Completion of the profits period is constantly a great time to take a go back and see that radiated (and that not a lot). Allow’s have a look at exactly how waste administration supplies got on in Q2, beginning with Clean Harbors (NYSE: CLH).

Waste administration firms can have licenses allowing them to manage dangerous products. Moreover, several solutions are carried out via agreements and statutorily mandated, non-discretionary, or reoccuring, causing even more foreseeable income streams. Nonetheless, law can be a headwind, making existing solutions out-of-date or forcing firms to spend priceless resources to adhere to brand-new, much more environmentally-friendly guidelines. Finally, waste administration firms go to the impulse of financial cycles. Rate of interest, for instance, can substantially influence commercial manufacturing or industrial tasks that develop waste and by-products.

The 8 waste administration supplies we track reported a slower Q2. En masse, earnings missed out on experts’ agreement quotes by 1.9%.

After much thriller, the Federal Get reduced its plan price by 50bps (half a percent) in September 2024. This notes the reserve bank’s initial easing of financial plan considering that 2020 and completion of its most sharp inflation-busting project considering that the 1980s. Rising cost of living had actually started to run warm in 2021 post-COVID because of an assemblage of aspects such as supply chain disturbances, labor lacks, and stimulation costs. While CPI (rising cost of living) analyses have actually been helpful recently, work procedures have actually triggered some issue. Moving forward, the marketplaces will certainly dispute whether this price cut (and much more possible ones in 2024 and 2025) is best timing to sustain the economic climate or a little bit far too late for a macro that has actually currently cooled down way too much.

While some waste administration supplies have actually made out rather far better than others, they have actually jointly decreased. Usually, share costs are down 3.5% considering that the current profits outcomes.

Ideal Q2: Clean Harbors (NYSE: CLH)

Developed in 1980, Clean Harbors (NYSE: CLH) supplies ecological and commercial solutions like dangerous and non-hazardous garbage disposal and emergency situation spill clean-ups.

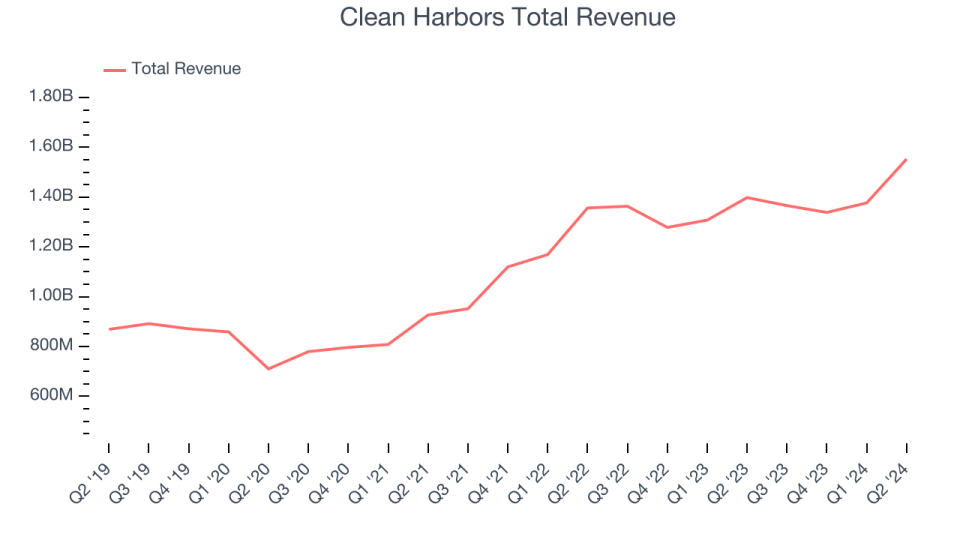

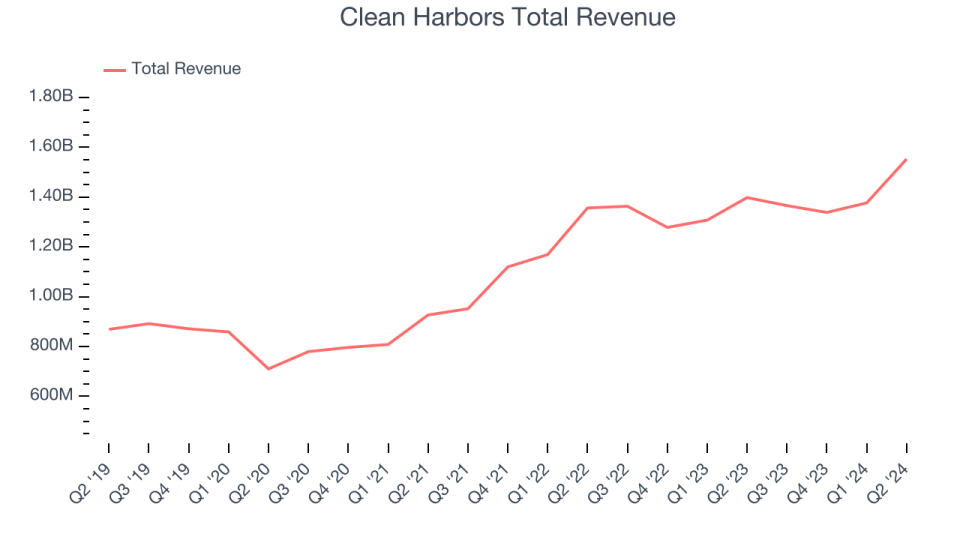

Clean Harbors reported earnings of $1.55 billion, up 11.1% year on year. This print went beyond experts’ assumptions by 1.5%. In general, it was an extremely solid quarter for the firm with a remarkable beat of experts’ operating margin quotes and a suitable beat of experts’ profits quotes.

” The favorable patterns that have actually added to the development of our service recently proceeded in the 2nd quarter, sustaining a superb efficiency that surpassed our assumptions,” claimed Mike Battles, Co-Chief Exec Policeman.

Tidy Harbors managed the greatest expert approximates beat of the entire team. Unsurprisingly, the supply is up 8.1% considering that reporting and presently trades at $242.62.

Republic Provider (NYSE: RSG)

Handling a number of million lots of recyclables each year, Republic (NYSE: RSG) supplies waste administration solutions for homes, firms, and communities.

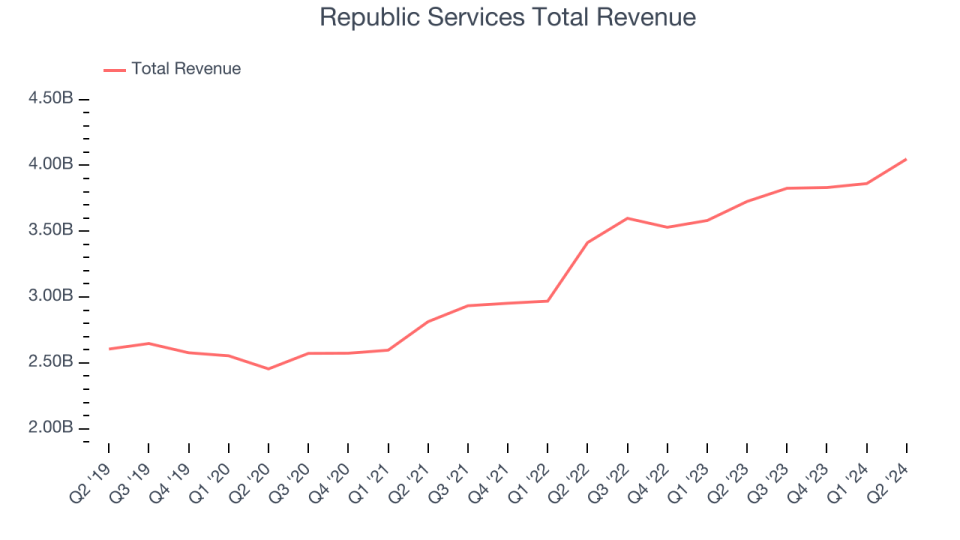

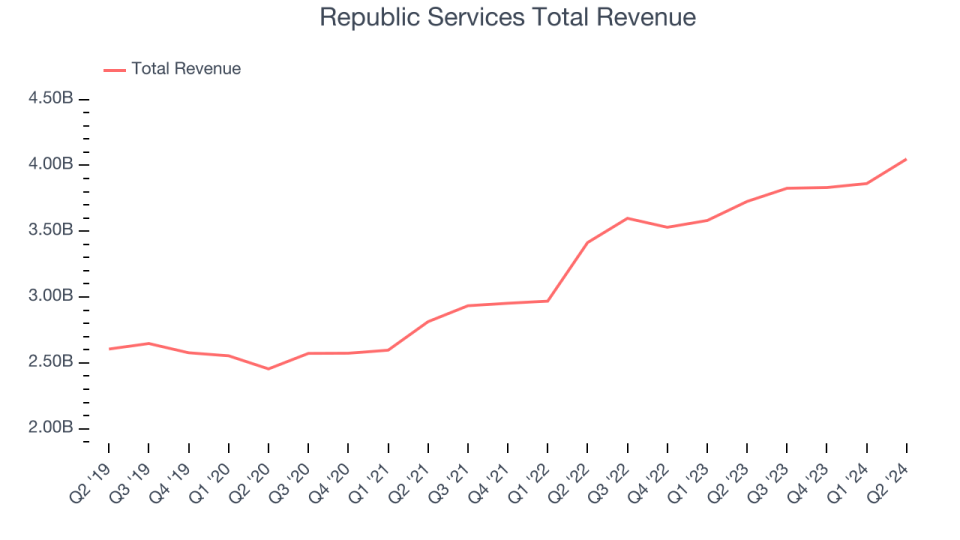

Republic Providers reported earnings of $4.05 billion, up 8.6% year on year, according to experts’ assumptions. Business carried out far better than its peers, yet it was sadly a combined quarter with a strong beat of experts’ operating margin quotes yet a miss out on of experts’ quantity quotes.

Nonetheless, the outcomes were most likely valued right into the supply as it’s traded sidewards considering that reporting. Shares presently rest at $199.30.

Is currently the moment to acquire Republic Providers? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Mission Source (NASDAQ: QRHC)

Reusing company waste to assist firms be much more lasting, Mission Source (NASDAQ: QRHC) is a service provider of waste and reusing solutions.

Mission Source reported earnings of $73.15 million, down 1.8% year on year, disappointing experts’ assumptions by 4.6%. It was a frustrating quarter as it published a miss out on of experts’ profits quotes.

As anticipated, the supply is down 6.5% considering that the outcomes and presently trades at $7.80.

Read our full analysis of Quest Resource’s results here.

Waste Administration (NYSE: WM)

Headquartered in Houston, Waste Administration (NYSE: WM) is a service provider of detailed waste administration solutions in The United States and Canada.

Waste Administration reported earnings of $5.40 billion, up 5.5% year on year. This outcome remained in line with experts’ assumptions. Nonetheless, it was a slower quarter as it logged a miss out on of experts’ profits quotes.

The supply is down 4.7% considering that reporting and presently trades at $207.11.

Read our full, actionable report on Waste Management here, it’s free.

Enviri (NYSE: NVRI)

Air conditioning America’s initial interior ice rink in the 19th century, Enviri (NYSE: NVRI) provides steel and waste handling solutions.

Enviri reported earnings of $610 million, level year on year. This outcome delayed experts’ assumptions by 1.1%. It was a frustrating quarter as it additionally taped a miss out on of experts’ profits quotes.

The supply is down 13.9% considering that reporting and presently trades at $10.18.

Read our full, actionable report on Enviri here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory much more valuable to capitalists like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.