As the trend of incomes period wanes, below’s a recall at a few of one of the most amazing (and some much less so) arises from Q2. Today, we are considering commercial product packaging supplies, beginning with Avery Dennison (NYSE: AVY).

Commercial product packaging business have actually developed affordable benefits from economic climates of range that bring about advantaged buying and capital expense that are hard and pricey to duplicate. Lately, environmentally friendly product packaging and preservation are driving clients choices and advancement. As an example, plastic is not as preferable a product as it when was. In spite of being essential to durable goods varying from beer to tooth paste to washing cleaning agent, these business are still at the impulse of the macro, particularly customer wellness and customer determination to invest.

The 9 commercial product packaging supplies we track reported an adequate Q2. En masse, profits missed out on experts’ agreement price quotes by 0.7% while following quarter’s income support was 2.3% listed below.

Broad view, the Federal Get has a twin required of rising cost of living and work. The previous had actually been running warm throughout 2021 and 2022 yet cooled down in the direction of the reserve bank’s 2% target since late. This motivated the Fed to reduce its plan price by 50bps (half a percent) in September 2024. Offered current work information that recommends the United States economic situation can be tottering, the marketplaces will certainly be examining whether this price and future cuts (the Fed indicated even more to find in 2024 and 2025) are the appropriate relocations at the correct time or whether they’re inadequate, far too late for a macro that has actually currently cooled down.

Fortunately, commercial product packaging supplies have actually been resistant with share rates up 5.7% typically because the most up to date incomes outcomes.

Ideal Q2: Avery Dennison (NYSE: AVY)

Started as Kum Kleen Products, Avery Dennison (NYSE: AVY) is a producer of sticky products, show graphics, and product packaging items, offering numerous markets.

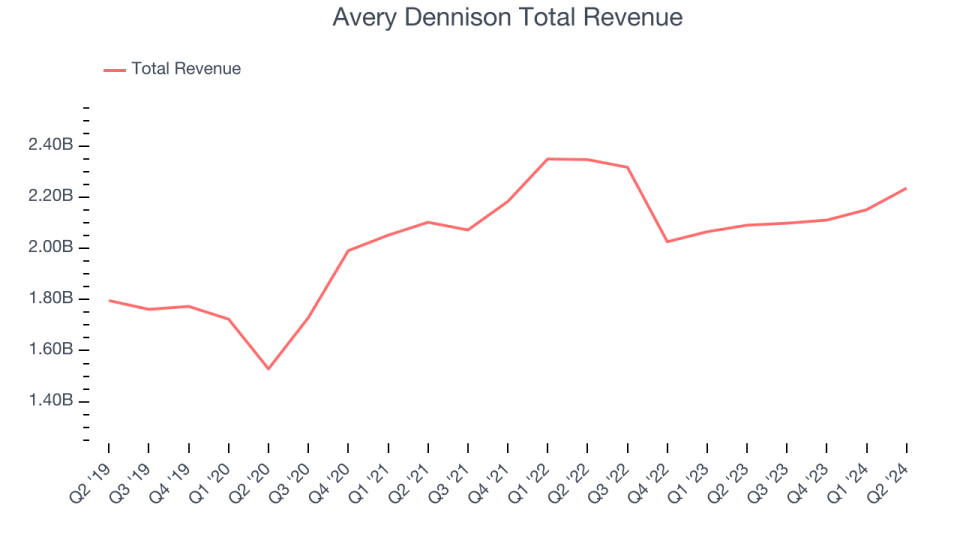

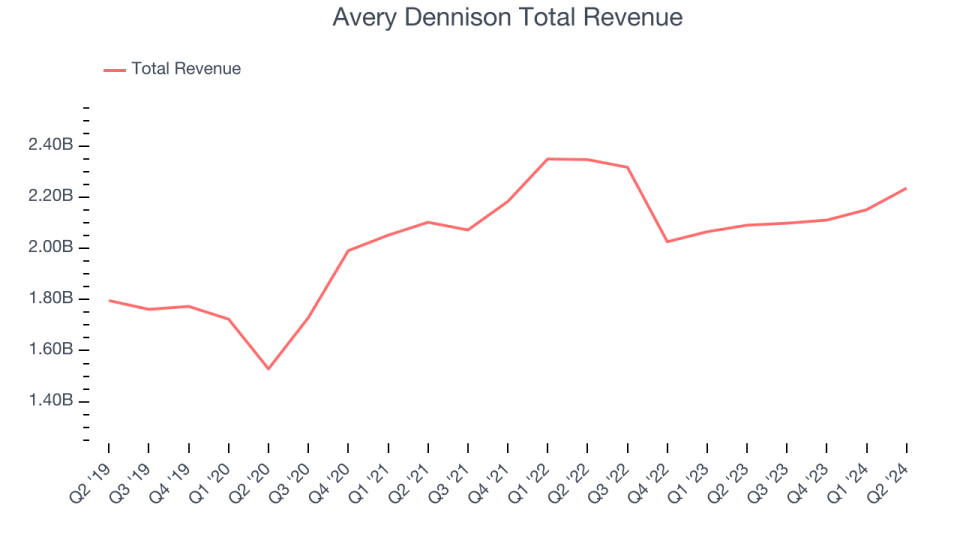

Avery Dennison reported profits of $2.24 billion, up 6.9% year on year. This print surpassed experts’ assumptions by 1.9%. On the whole, it was a really solid quarter for the firm with an outstanding beat of experts’ natural income price quotes.

” We provided a solid 2nd quarter, with considerable incomes development, driven by greater quantity and performance gains,” stated Deon Stander, head of state and chief executive officer.

Avery Dennison racked up the fastest income development of the entire team. Capitalist assumptions, nonetheless, were likely greater than Wall surface Road’s released estimates, leaving some yearning for also far better outcomes (experts’ agreement price quotes are those released by huge financial institutions and consultatory companies, not the capitalists that make deal choices). The supply is down 3.5% because reporting and presently trades at $216.52.

Is currently the moment to acquire Avery Dennison? Access our full analysis of the earnings results here, it’s free.

Product Packaging Firm of America (NYSE: PKG)

Established In 1959, Product Packaging Firm of America (NYSE: PKG) generates containerboard and corrugated product packaging items, additionally using screens and safety product packaging services.

Product Packaging Firm of America reported profits of $2.08 billion, up 6.3% year on year, exceeding experts’ assumptions by 2.5%. Business had a really solid quarter with an outstanding beat of experts’ quantity price quotes and a respectable beat of experts’ operating margin price quotes.

The marketplace appears satisfied with the outcomes as the supply is up 8.9% because coverage. It presently trades at $210.

Is currently the moment to acquire Product packaging Firm of America? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Silgan Holdings (NYSE: SLGN)

Developed in 1987, Silgan Holdings (NYSE: SLGN) is a distributor of stiff product packaging for durable goods items, focusing on steel containers, closures, and plastic product packaging.

Silgan Holdings reported profits of $1.38 billion, down 3.2% year on year, disappointing experts’ assumptions by 3.4%. It was a softer quarter as it published a miss out on of experts’ natural income price quotes.

Remarkably, the supply is up 5.9% because the outcomes and presently trades at $51.60.

Read our full analysis of Silgan Holdings’s results here.

Crown Holdings (NYSE: CCK)

Previously Crown Cork & & Seal, Crown Holdings (NYSE: CCK) generates product packaging items for customer advertising and marketing business, consisting of food, drink, house, and commercial items.

Crown Holdings reported profits of $3.04 billion, down 2.2% year on year. This outcome remained in line with experts’ assumptions. It was a solid quarter as it additionally videotaped an outstanding beat of experts’ operating margin price quotes and a strong beat of experts’ incomes price quotes.

The supply is up 22% because reporting and presently trades at $94.50.

Read our full, actionable report on Crown Holdings here, it’s free.

Sealed Air (NYSE: SEE)

Established In 1960, Sealed Air Firm (NYSE: SEE) focuses on the growth and manufacturing of safety and food product packaging services, offering a selection of markets.

Sealed Air reported profits of $1.35 billion, down 2.6% year on year. This outcome went beyond experts’ assumptions by 2.9%. It was a really solid quarter as it additionally generated an outstanding beat of experts’ operating margin and quantity price quotes.

Sealed Air attained the greatest expert approximates defeat amongst its peers. The supply is up 4.6% because reporting and presently trades at $35.99.

Read our full, actionable report on Sealed Air here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory a lot more handy to capitalists like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.