United States supplies slid on Monday as financiers revamped their sights on rates of interest cuts after a blowout tasks report in advance of a week of vital rising cost of living information and the begin of revenues period.

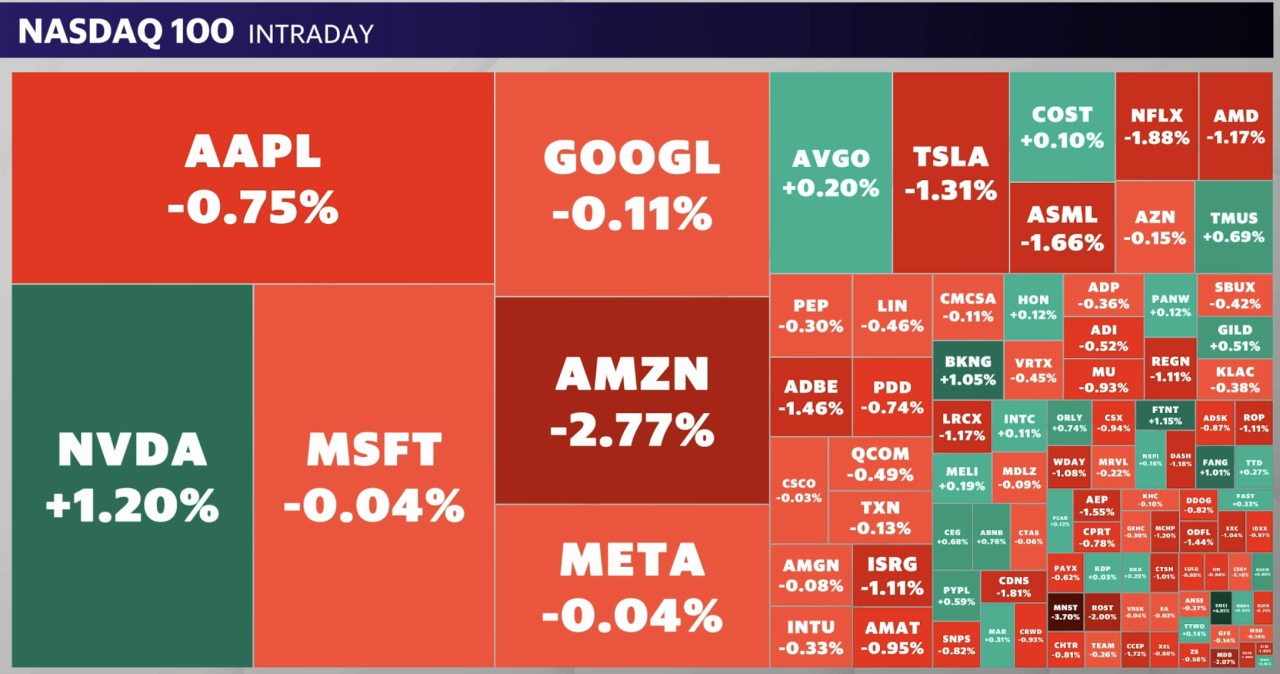

The Dow Jones Industrial Standard (^ DJI) dropped 0.3% after scratching a fresh document high as supplies rose to shut the week. The S&P 500 (^ GSPC) dropped approximately 0.2%, while the tech-heavy Nasdaq Compound (^ IXIC) led the losses with a 0.4% decline.

Expects an outsized price reduced from the Federal Book have actually disappeared after a better-than-expected September tasks report eliminated issues regarding splits in the labor market. The benchmark 10-year Treasury return (^ TNX) struck 4% for the very first time given that August amidst uncertainties regarding the Fed’s following step.

Learn More: What the Fed price reduced ways for savings account, CDs, car loans, and charge card

Investors have actually deserted recently’s bank on a 0.50% price reduced in November and currently see an 88% opportunity of a 0.25% step, according to theCME FedWatch Tool Those assumptions might drag out supplies, which have actually rallied to documents amidst self-confidence that large price cuts and a financial “soft touchdown” got on the table.

The delay is currently on for the October customer rising cost of living record due Thursday to give fresh understanding right into whether the Fed is making progression on bringing already-cooling cost stress to its 2% target.

The begin of 3rd quarter revenues remains in emphasis as Goldman Sachs (GS) elevated its target for the S&P 500, stating it anticipates greater margin development for company firms. After Pepsi (PEP) results on Tuesday, the period obtains underway in earnest on Friday with records from large financial institutions JPMorgan (JPM), Wells Fargo (WFC), and BlackRock (BLK).

Live 4 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.