Completion of the profits period is constantly a great time to take a go back and see that beamed (and that not a lot). Allow’s have a look at exactly how software program advancement supplies got on in Q2, beginning with JFrog (NASDAQ: FROG).

As epic VC financier Marc Andreessen states, “Software program is consuming the globe”, and it touches practically every sector. That drives boosting need for devices aiding software program designers do their tasks, whether it be keeping an eye on crucial cloud facilities, incorporating sound and video clip performance, or making sure smooth material streaming.

The 11 software program advancement supplies we track reported a combined Q2. En masse, profits defeated experts’ agreement price quotes by 1.6% while following quarter’s profits assistance remained in line.

Rising cost of living proceeded in the direction of the Fed’s 2% objective lately, leading the Fed to decrease its plan price by 50bps (half a percent or 0.5%) in September 2024. This is the initial cut in 4 years. While CPI (rising cost of living) analyses have actually been helpful recently, work actions have actually verged on uneasy. The marketplaces will certainly be disputing whether this price cut’s timing (and a lot more possible ones in 2024 and 2025) is optimal for sustaining the economic climate or a little bit far too late for a macro that has actually currently cooled down excessive.

Fortunately, software program advancement supplies have actually been resistant with share costs up 6.3% typically considering that the most recent profits outcomes.

JFrog (NASDAQ: FROG)

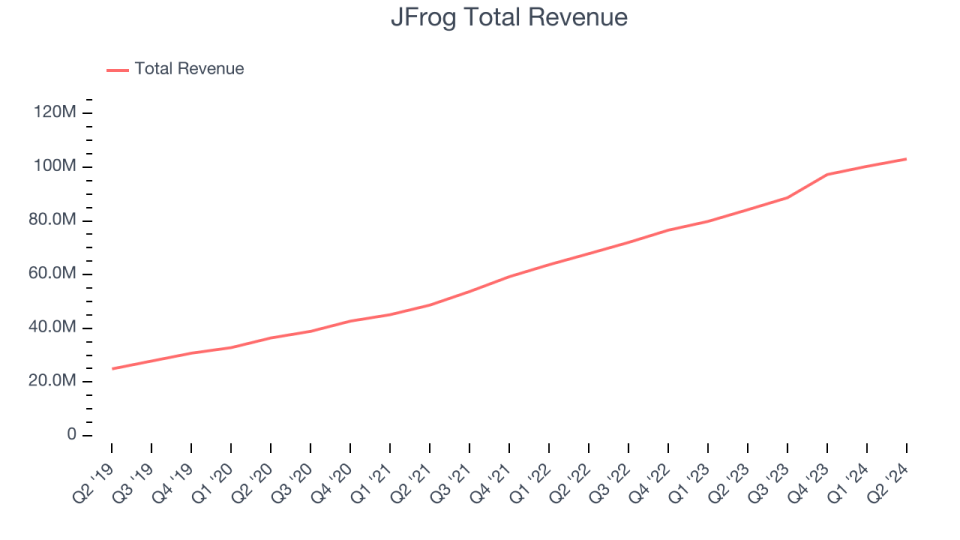

Called after the creators’ fondness for frogs, JFrog (NASDAQ: FROG) offers a software-as-a-service system that makes creating and launching software program much easier and quicker, specifically for big groups.

JFrog reported profits of $103 million, up 22.4% year on year. This print remained in line with experts’ assumptions, however in general, it was a softer quarter for the firm with underwhelming profits assistance for the following quarter and decreasing development in big consumers.

” We get on a goal to reinvent the software program sector with a merged system that incorporates EveryOps and simplifies the software program supply chain circulation,” claimed Shlomi Ben Haim, Founder and Chief Executive Officer of JFrog.

JFrog provided the weakest efficiency versus expert price quotes of the entire team. The firm included 17 venture consumers paying greater than $100,000 each year to get to an overall of 928. Unsurprisingly, the supply is down 14.1% considering that reporting and presently trades at $29.26.

Is currently the moment to purchase JFrog? Access our full analysis of the earnings results here, it’s free.

Finest Q2: GitLab (NASDAQ: GTLB)

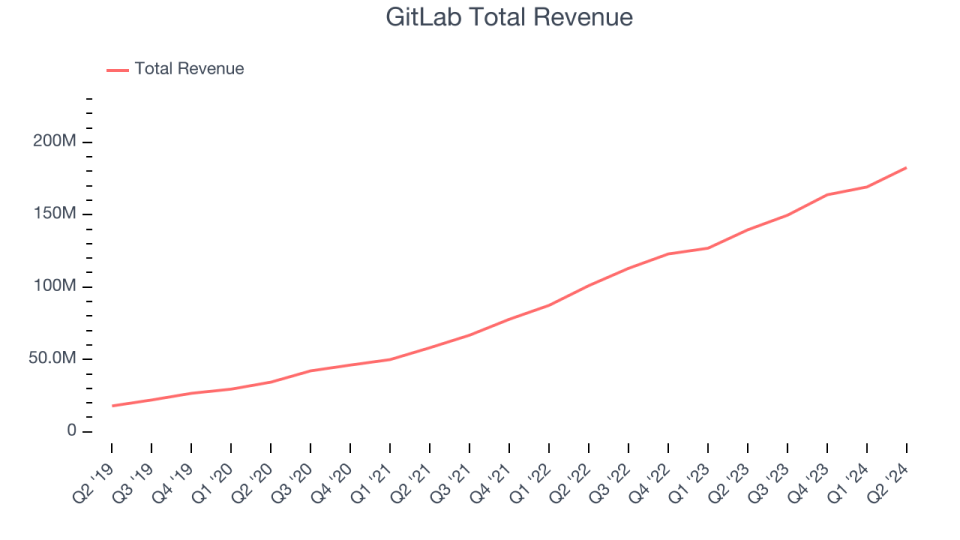

Started as an open-source task in 2011, GitLab (NASDAQ: GTLB) is a leading software program advancement devices system.

GitLab reported profits of $182.6 million, up 30.8% year on year, outshining experts’ assumptions by 3.1%. Business had a solid quarter with an excellent beat of experts’ invoicings price quotes and a slim beat of experts’ ARR (yearly repeating profits) price quotes.

GitLab carried out the fastest profits development and highest possible full-year assistance raising amongst its peers. The marketplace appears satisfied with the outcomes as the supply is up 15.8% considering that coverage. It presently trades at $51.76.

Is currently the moment to purchase GitLab? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: PagerDuty (NYSE: PD)

Begun by 3 previous Amazon designers, PagerDuty (NYSE: PD) is a software-as-a-service system that assists firms reply to IT cases quick and ensure that any kind of downtime is decreased.

PagerDuty reported profits of $115.9 million, up 7.7% year on year, according to experts’ assumptions. It was a softer quarter as it uploaded underwhelming profits assistance for the following quarter and decreasing client development.

PagerDuty provided the weakest full-year assistance upgrade in the team. The firm shed 76 consumers and wound up with an overall of 15,044. The supply is level considering that the outcomes and presently trades at $18.25.

Read our full analysis of PagerDuty’s results here.

F5 (NASDAQ: FFIV)

At first began as an equipment home appliances firm in the late 1990s, F5 (NASDAQ: FFIV) makes software program that assists big ventures guarantee their internet applications are constantly offered by dispersing network website traffic and safeguarding them from cyberattacks.

F5 reported profits of $695.5 million, down 1% year on year. This outcome went beyond experts’ assumptions by 1.4%. Taking a go back, it was a softer quarter as it tape-recorded a miss out on of experts’ invoicings price quotes.

F5 had the slowest profits development amongst its peers. The supply is up 23.2% considering that reporting and presently trades at $219.

Read our full, actionable report on F5 here, it’s free.

Cloudflare (NYSE: WEB)

Started by 2 college student of Harvard Service College, Cloudflare (NYSE: WEB) is a software program as a solution system that assists enhance safety, integrity and filling times of web applications and internet sites.

Cloudflare reported profits of $401 million, up 30% year on year. This print covered experts’ assumptions by 1.6%. Extra generally, it was a softer quarter as it tape-recorded a miss out on of experts’ invoicings price quotes.

The supply is up 9.3% considering that reporting and presently trades at $81.35.

Read our full, actionable report on Cloudflare here, it’s free.

Sign Up With Paid Supply Financier Research Study

Assist us make StockStory a lot more practical to financiers like on your own. Join our paid individual study session and get a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.