Toncoin’s (HEAP) rate has actually continued to be reasonably steady over the previous week. Trading in between $5.96 and $5.37, the altcoin has actually preserved this variety in spite of wider market changes.

Nevertheless, this fad might quickly be interrupted as 2 crucial on-chain metrics indicate a possible brief press. This evaluation discovers what load owners ought to prepare for as this deciphers.

Toncoin Goes To Crossroads

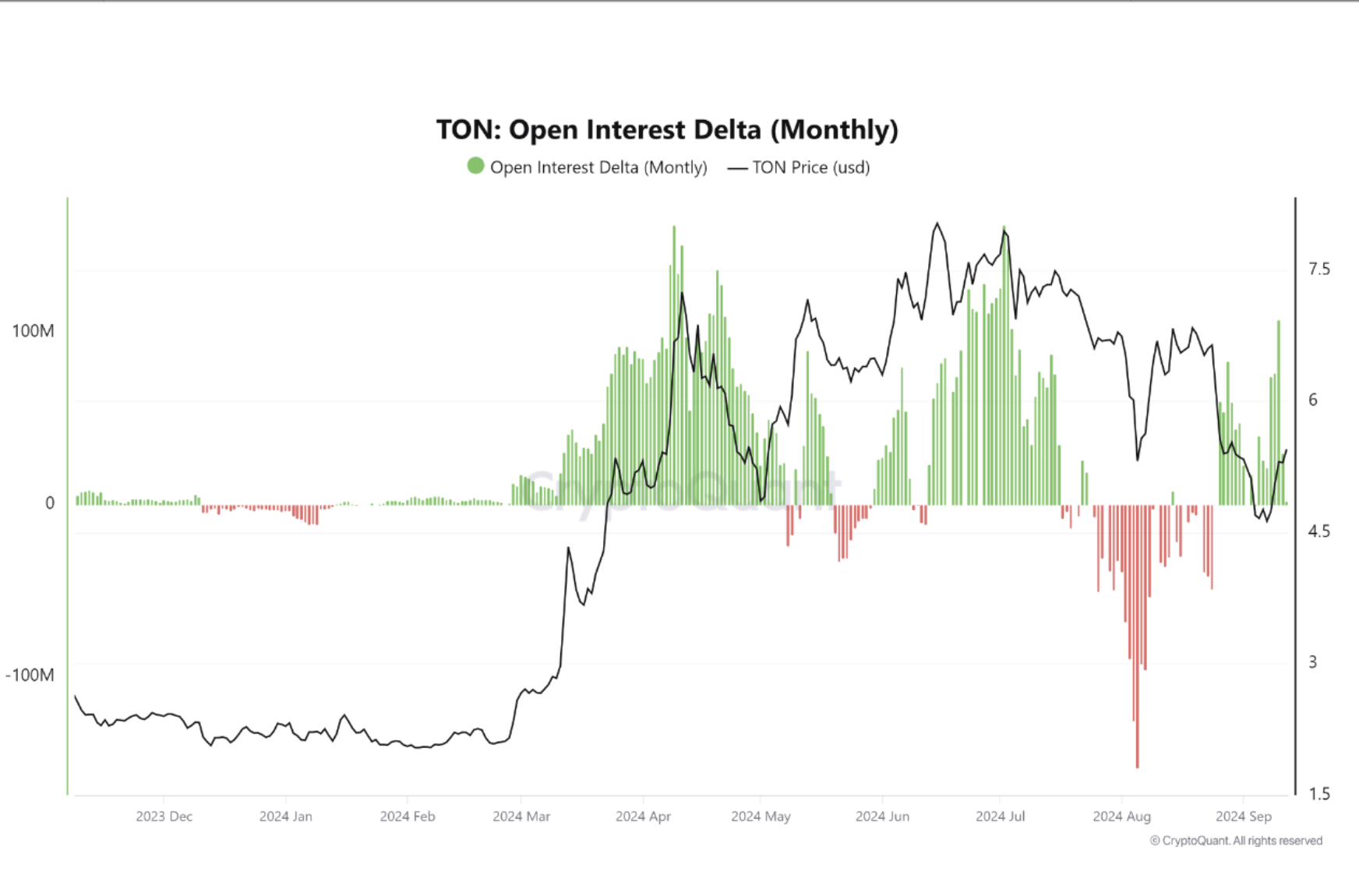

A brief press happens when a sharp increase in a possession’s rate pressures investors that have actually wagered versus a cryptocurrency by taking brief placements to purchase it back at greater costs, even more driving it up and raising market volatility. In a brand-new report, CryptoQuant factor Joao Wedson kept in mind that the consolidated analysis of Toncoin’s 30-day open rate of interest delta and its adverse financing price signals that the altcoin might be headed because instructions.

” This can be taken an indication that capitalists are banking on a higher rate fad for load, as they want to hold their placements instead of liquidate them. This boost in self-confidence can be a forerunner to rising rate motions, specifically if gone along with by expanding quantities,” the scientist claimed.

Toncoin’s open rate of interest delta determines the adjustments in its open rate of interest over a collection duration. It aids investors establish whether brand-new cash is getting in the marketplace or if existing placements are being shut. 30-day open rate of interest delta just recently transformed favorable, suggesting raised market task.

Find Out More: What Are Telegram Bot Coins?

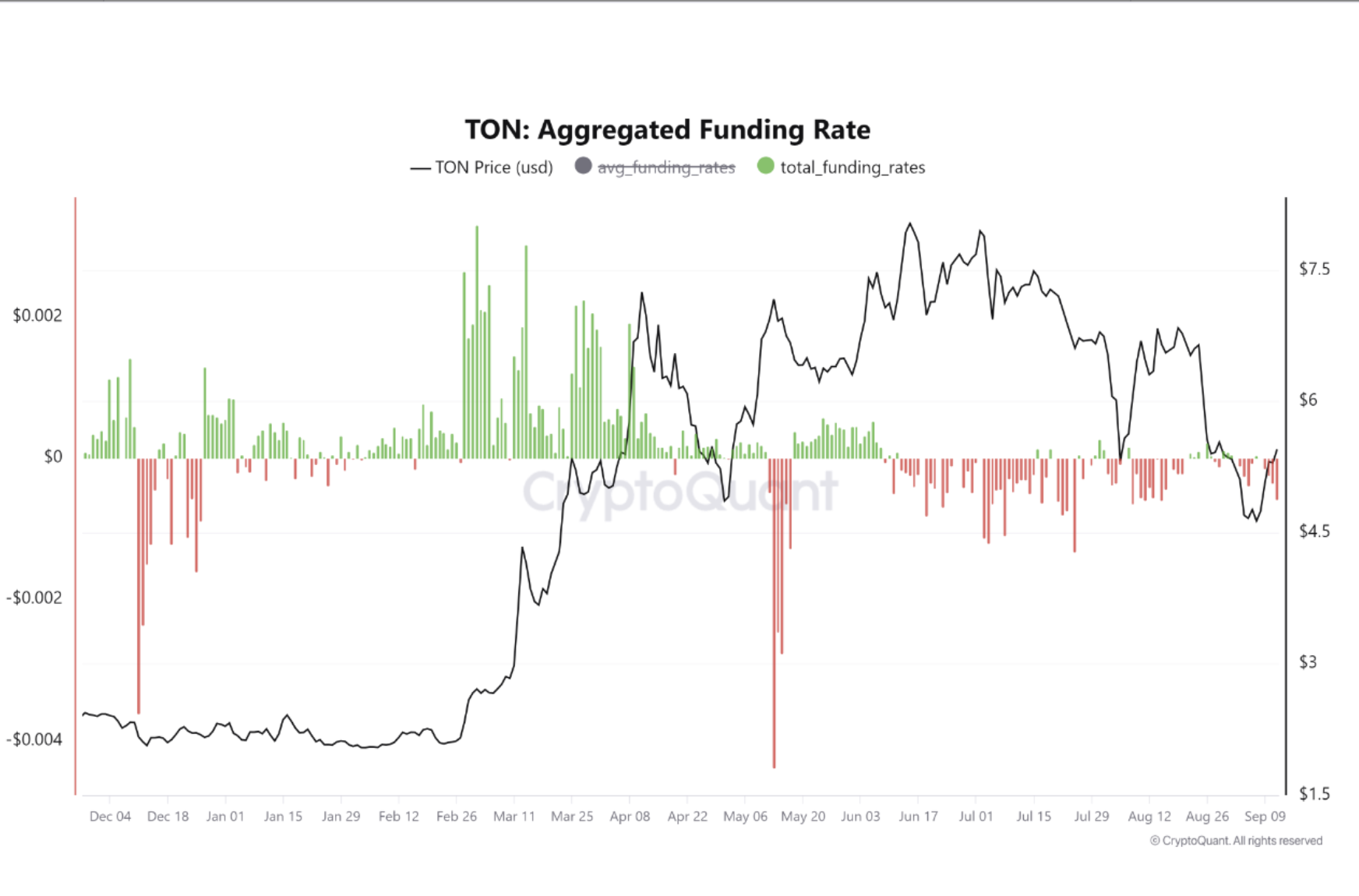

Nevertheless, while Toncoin’s open rate of interest delta declares, its adverse financing price throughout cryptocurrency exchanges offers a fascinating scenario that might influence Toncoin’s rate in the close to term.

Financing prices are regular charges to make certain a possession’s agreement rate remains near to its area rate. An unfavorable price shows that investors are paying to maintain brief placements open, indicating a bearish overview.

A mixed analysis of these metrics offers a scenario in which, on the one hand, capitalists are certain that Toncoin’s rate will certainly remain to rally, while on the various other, numerous investors still anticipate the rate to drop. According to Wedson, this circumstance might lead to a “possible brief press, a change in belief, and raised volatility.”

Load Rate Forecast: Uptrend Is Solid, Yet There Is a Catch

Toncoin is presently trading at $5.88, with its Aroon Up Line revealing a solid uptrend at 92.86%. This indication, which determines the toughness of a rate rally, recommends that Toncoin’s current high was gotten to recently.

When the Aroon Up Line methods 100%, it indicates a durable higher fad.

Find Out More: What Are Telegram Mini Apps? A Guide for Crypto Beginners

If Toncoin’s rally proceeds, it might acquire 51%, pressing its rate past the crucial resistance created at $8.02 at safeguarding the brand-new all-time-high. Nevertheless, if market belief transforms adverse, Toncoin’s rate might go down to $4.44, negating the present favorable overview.

Please Note

According to the Trust fund Task standards, this rate evaluation short article is for educational objectives just and ought to not be thought about monetary or financial investment recommendations. BeInCrypto is devoted to precise, objective coverage, however market problems go through alter without notification. Constantly perform your very own study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.