The power company is infamously intermittent, adhering to ups and downs in the economic situation, encountering headwinds of supply and need– and obtaining from tailwinds when fads begin seeking out. That’s taking place currently in the gas field, where a mix of enhancing need and a demand for added facilities is producing a favorable scenario in the midstream power supplies.

The midstream business hold an essential placement amongst the power gamers, giving the solutions required to relocate crude and refined gas from the manufacturing websites with the pipes and storage space centers to the refineries and circulation factors.

According to Citi expert Douglas Irwin, the compression market– a crucial web link in the gas supply chain– is especially well placed for gains provided present problems.

” We anticipate a currently limited compression market to gain from a number of continuous macro tailwinds, most especially enhancing gas need over the near-to-medium term,” Irwin states, and takes place to include, “Particularly, we approximate the possibility for as long as 20+ bcf/d of step-by-step gas need with 2030, which would approximately equate to a require ~ 12 million horse power (HP) of step-by-step compression capability in the United States. This would certainly stand for a ~ 20% boost over approximated present operating capability, which we anticipate to lead to step-by-step fleet enhancements, enhancing application prices, and proceeded higher stress on rates.”

Irwin adheres to these declarations with some certain suggestions on midstream supplies that are positioned to gain from that collection of solid tailwinds. Opening the TipRanks system, we have actually searched for his selections– and located that they obtain Solid Buy scores from Wall surface Road. Allow’s take a better look.

Kodiak Gas Solutions ( KGS)

To Begin With, Kodiak Gas Solutions offers massive gas compression solutions on an agreement basis, for area celebration, improved oil recuperation, gas lift, and handling. The firm has more than 4 million horse power of running tools in its fleet, and flaunts that this fleet is one of the most energy-efficient, and latest, in the market. Kodiak can create, construct, and compensation compressor terminals and various other gas midstream facilities, along with agreement for procedures and upkeep of customer-owned facilities and tools.

Every one of this makes Kodiak a leading service provider of compression solutions in the United States power market. The firm runs in all of the significant hydrocarbon manufacturing areas of the United States, with a specifically solid existence in the Permian container of Texas. Kodiak asserts, with factor, that its solutions are essential in allowing its consumers to satisfy the gas and oil needs of the worldwide economic situation.

Kodiak went public with an IPO in the summer season of in 2014, and ever since has actually seen stable gains in its share rate. Year-to-date, the supply is up 51%, a solid outperformance when contrasted to the ytd gain of 20% on the S&P 500 index. We need to keep in mind that Kodiak’s quarterly incomes were stable near $200 million in its very first 4 public profits records, however took a remarkable dive upwards in 2Q24.

That 2nd quarter record saw Kodiak generate $309.7 million, for a 52% year-over-year boost– although it a little missed out on the projection, can be found in $1.76 million listed below the price quotes. Near the bottom line, Kodiak generated profits of 6 cents per share by GAAP actions. The firm created an optional capital in the quarter of greater than $90 million.

For expert Irwin, in his insurance coverage for Citi, the essential thing to remember regarding Kodiak is the firm’s strong placement in the market. As he states, “Our team believe KGS is well placed to maximize a limited and expanding market for a couple of factors. Initially, KGS supplies the biggest fleet amongst peers with ~ 4.5 million HP. Second, this fleet is purposefully placed with >> 80% of capability situated in the Permian or Eagle Ford, which we anticipate to see significant need development as United States LNG capability is positioned to greater than fold the following 5 years. Ultimately, KGS supplies peer-leading application prices (~ 97% 2024 Citi quote) and earnings/ HP, both of which we anticipate to remain to boost with time.”

Looking in advance, Irwin thinks that Kodiak will certainly bring more powerful returns for capitalists, creating of the supply, “Consequently, KGS flaunts a swiftly expanding FCF account, which we anticipate to permit enhanced funding returns in the kind of an expanding reward and added possible buybacks progressing.”

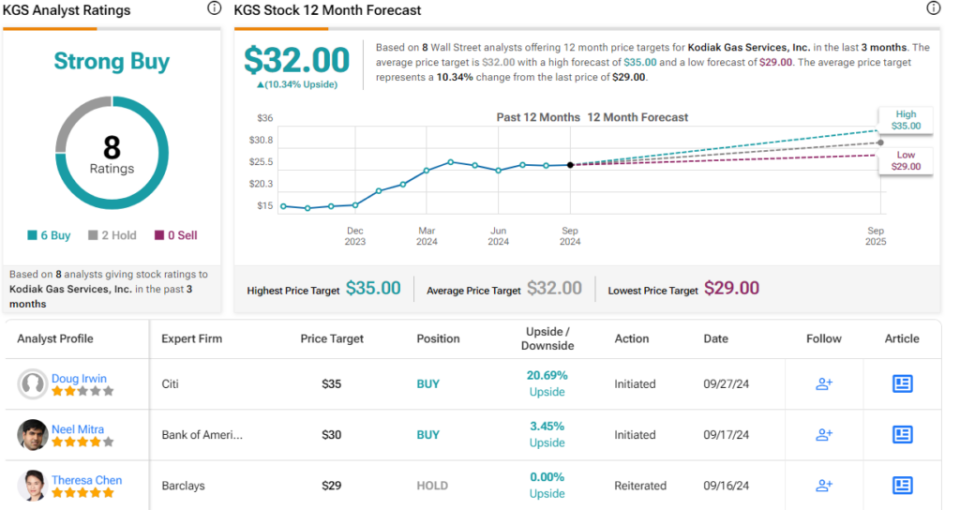

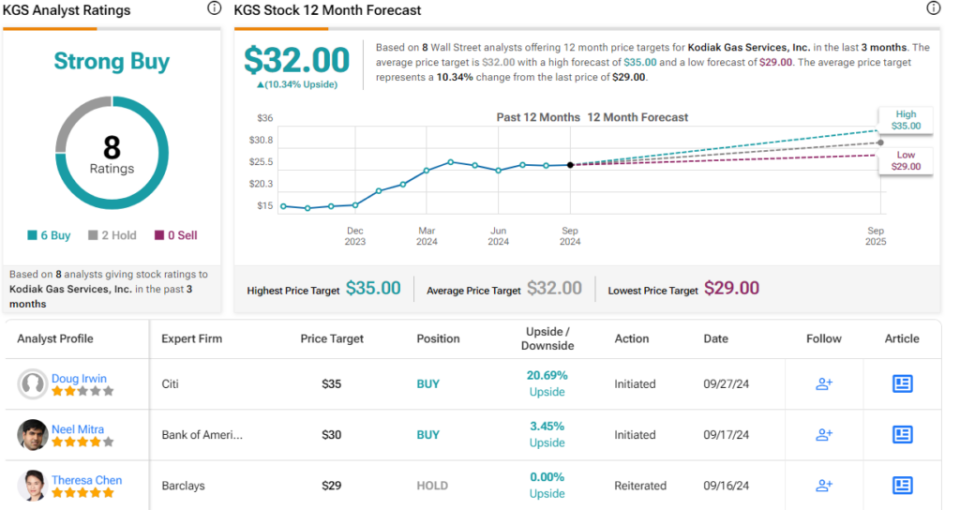

These remarks sustain a Buy score on the shares, and Irwin’s $35 rate target suggests possible for a 1 year upside far better than 20%. (To see Irwin’s performance history, visit this site)

This supply’s Solid Buy agreement score is based upon 8 Wall surface Road assesses that consist of 6 Acquires to 2 Holds. The shares are trading for $29 and their $32 typical rate target indicates a gain of 10% over the following year. (See KGS supply projection)

Archrock ( AROC)

Successive is Archrock, a pure-play midstream firm concentrated on gas compression. Archrock offers these solutions to consumers in the oil and gas market throughout the United States, and additionally offers aftermarket solutions to consumers that separately possess their compression tools. The Houston-based firm flaunts a market cap of almost $3.6 billion, and is a leading service provider of compression solutions in the United States midstream field.

Archrock utilizes its very own fleet of compression tools to supply acquired gas compression solutions. This fleet is based upon both typical and electrical motor drive (EMD) compression plans. EMD plans minimize the carbon dioxide exhausts fundamental in compression procedures, and Archrock is the leader in giving this alternative to the United States market. Additionally, Archrock offers methane decrease solutions– crucial, as methane is a significant spin-off of all sectors of the gas market– and aftermarket solutions of all kinds for consumers that possess their very own compression tools however are trying to find better functional competence. Archrock brings some 70 years’ experience to the gas midstream field.

We need to keep in mind right here that in August, Archrock finished a crucial purchase step, when it shut the purchase with Overall Procedures and Manufacturing Solutions (TOPS). The purchase brings 580,000 horse power of brand-new operating capability to Archrock. The purchase of around $983 million, was carried out in both cash money and supply.

Like Kodiak over, Archrock’s supply has actually exceeded the more comprehensive markets this year, with a 35% year-to-date share gain. The firm is riding high up on enhanced need, in both the residential and export markets, and incomes have actually been trending upwards for the previous a number of quarters. In one of the most current noted quarter, 2Q24, the firm had a leading line of $270.5 million, up 9% year-over-year and in-line with the price quotes. Incomes involved 22 cents per share, up from 16 cents in the prior-year duration although it missed out on the anticipated by 3 cents.

Transforming once again to the Citibank sight, as shared by Irwin, we locate the expert surveying a positive placement right here. Irwin points out Archrock’s total success, its placement in an expanding market, and its purchase task, creating of the company, “We design a peer-leading 2-year EBITDA CAGR of ~ 15%, which we anticipate to be driven by a number of aspects. The very first is proceeded natural development on the base company. With ~ 2/3 of the fleet situated in the Permian and Eagle Ford, we anticipate AROC to remain to gain from gas need tailwinds such as step-by-step LNG capability … Secondly, we anticipate AROC to gain from ongoing prices tailwinds in a structurally limited market– we design low-mid-single-digit development over the following 2 years.”

” Ultimately,” Irwin better included, “AROC lately finished the TOPS purchase, which we anticipate to drive a step-by-step ~$ 140mm of EBITDA (pre-synergy), including >> 500k HP to the fleet and giving direct exposure to an expanding electrical HP market.”

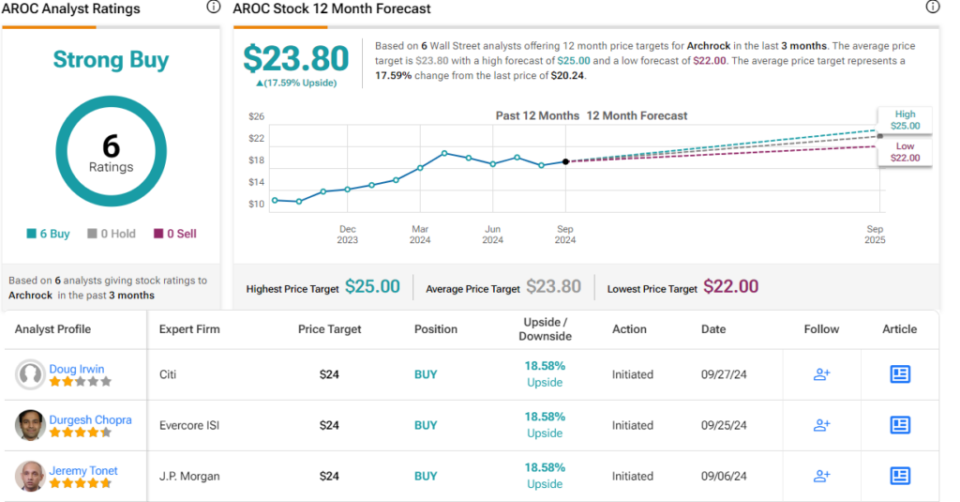

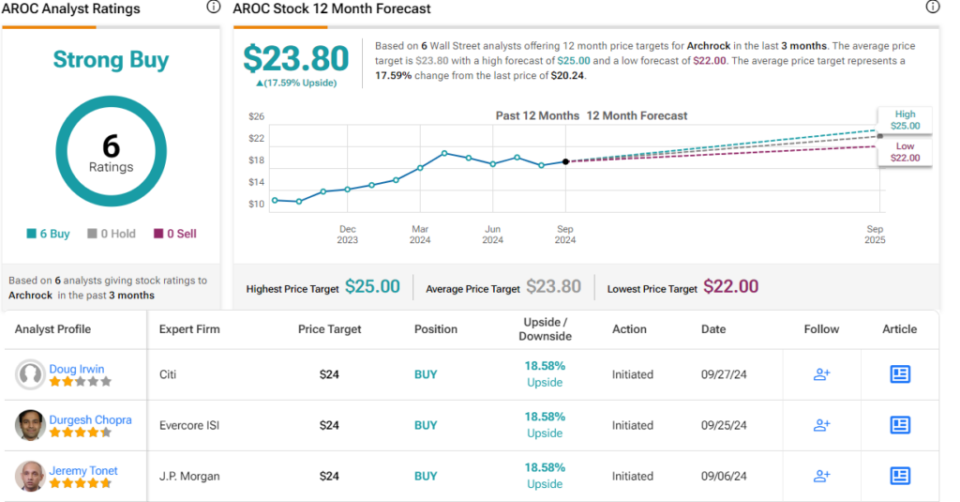

Irwin’s position is consistent with his Buy score on the supply, and his rate target, evaluated $24, indicates the supply has a possible 1 year advantage of 18.5%.

The Road has actually provided Archrock an agreement score of Solid Buy and it is consentaneous, hing on 6 current favorable expert evaluations. The shares have a trading rate of $20.24 and an ordinary target rate of $23.80, recommending an advantage of 17.5% by now following year. (See AROC supply projection)

To locate great concepts for supplies trading at eye-catching evaluations, browse through TipRanks’ Finest Supplies to Get, a device that unifies every one of TipRanks’ equity understandings.

Please note: The point of views shared in this short article are entirely those of the included experts. The material is planned to be utilized for informative objectives just. It is extremely crucial to do your very own evaluation prior to making any type of financial investment.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.