Quarterly revenues outcomes are a great time to sign in on a firm’s development, specifically contrasted to its peers in the very same industry. Today we are considering Thrill Enterprises (NASDAQ: RUSHA) and the very best and worst entertainers in the lorry components suppliers sector.

Supply chain and supply monitoring are styles that expanded in emphasis after COVID damaged the worldwide activity of resources and parts. Transport components suppliers that flaunt reputable choice in often specialized locations incorporated and rapidly supply items to consumers can take advantage of this style. In addition, suppliers that make purposeful earnings streams from aftermarket items can delight in even more consistent top-line patterns and greater margins. Yet like the more comprehensive industrials industry, transport components suppliers are additionally at the impulse of financial cycles that influence capital investment, transport quantities, and need for optional components and parts.

The 4 lorry components suppliers supplies we track reported a combined Q2. En masse, incomes defeated experts’ agreement quotes by 7.1%.

Broad view, the Federal Book has a double required of rising cost of living and work. The previous had actually been running warm throughout 2021 and 2022 however cooled down in the direction of the reserve bank’s 2% target since late. This triggered the Fed to reduce its plan price by 50bps (half a percent) in September 2024. Provided current work information that recommends the United States economic situation might be tottering, the marketplaces will certainly be examining whether this price and future cuts (the Fed signified even more to find in 2024 and 2025) are the appropriate actions at the correct time or whether they’re inadequate, far too late for a macro that has actually currently cooled down.

Lorry Components Distributors supplies have actually held consistent in the middle of all this with ordinary share costs fairly the same because the most up to date revenues outcomes.

Finest Q2: Thrill Enterprises (NASDAQ: RUSHA)

Headquartered in Texas, Thrill Enterprises (NASDAQ: RUSH.A) offers truck-related solutions and services, consisting of sales, leasing, components, and upkeep for industrial lorries.

Thrill Enterprises reported incomes of $2.03 billion, up 1.2% year on year. This print went beyond experts’ assumptions by 8.8%. In general, it was an outstanding quarter for the business with a remarkable beat of experts’ revenues quotes.

Unsurprisingly, the supply is down 2.9% because reporting and presently trades at $49.51.

Is currently the moment to acquire Thrill Enterprises? Access our full analysis of the earnings results here, it’s free.

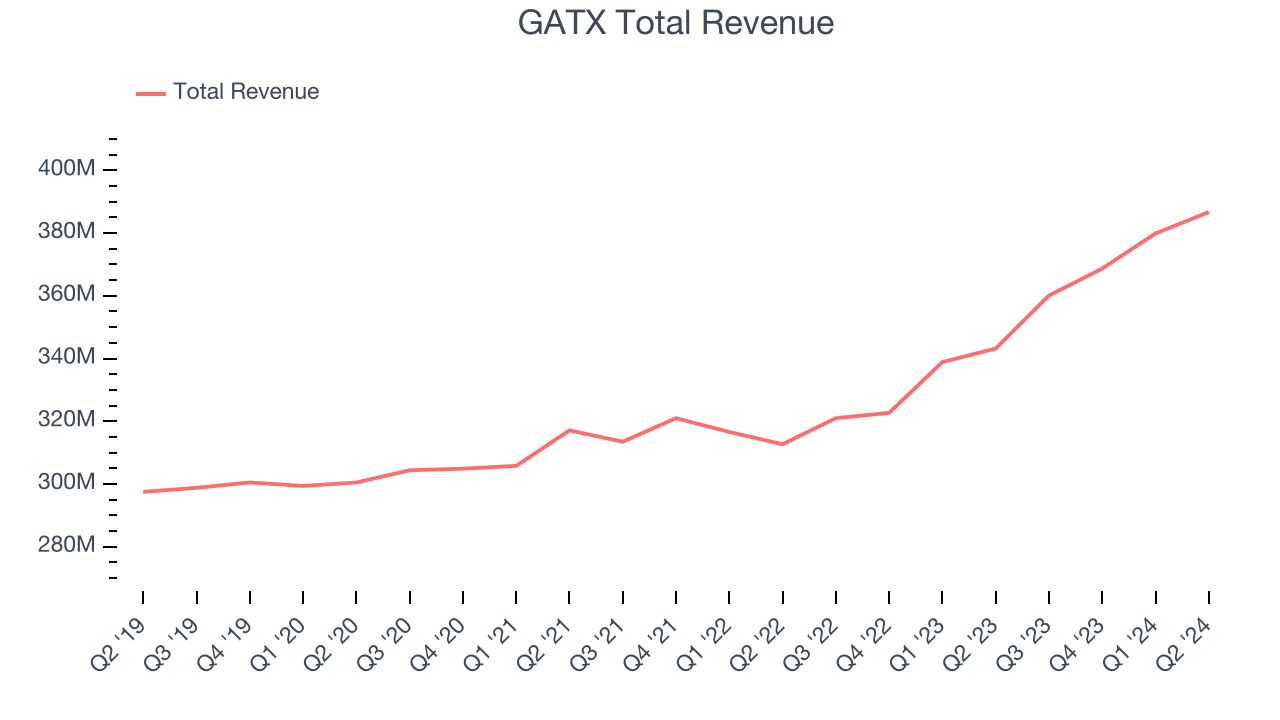

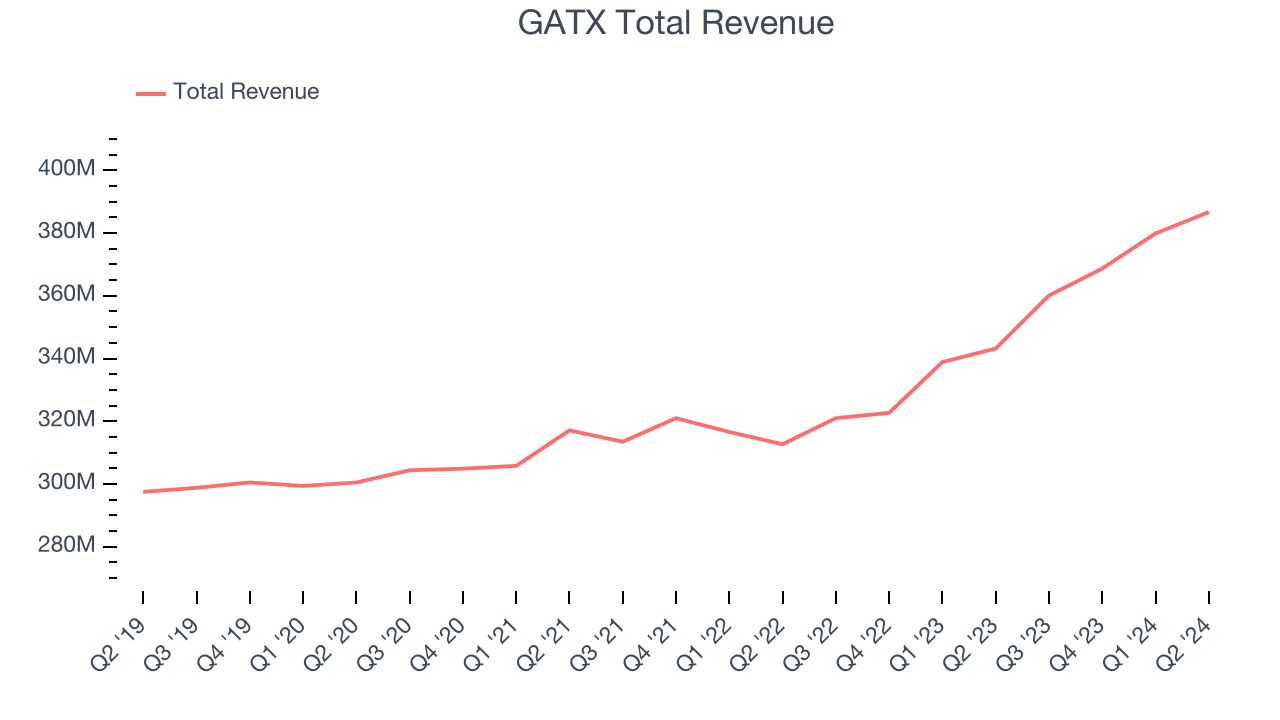

GATX (NYSE: GATX)

Initially started to deliver beer, GATX (NYSE: GATX) offers leasing and monitoring solutions for railcars and various other transport possessions internationally.

GATX reported incomes of $386.7 million, up 12.7% year on year, in accordance with experts’ assumptions. Business carried out much better than its peers, however it was sadly a slower quarter with a miss out on of experts’ revenues quotes and underwhelming revenues assistance for the complete year.

Although it had a great quarter contrasted its peers, the marketplace appears miserable with the outcomes as the supply is down 10.8% because coverage. It presently trades at $129.80.

Is currently the moment to acquire GATX? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Air Lease (NYSE: AL)

Developed by an owner of Century City in Los Angeles, Air Lease Company (NYSE: AL) offers airplane leasing and funding services to airline companies worldwide.

Air Lease reported incomes of $667.3 million, level year on year, disappointing experts’ assumptions by 2.6%. It was a softer quarter as it uploaded a miss out on of experts’ revenues quotes.

Air Lease provided the weakest efficiency versus expert quotes and slowest earnings development in the team. As anticipated, the supply is down 8.2% because the outcomes and presently trades at $43.83.

Read our full analysis of Air Lease’s results here.

FTAI Aeronautics (NASDAQ: FTAI)

With a concentrate on the CFM56 engine that powers Boeing and Airplane’s airplanes, FTAI Aeronautics (NASDAQ: FTAI) offers airplane and engine leasing in addition to the repair and maintenance of these items.

FTAI Aeronautics reported incomes of $443.6 million, up 61.7% year on year. This outcome covered experts’ assumptions by 22%. Besides that, it was a slower quarter as it created a miss out on of experts’ revenues quotes.

FTAI Aeronautics racked up the greatest expert approximates beat and fastest earnings development amongst its peers. The supply is up 25.1% because reporting and presently trades at $135.

Read our full, actionable report on FTAI Aviation here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory extra handy to capitalists like on your own. Join our paid individual research study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.