As the Q2 profits period ends, it’s time to analyze this quarter’s finest and worst entertainers airborne products and logistics market, consisting of United Parcel Solution (NYSE: UPS) and its peers.

The development of shopping and international profession remains to drive need for expedited delivery solutions, providing chances for air cargo firms. The market remains to purchase innovative modern technologies such as automated arranging systems and real-time monitoring services to boost functional effectiveness. Regardless of the benefits of rate and international reach, air cargo and logistics firms are still at the impulse of financial cycles. Customer investing, for instance, can significantly influence the need for these firms’ offerings while gas expenses can affect revenue margins.

The 7 air cargo and logistics supplies we track reported a slower Q2. En masse, profits missed out on experts’ agreement quotes by 1%.

Broad view, the Federal Book has a double required of rising cost of living and work. The previous had actually been running warm throughout 2021 and 2022 yet cooled down in the direction of the reserve bank’s 2% target since late. This triggered the Fed to reduce its plan price by 50bps (half a percent) in September 2024. Provided current work information that recommends the United States economic climate might be tottering, the marketplaces will certainly be analyzing whether this price and future cuts (the Fed signified even more to find in 2024 and 2025) are the ideal relocations at the correct time or whether they’re inadequate, far too late for a macro that has actually currently cooled down.

Taking into account this information, air cargo and logistics supplies have actually held consistent with share rates up 2.9% usually because the most up to date profits outcomes.

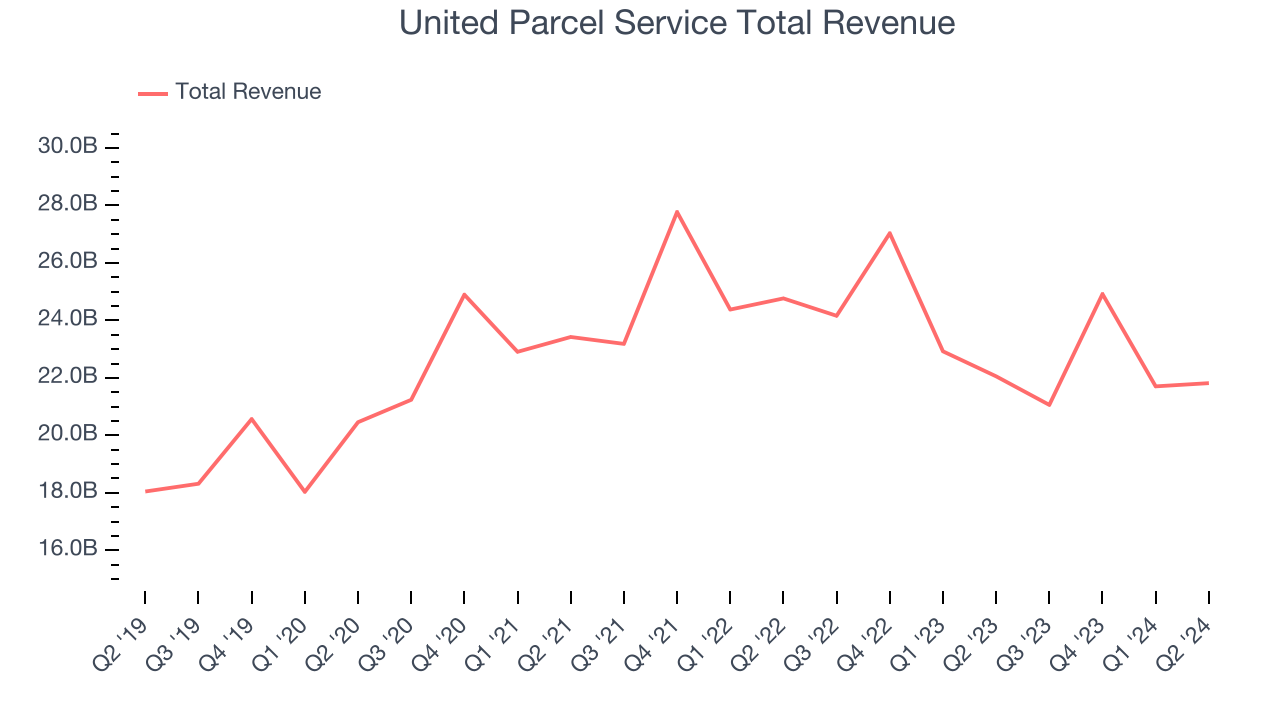

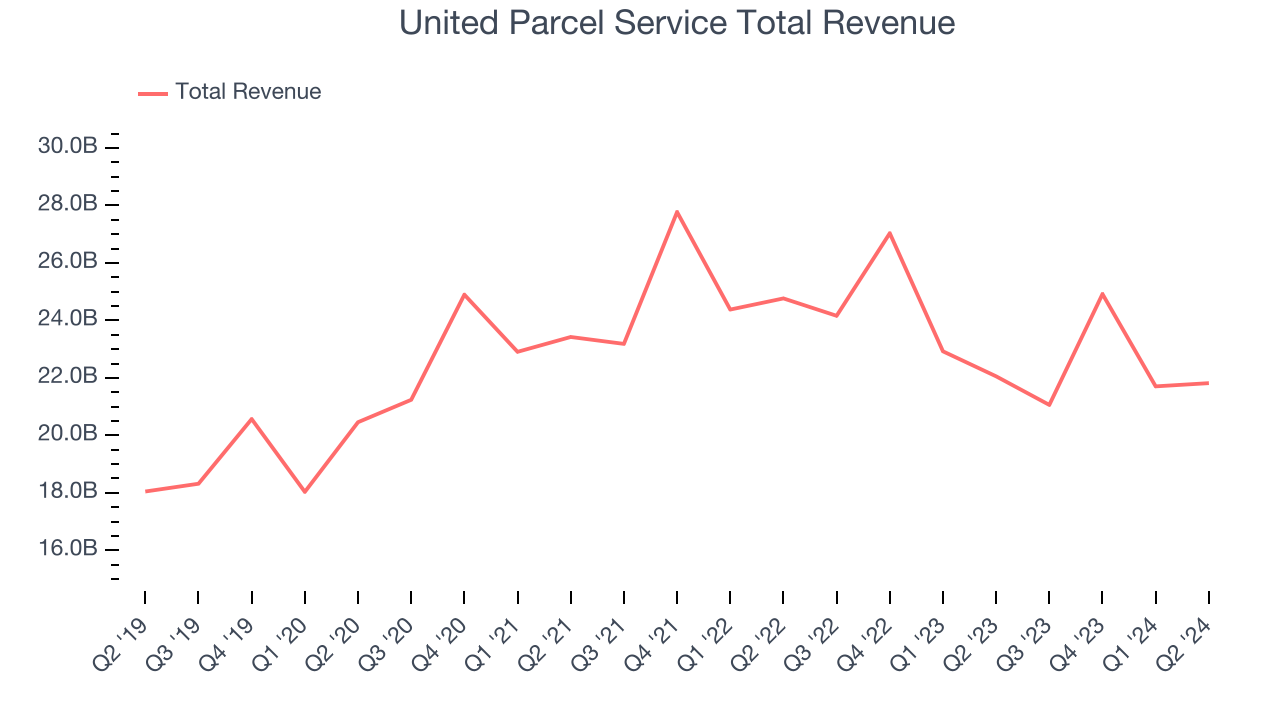

United Parcel Solution (NYSE: UPS)

Trademarking its identifiable UPS Brown shade, UPS (NYSE: UPS) uses plan shipment, supply chain administration, and products forwarding solutions.

United Parcel Solution reported profits of $21.82 billion, down 1.1% year on year. This print disappointed experts’ assumptions by 1.9%. Generally, it was a softer quarter for the business with a miss out on of experts’ profits quotes.

” I intend to give thanks to all UPSers for their effort and initiatives in the 2nd quarter,” stated Carol Tomé, UPS president.

United Parcel Solution attained the highest possible full-year support raising of the entire team. Despite the fact that it had a terrific quarter about its peers, the marketplace appears unhappiness with the outcomes. The supply is down 22.1% because reporting and presently trades at $108.75.

Read our full report on United Parcel Service here, it’s free

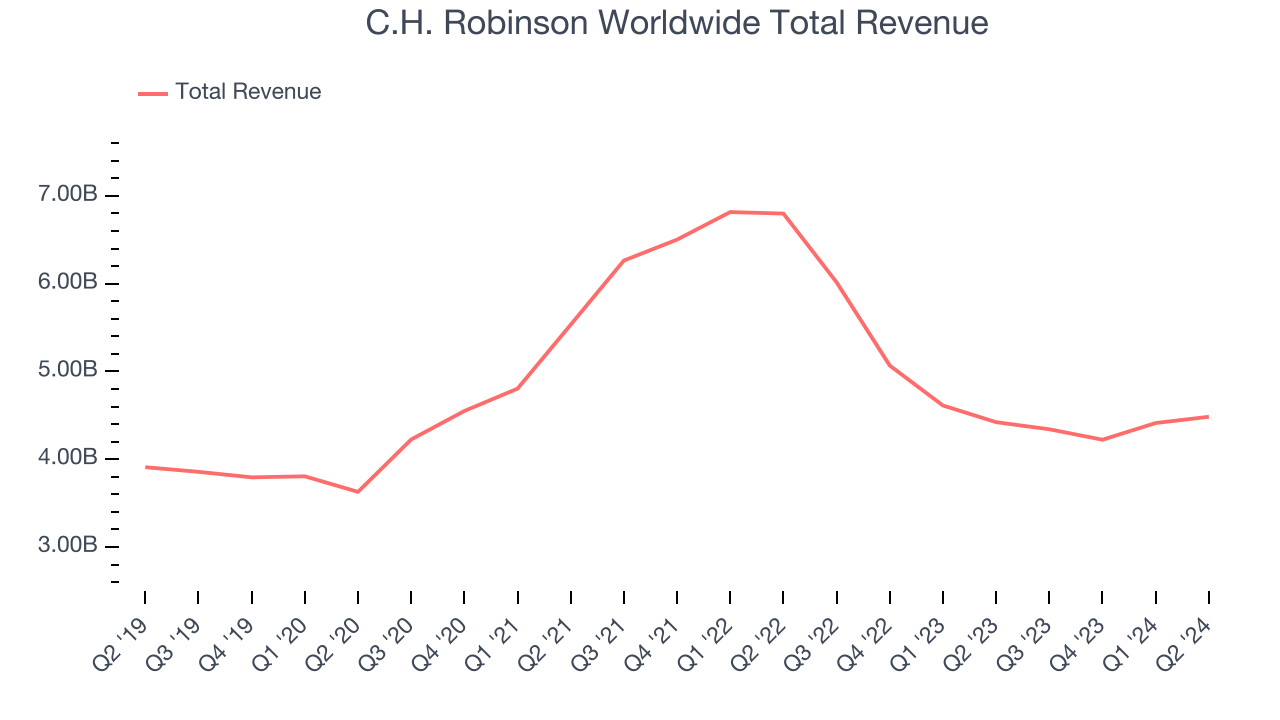

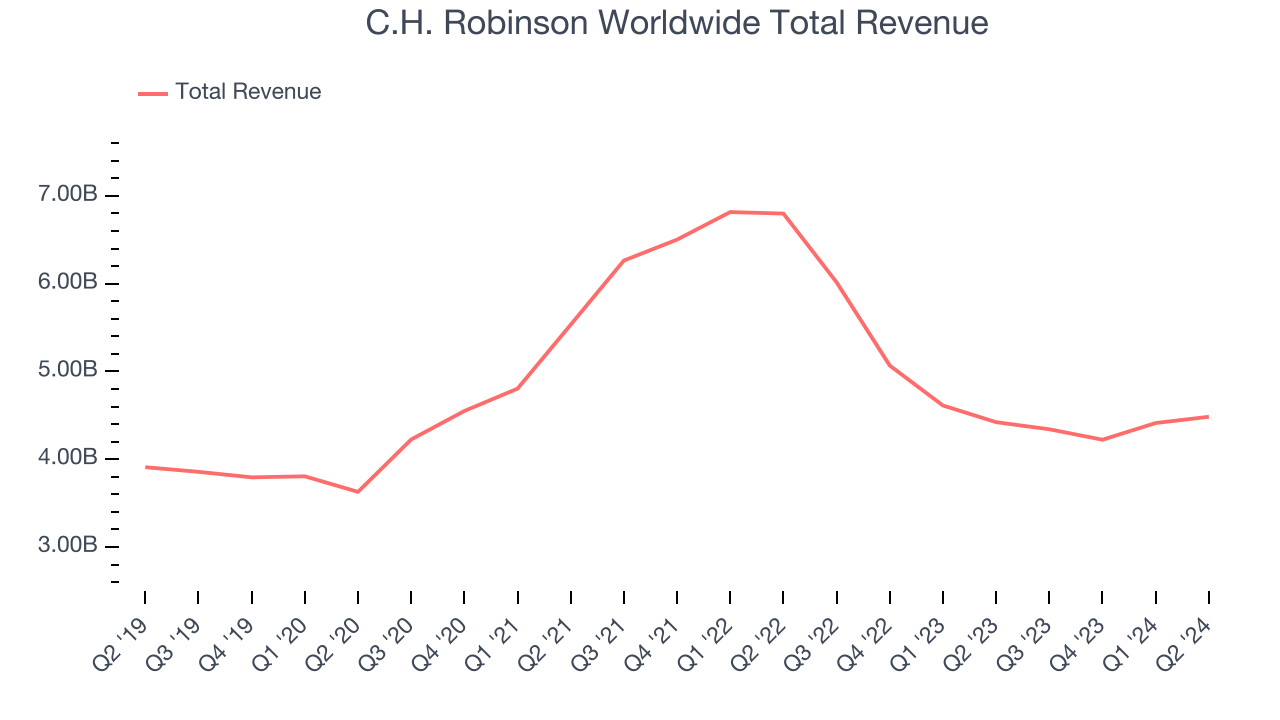

Ideal Q2: C.H. Robinson Worldwide (NASDAQ: CHRW)

Participating in agreements with 10s of hundreds of transport firms, C.H. Robinson (NASDAQ: CHRW) uses products transport and logistics solutions.

C.H. Robinson Worldwide reported profits of $4.48 billion, up 1.4% year on year, in accordance with experts’ assumptions. Business had a solid quarter with an excellent beat of experts’ operating margin and profits quotes.

The marketplace appears delighted with the outcomes as the supply is up 22.1% because coverage. It presently trades at $108.75.

Is currently the moment to get C.H. Robinson Worldwide? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: FedEx (NYSE: FDX)

Infamously taking its last $5,000 to a Las Las vega blackjack table to maintain the business afloat, FedEx (NYSE: FDX) is a service provider of parcel and freight shipment solutions

FedEx reported profits of $21.58 billion, level year on year, disappointing experts’ assumptions by 1.5%. It was a frustrating quarter as it uploaded a miss out on of experts’ profits quotes.

As anticipated, the supply is down 11.3% because the outcomes and presently trades at $266.66.

Read our full analysis of FedEx’s results here.

Air Transportation Provider (NASDAQ: ATSG)

Established In 1980, Air Transportation Provider Team (NASDAQ: ATSG) offers air freight transport and logistics services.

Air Transportation Provider reported profits of $491.5 million, down 7.1% year on year. This outcome can be found in 4.3% listed below experts’ assumptions. It was a slower quarter as it additionally created a miss out on of experts’ Freight Airplane Administration profits quotes.

Air Transportation Provider had the slowest profits development amongst its peers. The supply is up 17.8% because reporting and presently trades at $15.62.

Read our full, actionable report on Air Transport Services here, it’s free.

Center Team (NASDAQ: HUBG)

Begun with $10,000, Center Team (NASDAQ: HUBG) is a service provider of intermodal, vehicle brokerage firm, and logistics solutions, helping with transport services for organizations worldwide.

Center Team reported profits of $986.5 million, down 5.2% year on year. This print delayed experts’ assumptions by 9.7%. It was a softer quarter as it additionally videotaped full-year profits support missing out on experts’ assumptions and a miss out on of experts’ quantity quotes.

Center Team had the weakest efficiency versus expert quotes and weakest full-year support upgrade amongst its peers. The supply is down 5.2% because reporting and presently trades at $43.86.

Read our full, actionable report on Hub Group here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Assist us make StockStory a lot more valuable to financiers like on your own. Join our paid individual research study session and get a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.