Profits results usually show what instructions a firm will certainly absorb the months in advance. With Q2 behind us, allow’s look at Axon (NASDAQ: AXON) and its peers.

Exhausts and automation are necessary in aerospace, so firms that flaunt breakthroughs in these locations can take market share. On the protection side, geopolitical stress– whether it be Russia’s intrusion of Ukraine or China’s aggressiveness towards Taiwan– have actually highlighted the requirement for constant or perhaps raised protection costs. When it comes to difficulties, need for aerospace and protection items can ups and downs with financial cycles and nationwide protection spending plans, which are unforeseeable and especially excruciating for firms with high dealt with prices.

The 32 aerospace and protection supplies we track reported a solid Q2. En masse, profits defeated experts’ agreement quotes by 3% while following quarter’s income support was 1.9% listed below.

After much thriller, the Federal Get reduced its plan price by 50bps (half a percent) in September 2024. This notes the reserve bank’s very first easing of financial plan given that 2020 and completion of its most sharp inflation-busting project given that the 1980s. Rising cost of living had actually started to run warm in 2021 post-COVID as a result of an assemblage of aspects such as supply chain interruptions, labor scarcities, and stimulation costs. While CPI (rising cost of living) analyses have actually been helpful recently, work steps have actually motivated some issue. Moving forward, the marketplaces will certainly dispute whether this price cut (and much more prospective ones in 2024 and 2025) is ideal timing to sustain the economic climate or a little bit far too late for a macro that has actually currently cooled down excessive.

Fortunately, aerospace and protection supplies have actually carried out well with share rates up 13.8% generally given that the most up to date revenues outcomes.

Axon (NASDAQ: AXON)

Supplying body electronic cameras and tasers for very first -responders, AXON (NASDAQ: AXON) establishes modern technology options and tools items for armed forces, police, and private citizens.

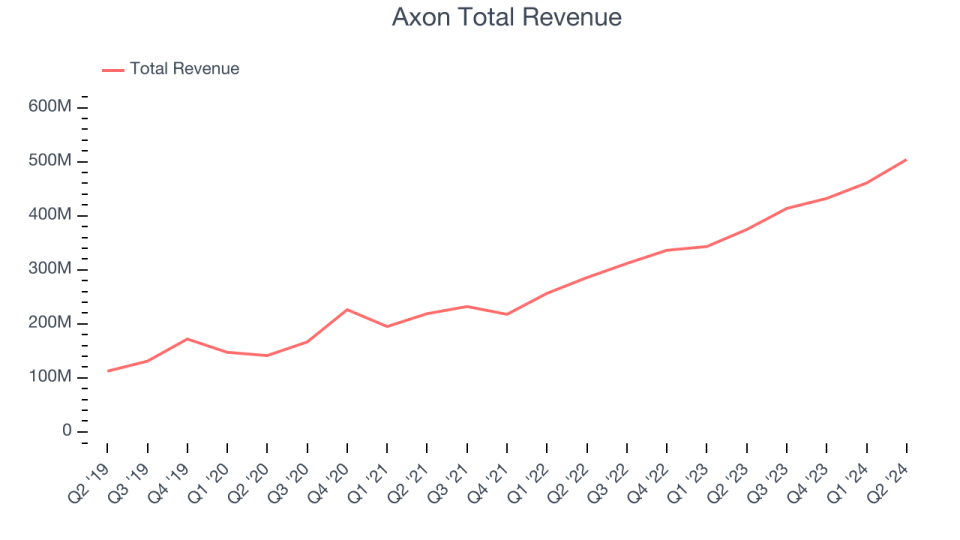

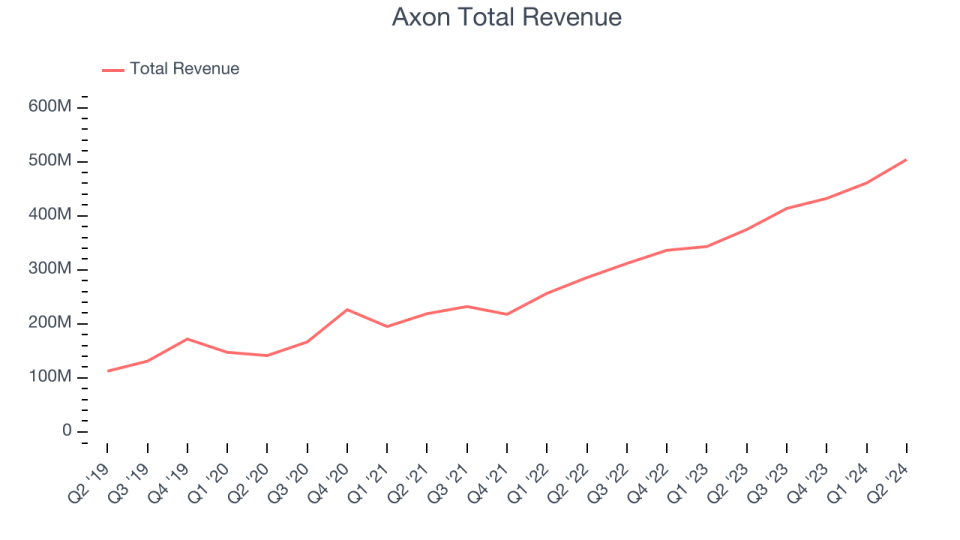

Axon reported profits of $504.1 million, up 34.6% year on year. This print went beyond experts’ assumptions by 5.4%. Generally, it was a solid quarter for the business with an outstanding beat of experts’ revenues quotes and full-year income support going beyond experts’ assumptions.

Surprisingly, the supply is up 41% given that reporting and presently trades at $416.15.

Ideal Q2: Mercury Solution (NASDAQ: MRCY)

Established In 1981, Mercury Solution (NASDAQ: MRCY) concentrates on supplying handling subsystems and elements for largely protection applications.

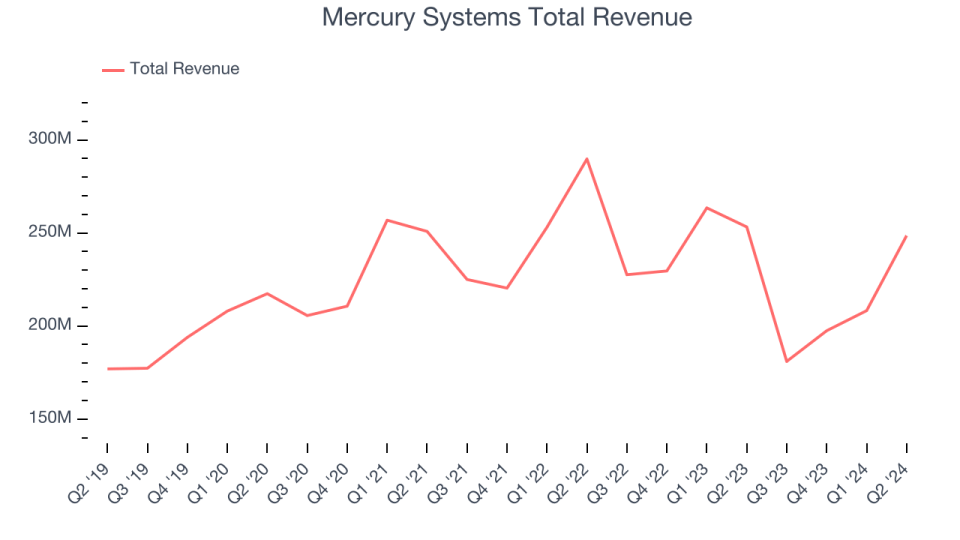

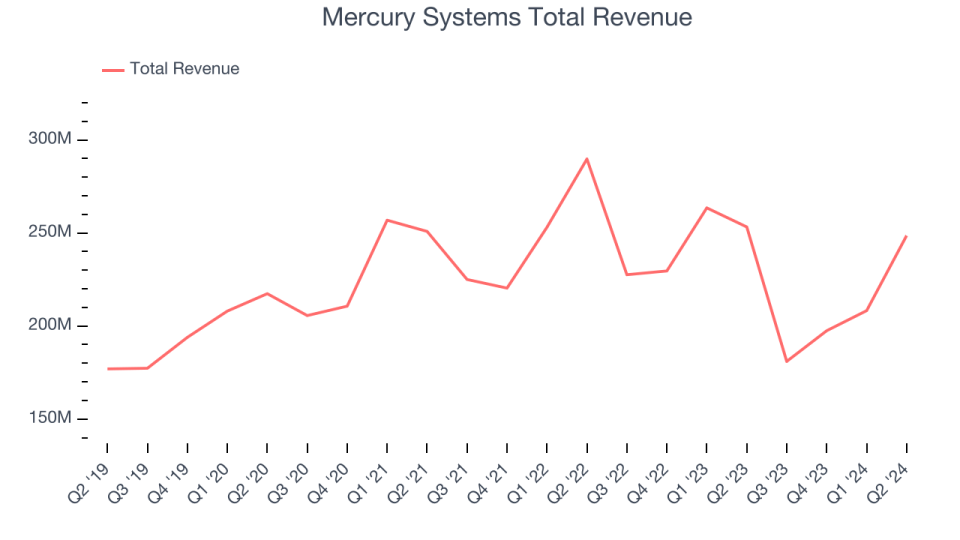

Mercury Solutions reported profits of $248.6 million, down 1.8% year on year, outshining experts’ assumptions by 7.8%. Business had an unbelievable quarter with an outstanding beat of experts’ natural income and revenues quotes.

The marketplace appears delighted with the outcomes as the supply is up 9.6% given that coverage. It presently trades at $37.28.

Is currently the moment to purchase Mercury Solutions? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: AerSale (NASDAQ: ASLE)

Supplying a one-stop store that incorporates several product and services offerings, AerSale (NASDAQ: ASLE) provides full-service assistance to mid-life industrial airplane.

AerSale reported profits of $77.1 million, up 11.2% year on year, disappointing experts’ assumptions by 12.7%. It was a frustrating quarter as it published a miss out on of experts’ revenues quotes.

AerSale supplied the weakest efficiency versus expert quotes in the team. As anticipated, the supply is down 12.2% given that the outcomes and presently trades at $4.89.

Read our full analysis of AerSale’s results here.

General Characteristics (NYSE: GD)

Developer of the renowned M1 Abrahms container, General Characteristics (NYSE: GD) establishes aerospace, aquatic systems, battle systems, and infotech items.

General Characteristics reported profits of $11.98 billion, up 18% year on year. This print defeated experts’ assumptions by 4.1%. Taking a go back, it was a slower quarter as it logged a miss out on of experts’ stockpile sales quotes.

The supply is up 1.6% given that reporting and presently trades at $299.01.

Read our full, actionable report on General Dynamics here, it’s free.

HEICO (NYSE: HEI)

Established In 1957, HEICO (NYSE: HEI) makes and services aerospace and digital elements for industrial aeronautics, protection, room, and various other markets.

HEICO reported profits of $992.2 million, up 37.3% year on year. This print remained in line with experts’ assumptions. Other than that, it was a slower quarter as it logged a miss out on of experts’ natural income quotes.

The supply is up 5.8% given that reporting and presently trades at $260.31.

Read our full, actionable report on HEICO here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory much more handy to capitalists like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.