Completing Q2 revenues, we check out the numbers and vital takeaways for the customer membership supplies, consisting of Coursera (NYSE: COUR) and its peers.

Customers today anticipate products and solutions to be hyper-personalized and as needed. Whether it be what songs they pay attention to, what flick they enjoy, and even discovering a day, on-line customer organizations are anticipated to thrill their clients with basic interface that amazingly satisfy need. Registration versions have actually better raised use and dampness of lots of on-line customer solutions.

The 8 customer membership supplies we track reported a slower Q2. En masse, earnings defeated experts’ agreement quotes by 1.1% while following quarter’s profits support was 2.9% listed below.

Rising cost of living proceeded in the direction of the Fed’s 2% objective just recently, leading the Fed to lower its plan price by 50bps (half a percent or 0.5%) in September 2024. This is the very first cut in 4 years. While CPI (rising cost of living) analyses have actually been helpful recently, work procedures have actually approached uneasy. The marketplaces will certainly be disputing whether this price cut’s timing (and much more possible ones in 2024 and 2025) is optimal for sustaining the economic situation or a little bit far too late for a macro that has actually currently cooled down way too much.

The good news is, customer membership supplies have actually been resistant with share costs up 7.5% usually because the current revenues outcomes.

Coursera (NYSE: COUR)

Established by 2 Stanford College computer technology teachers, Coursera (NYSE: COUR) is an on-line understanding system that provides programs, expertises, and levels from leading colleges and companies worldwide.

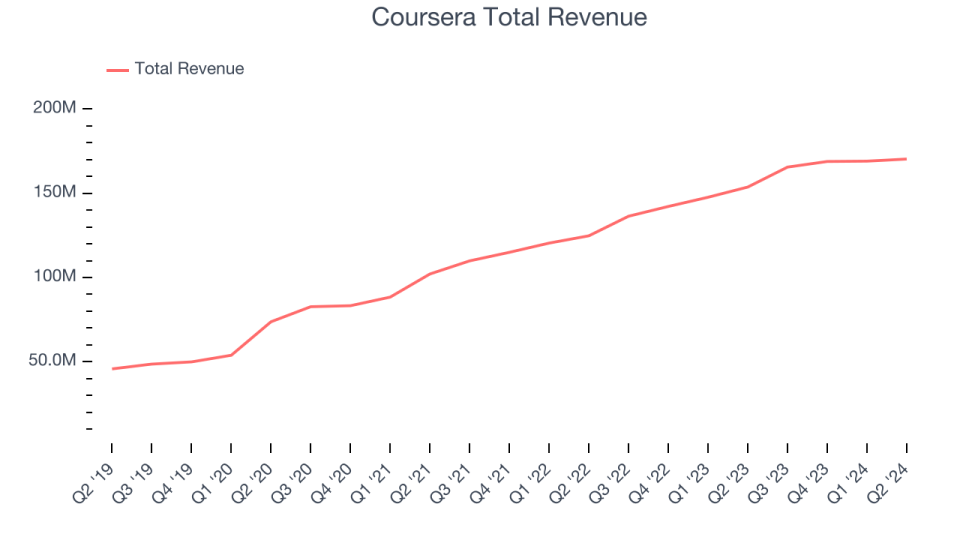

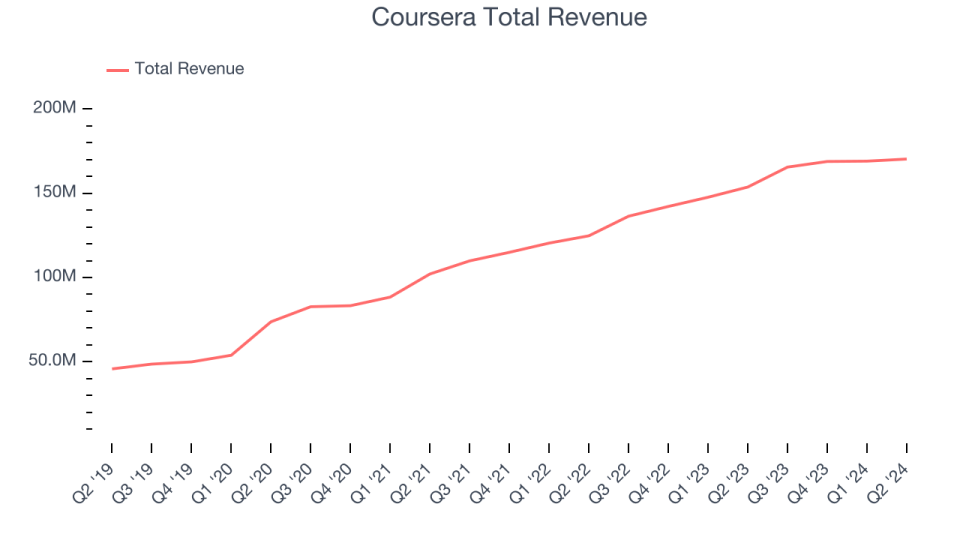

Coursera reported earnings of $170.3 million, up 10.8% year on year. This print surpassed experts’ assumptions by 3.5%. Regardless of the top-line beat, it was still a combined quarter for the business with solid development in its customers however slow-moving profits development.

” We are thrilled to go beyond greater than 2 million registrations in our generative AI magazine obviously, qualifications, and hands-on tasks developed by the globe’s leading modern technology firms and research study colleges,” stated Coursera chief executive officer Jeff Maggioncalda.

Coursera accomplished the most significant expert approximates beat of the entire team. The business reported 155 million customers, up 20.2% year on year. Unsurprisingly, the supply is up 7.3% because reporting and presently trades at $7.94.

Read our full report on Coursera here, it’s free

Finest Q2: Duolingo (NASDAQ: DUOL)

Established by a Carnegie Mellon computer technology teacher and his Ph.D. pupil, Duolingo (NASDAQ: DUOL) is a mobile application assisting individuals discover brand-new languages.

Duolingo reported earnings of $178.3 million, up 40.6% year on year, in accordance with experts’ assumptions. Business had a solid quarter with outstanding development in its customers and extraordinary profits development.

Duolingo racked up the fastest profits development and highest possible full-year support raising amongst its peers. The business reported 103.6 million customers, up 39.8% year on year. The marketplace appears pleased with the outcomes as the supply is up 72.7% because coverage. It presently trades at $279.50.

Is currently the moment to get Duolingo? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Chegg (NYSE: CHGG)

Began as a physical book rental solution, Chegg (NYSE: CHGG) is currently an electronic system dealing with pupil discomfort factors by supplying research study and scholastic aid.

Chegg reported earnings of $163.1 million, down 10.8% year on year, surpassing experts’ assumptions by 2%. Still, it was a softer quarter as it uploaded a decrease in its customers and slow-moving profits development.

Chegg provided the slowest profits development in the team. The business reported 4.37 million customers, down 9.1% year on year. As anticipated, the supply is down 38.8% because the outcomes and presently trades at $1.80.

Read our full analysis of Chegg’s results here.

Udemy (NASDAQ: UDMY)

With programs varying from spending to food preparation to computer system programs, Udemy (NASDAQ: UDMY) is an on-line understanding system that attaches students with professional trainers that concentrate on a large range of subjects.

Udemy reported earnings of $194.4 million, up 9% year on year. This print remained in line with experts’ assumptions. Extra generally, it was a combined quarter as it generated underwhelming profits support for the following quarter and slow-moving profits development.

Udemy had the weakest full-year support upgrade amongst its peers. The business reported 16,595 energetic customers, up 11% year on year. The supply is down 18.1% because reporting and presently trades at $7.58.

Read our full, actionable report on Udemy here, it’s free.

Suit Team (NASDAQ: MTCH)

Initially began as a dial-up solution prior to extensive net fostering, Suit (NASDAQ: MTCH) was a very early trendsetter in on-line dating and today has a profile of applications consisting of Tinder, Joint, Archer, and OkCupid.

Suit Team reported earnings of $864.1 million, up 4.2% year on year. This print remained in line with experts’ assumptions. Extra generally, it was a combined quarter as it logged a decrease in its customers and underwhelming profits support for the following quarter.

The business reported 14.84 million customers, down 5% year on year. The supply is up 10.8% because reporting and presently trades at $37.33.

Read our full, actionable report on Match Group here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory much more useful to capitalists like on your own. Join our paid individual research study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.