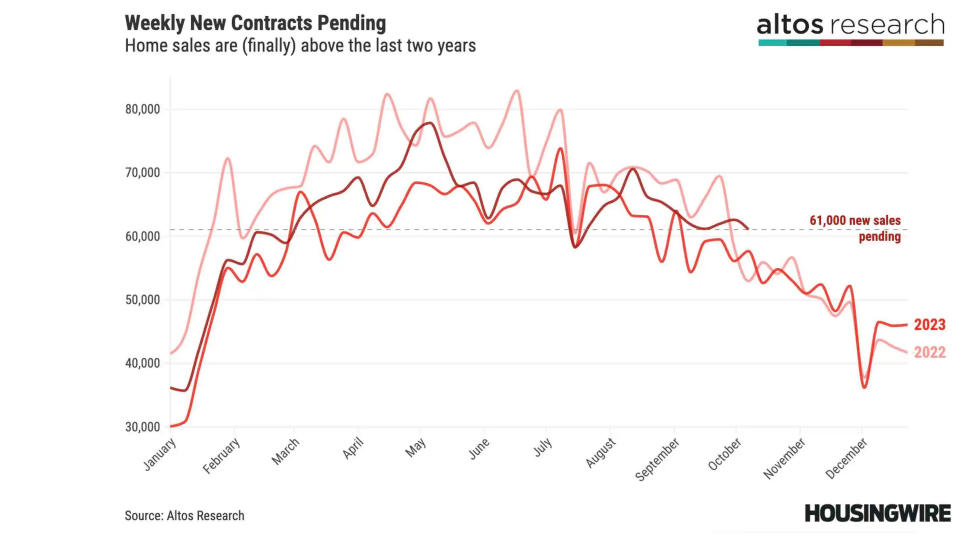

In 2014’shome sales were low There were really couple of purchasers in the 4th quarter 2023. So, having even more currently isn’t such as a large accomplishment, however it reveals that customers do obtain encouraged as the price of cash obtains more affordable. Alternatively, if home loan prices do not remain reduced, we have actually seen buyers really happy to wait. The standard knowledge is that home loan prices will usually remain to relocate lower, however there’s no factor that should hold true, as shown in the last couple of days.

Pending home sales remain to climb up

There are 362,000 single-family homes under agreement. That’s been climbing up all September from 357,000 earlier in the month. It was simply under a 1% boost today. This is gauging the complete matter of homes that are under agreement currently. We’re revealing 6% even more homes under agreement currently than in 2015.

Houses remain under agreement for 30 to 40 days. At the end of the month, a lot of sales close. There’s an action down every month for the initial week of the month. Following week, we’ll begin October with less sales still at the same time.

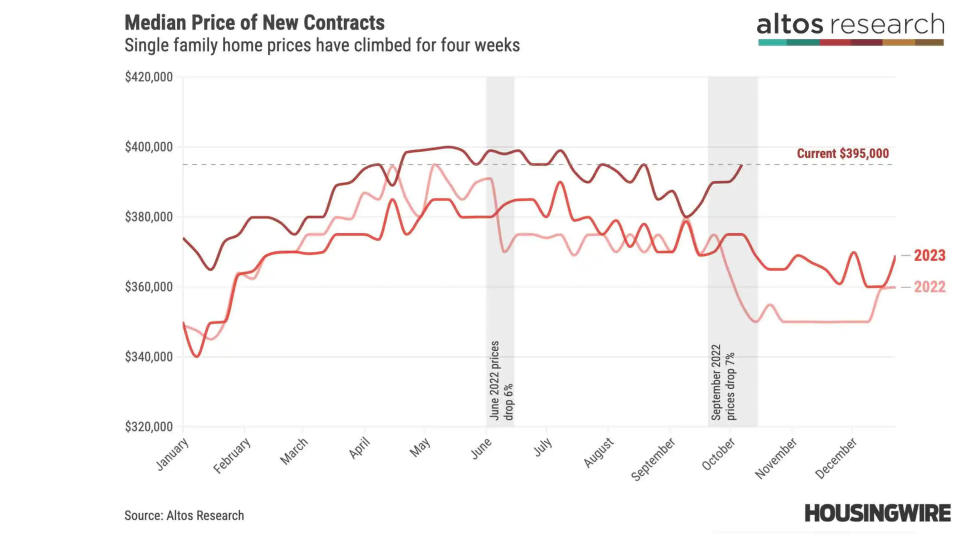

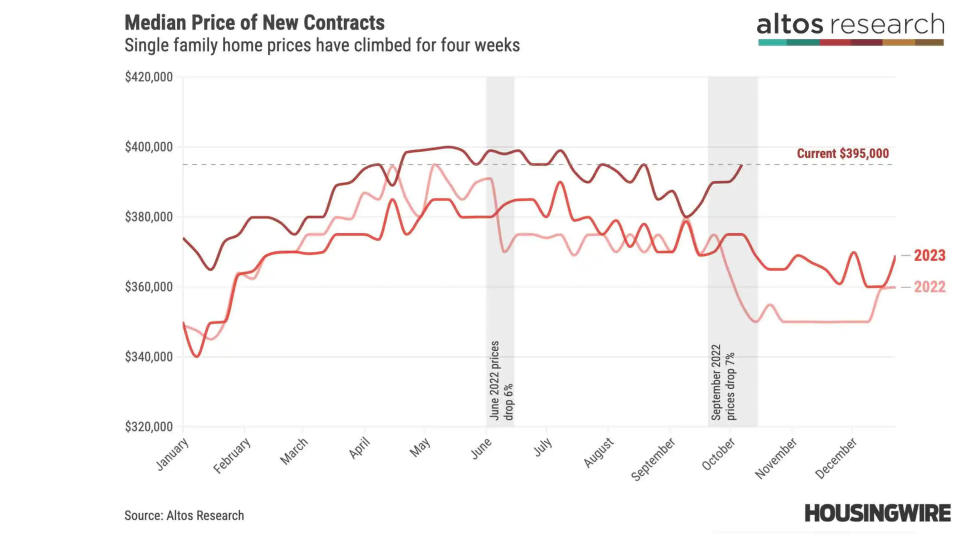

Home costs ticks up

The mean cost for the homes that individuals are getting– those that went under agreement today– is $395,000. It has actually shocked me that for 4 weeks straight, this procedure of home costs has actually ticked up. Normally, we anticipate home costs to reduce down in the loss.

These brand-new pendings costs climbed by 1.25% today, to $395,000 and are 5% more than a year earlier.

In the last 2 years, when October had greatly greater mortgage rates, home sales were tanking and costs were going down. The reverse is occurring currently. I do not anticipate this to proceed. Yet, this is a more powerful signal than I anticipated for strength of thehomebuyer This is the cost factor individuals are getting. This current fad suggests that the annual home cost gratitude has a little bit even more space than we have actually been anticipating.

The mean cost of all the homes on the marketplace is currently $440,000, that’s the same from in 2015.

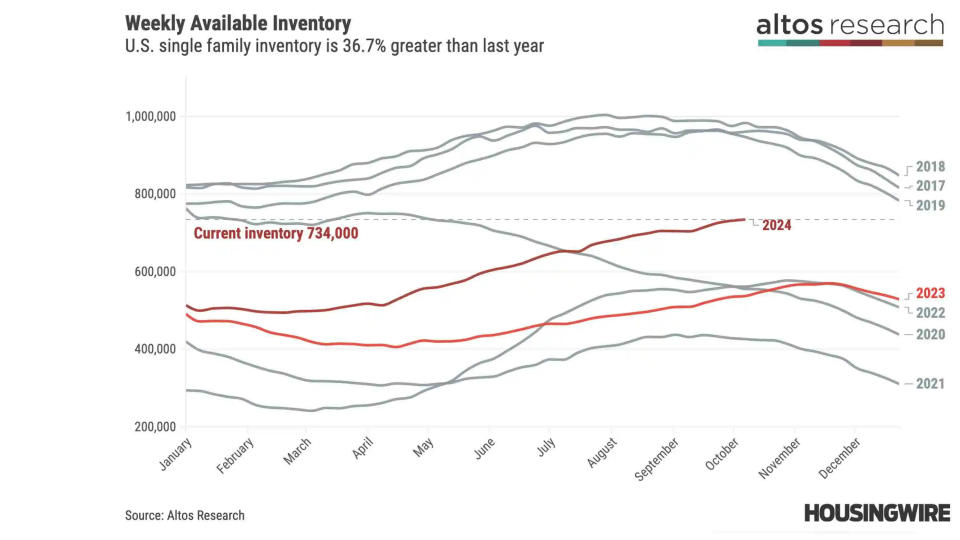

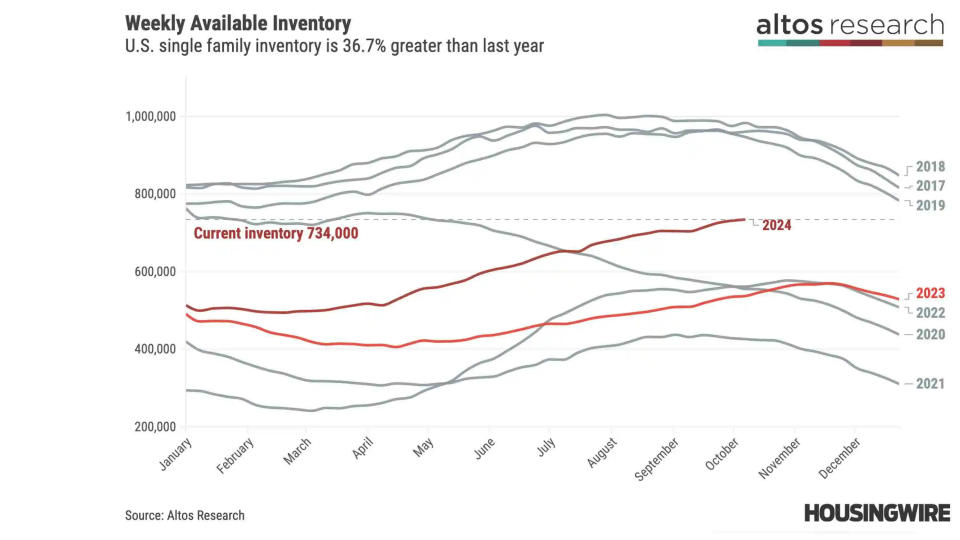

Supply is up

The offered inventory of unsold homes on the marketplace ticked as much as 734,000 single-family homes. That’s up half a percent for the week and is 36.7% even more homes on the marketplace than a year earlier.

A Few Of the Sunbelt states, like Arizona, Texas and Florida have not peaked with supply yet. Texas has 44% even more homes on the marketplace that in 2015 and 24% even more unsold homes on the marketplace currently than in 2019. Arizona has 70% even more homes on the marketplace currently than a year earlier. Country wide, we have 36.7% even more homes unsold than in 2015, however we’re still 23% less homes on the marketplace currently than in 2019. There are 8 states with even more supply currently than in 2019.

Additionally, we see typhoon effect in North Carolina, Georgia and Florida with less brand-new listings, even more withdrawals, and less brand-new pendings.

Asheville city had a 40% decrease in sales throughout the week. And it’ll most likely go down additionally this coming week.

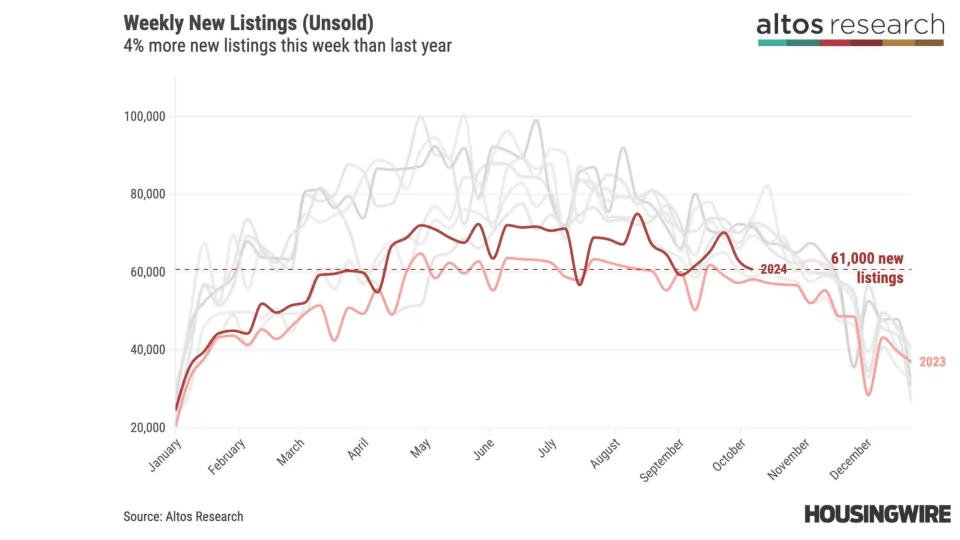

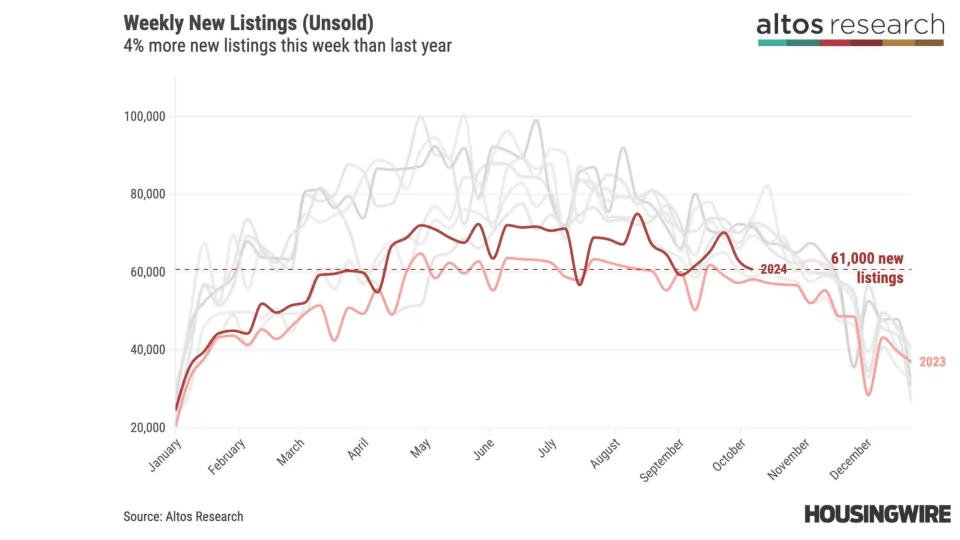

New listings

There were 61,000 brand-new listings unsold today– down a couple of percent factors for the week and a portion greater than a year earlier.

The instant sales go to their cheapest degrees considering that we began tracking throughout the pandemic. These are the bidding process battles and homes that obtain deals promptly after listing. These are the most effective homes in the most effective areas that are correctly valued and well marketed. It’s significant that, while we’re gauging a minor pick-up in complete sales and the costs being paid are holding company, the necessity of purchasers is not boosting. Property buyers remain in a much more powerful placement than they have actually remained in years.

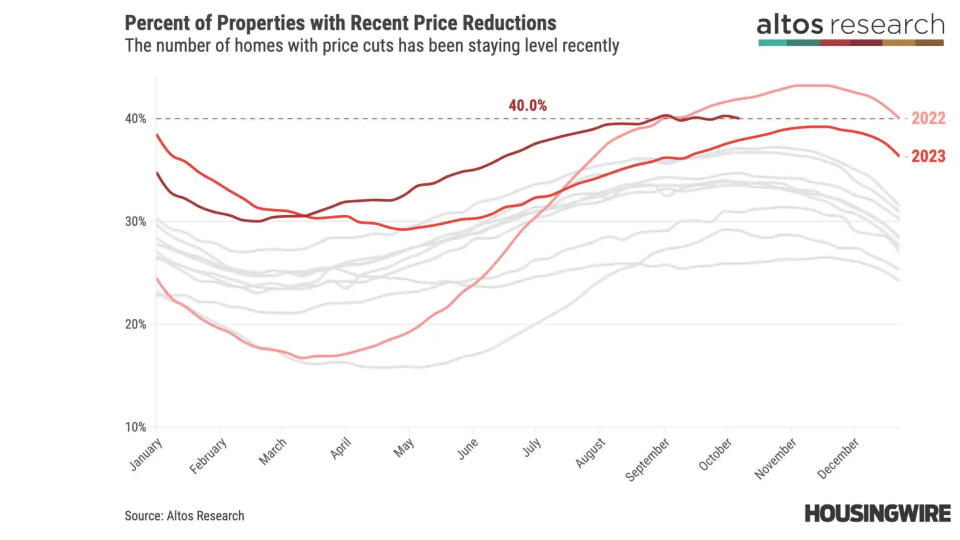

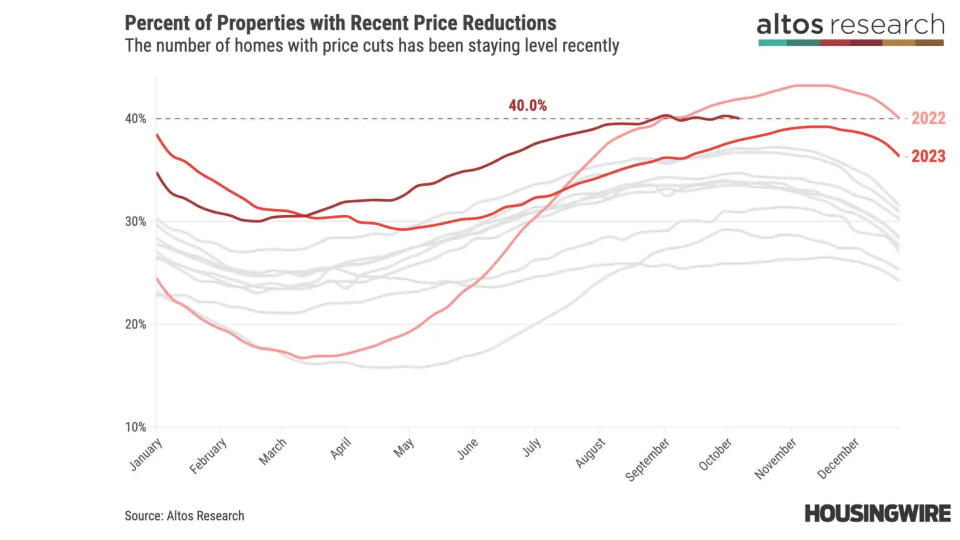

Cost decreases remain level

Practically 40% of the homes on the marketplace have actually taken a cost decrease from the initial retail price. This percent has actually been remaining level for a pair months currently. One means to gauge the minor renovation in homebuyer demand over the last month is that cost decreases have not climbed up whatsoever.

Fees increased in the fall of 2022. Back then, the rate of withdrawals increased and cost cuts climbed up.

It’s wild exactly how swiftly the view can transform in a week. We were perhaps at a change indicate see some home sales development, and unexpectedly we had a large home loan price spike. Purchasers can place the brakes on swiftly.

Mike Simonsen is the owner of Altos Research.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.