The United States Stocks and Exchange Payment (SEC) is most likely to appeal versus the court’s July 13 choice in the Surge instance.

As it took place, Federal Court Court Analisa Torres figured out that the XRP token is just a safety and security when marketed to institutional capitalists.

Specialists Consider In: Will SEC Allure Surge XRP Judgment by October 7?

Fox Company press reporter Eleanor Terrett, mentioning a previous SEC legal representative, claimed the safety and securities regulatory authority can appeal Court Torres’s judgment, which had actually given Surge Labs a partial triumph.

” Everybody over there [at the SEC] really thinks that the choice is incorrect, that it’s bad legislation, and ought to be appealed,” read the record.

BeInCrypto lately reported that the SEC went down insurance claims versus Surge execs Chris Larsen and Brad Garlinghouse. This stimulated conjecture of an allure concentrated on programmatic sales.

A number of lawful specialists have actually discussed this conjecture, consisting of XRP supporter and Massachusetts Us senate prospect John Deaton.

John Deaton

Deaton claims Court Torres’s ruling was extremely fact-specific, relying upon the sent XRP owner sworn statements. Even more, the SEC fell short to develop a “typical venture.” This is the 2nd problem of the Howey Examination, and appealing the judgment would certainly not make good sense.

” An appellate court can state, equally as Court Torres recognized, there can be a circumstance where second sales can certify as financial investment agreements due to the fact that the truths satisfy all the Howey aspects. However in the Surge XRP instance, the truths offered simply do not please it. Hence, the instance obtains attested on charm yet it does not stop the SEC from suggesting second sales comprise financial investment agreements in various other instances,” Deaton noted.

Find Out More: Every little thing You Required To Learn About Surge vs. SEC

The Howey Examination describes 4 requirements that have to be satisfied for a financial investment agreement to certify as a safety and security. Initially, there have to be a financial investment of cash. Second, the financial investment needs to remain in a typical venture. Third, there ought to be an assumption of revenues. Lastly, these revenues ought to arise from the initiatives of others.

Court Torres’s essential searching for in the Surge instance rested on the 3rd need. Especially, the court figured out that XRP’s sale on exchanges did not satisfy the assumption of revenues based upon the initiatives of others. The judgment wrapped up that marketing XRP on exchanges, where customers acquired via an order publication instead of straight from Surge in an ICO or IEO, did not breach safety and securities legislation.

John Deaton, that played a considerable duty in case, sent an Amicus Short in behalf of XRP owners. His initiatives added to the court’s judgment, with Court Torres mentioning his entry of 3,800 sworn statements from XRP owners as component of the choice.

Fred Rispoli

An additional lawful professional and XRP supporter, lawyer Fred Rispoli, likewise considered in. He verbalized that the court clearly claimed “programmatic sales” and not “second sales.” Per Rispoli, if an allure does take place, it would certainly protest the loss on programmatic sales.

This is due to the fact that second sales on exchanges were omitted from the Court’s factor to consider and were not chosen. For that reason, it can not be an appellate problem.

” The distinction is Surge marketing on an exchange in contrast to others marketing on an exchange to every various other. Web page 23, n. 16 of the 7/13/23 order addresses this,” Rispoli explained.

Looking in advance, Rispoli claims XRP can exceed its peak cost of $1.96 in 2021 and established a brand-new all-time high.

Jeremy Hogan

Lawyer Jeremy Hogan, that has actually gathered a massive adhering to throughout social networks, offering his knowledge on lawful issues in the cryptocurrency room, likewise commented. The companion at Hogan & & Hogan law office said the SEC had actually shed the story. In his viewpoint, the safety and securities regulatory authority ought to consider what an allure would certainly suggest for its required of financier security and funding development.

At the same time, investigatory reporter Forest Inc Crypto on X advises the SEC to appeal if it believes the judgment on programmatic sales is incorrect. This position is based upon the presumption that the second market requires extra security, as it consists of much less experienced capitalists. However, the reporter urges that the SEC ought to initially assess its genuine intention.

” The genuine concern is whether the judgment was really wrong, or if the SEC merely does not such as the end result. As Gary Gensler typically claims, doing not like a legislation is various from not comprehending it. If the SEC simply does not concur with the present legislation, they ought to not appeal yet ought to press Congress for upgraded laws,” Forest Inc Crypto wrote.

Find Out More: Crypto Law: What Are the Perks and Drawbacks?

Therefore, the instance continues to be unsolved, and the XRP neighborhood excitedly waits for more updates. The due date for an allure is established for October 7.

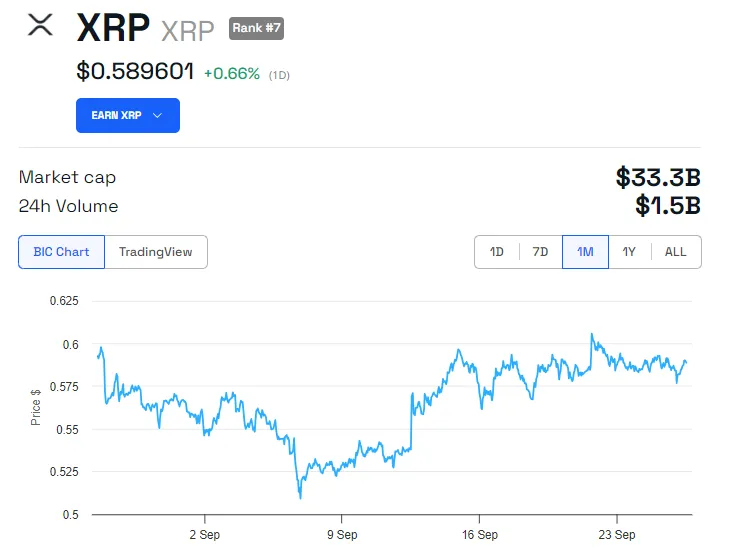

According to information from BeInCrypto, XRP is presently trading at $0.59, mirroring a small 0.66% boost considering that the marketplace opened up on Friday.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt details. Nevertheless, visitors are recommended to confirm truths separately and seek advice from a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.