Profits results commonly suggest what instructions a business will certainly absorb the months in advance. With Q2 behind us, allow’s take a look at Freshworks (NASDAQ: FRSH) and its peers.

Business require to be able to engage with and market to their clients as successfully as feasible. This truth combined with the recurring movement of ventures to the cloud drives need for cloud-based client connection monitoring (CRM) software application that incorporates information analytics with sales and advertising features.

The 4 sales software application supplies we track reported a blended Q2. En masse, earnings remained in line with experts’ agreement quotes while following quarter’s earnings support was 1.2% listed below.

Broad view, the Federal Book has a double required of rising cost of living and work. The previous had actually been running warm throughout 2021 and 2022 yet cooled down in the direction of the reserve bank’s 2% target since late. This motivated the Fed to reduce its plan price by 50bps (half a percent) in September 2024. Provided current work information that recommends the United States economic situation can be tottering, the marketplaces will certainly be analyzing whether this price and future cuts (the Fed signified even more ahead in 2024 and 2025) are the ideal actions at the correct time or whether they’re insufficient, far too late for a macro that has actually currently cooled down.

Due to this information, sales software application supplies have actually held stable with share rates up 1.3% generally considering that the most up to date incomes outcomes.

Ideal Q2: Freshworks (NASDAQ: FRSH)

Established In Chennai, India in 2010 with the concept of developing a “fresh” helpdesk item, Freshworks (NASDAQ: FRSH) supplies a wide variety of software application targeted at tiny and medium-sized services.

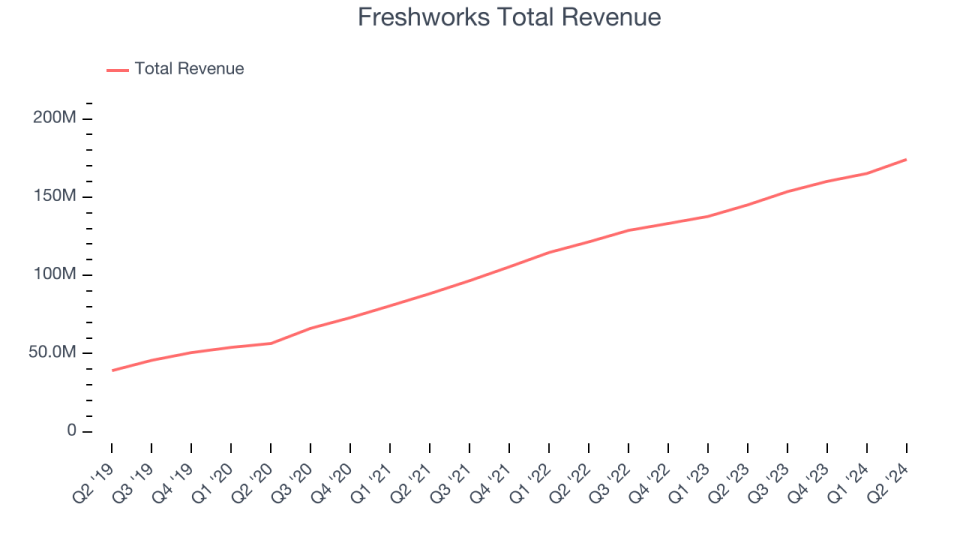

Freshworks reported earnings of $174.1 million, up 20% year on year. This print surpassed experts’ assumptions by 3%. In general, it was an extremely solid quarter for the firm with speeding up development in huge clients and a remarkable beat of experts’ invoicings quotes.

” Freshworks provided a strong Q2, expanding earnings to $174.1 million with a cost-free capital margin of 19%,” claimed Dennis Woodside, CHIEF EXECUTIVE OFFICER & & Head Of State of Freshworks.

Freshworks racked up the largest expert approximates beat and highest possible full-year support raising of the entire team. The firm included 1,195 venture clients paying greater than $5,000 every year to get to an overall of 21,744. Financier assumptions, nevertheless, were likely greater than Wall surface Road’s released estimates, leaving some yearning for also far better outcomes (experts’ agreement quotes are those released by huge financial institutions and advising companies, not the financiers that make deal choices). The supply is down 15.3% considering that reporting and presently trades at $11.25.

We think Freshworks is a good business, but is it a buy today? Read our full report here, it’s free.

HubSpot (NYSE: CENTERS)

Began in 2006 by 2 MIT college student, HubSpot (NYSE: CENTERS) is a software-as-a-service system that aids tiny and medium-sized services market themselves, market, and obtain located on the net.

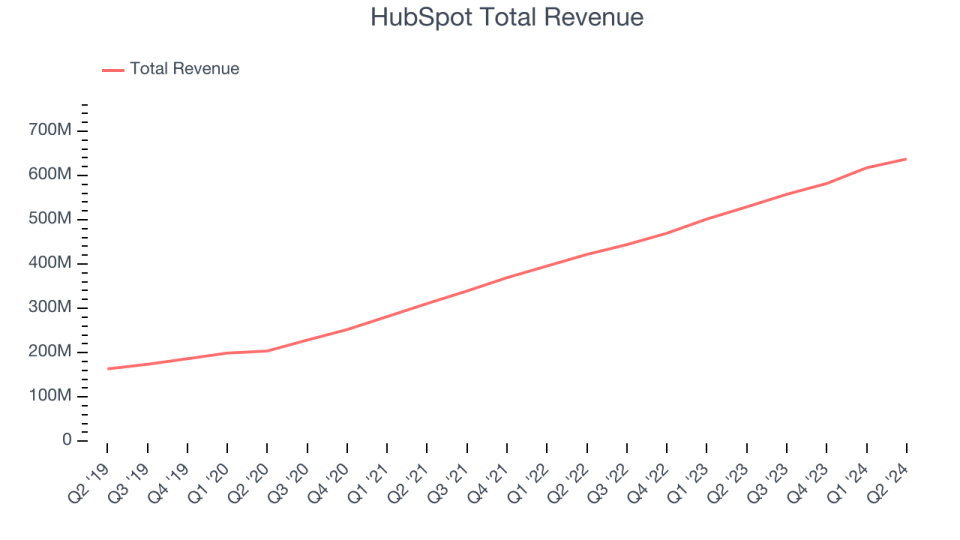

HubSpot reported earnings of $637.2 million, up 20.4% year on year, outmatching experts’ assumptions by 2.9%. Business had an acceptable quarter with a good beat of experts’ invoicings quotes.

HubSpot racked up the fastest earnings development amongst its peers. The firm included 11,214 clients to get to an overall of 228,054. The marketplace appears delighted with the outcomes as the supply is up 14.3% considering that coverage. It presently trades at $526.60.

Is currently the moment to acquire HubSpot? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: ZoomInfo (NASDAQ: ZI)

Established In 2007 as DiscoveryOrg and relabelled after a merging in 2019, ZoomInfo (NASDAQ: ZI) is a software application as a solution item that offers sales divisions with accessibility to a data source of potential customers.

ZoomInfo reported earnings of $291.5 million, down 5.5% year on year, disappointing experts’ assumptions by 5.3%. It was a softer quarter as it published underwhelming earnings support for the following quarter and a miss out on of experts’ invoicings quotes.

ZoomInfo provided the weakest efficiency versus expert quotes, slowest earnings development, and weakest full-year support upgrade in the team. The firm included 37 venture clients paying greater than $100,000 every year to get to an overall of 1,797. Remarkably, the supply is up 1.8% considering that the outcomes and presently trades at $10.

Read our full analysis of ZoomInfo’s results here.

Salesforce (NYSE: CRM)

Introduced in 1999 from a rented out one-bedroom house in San Francisco by Marc Benioff and his 3 founders, Salesforce (NYSE: CRM) is a software-as-a-service system that aids business accessibility, take care of, and share sales details.

Salesforce reported earnings of $9.33 billion, up 8.4% year on year. This print satisfied experts’ assumptions. Taking a go back, it was a blended quarter: While earnings support for following quarter missed out on experts’ assumptions, complete year earnings support was reconfirmed.

The supply is up 4.2% considering that reporting and presently trades at $269.99.

Read our full, actionable report on Salesforce here, it’s free.

Sign Up With Paid Supply Financier Study

Assist us make StockStory much more handy to financiers like on your own. Join our paid customer study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.