United States supplies leapt Thursday, as the S&P 500 (^ GSPC) shut at a document high. Capitalists invited a multitude of updates, consisting of strong United States financial information, Micron’s (MU) positive incomes, and China’s promises of even more stimulation.

The Dow Jones Industrial Standard (^ DJI) climbed 0.62%, while the S&P 500 (^ GSPC) included even more 0.4% to shut at a document high of 5,745.39. The tech-heavy Nasdaq Compound (^ IXIC) got 0.6% in the middle of a sharp spike in Micron’s shares, which improved various other chips.

A last upgrade from the United States federal government on 2nd quarter GDP development defeated Wall surface Road assumptions, while once a week out of work cases suddenly was up to the most affordable degrees in 4 months.

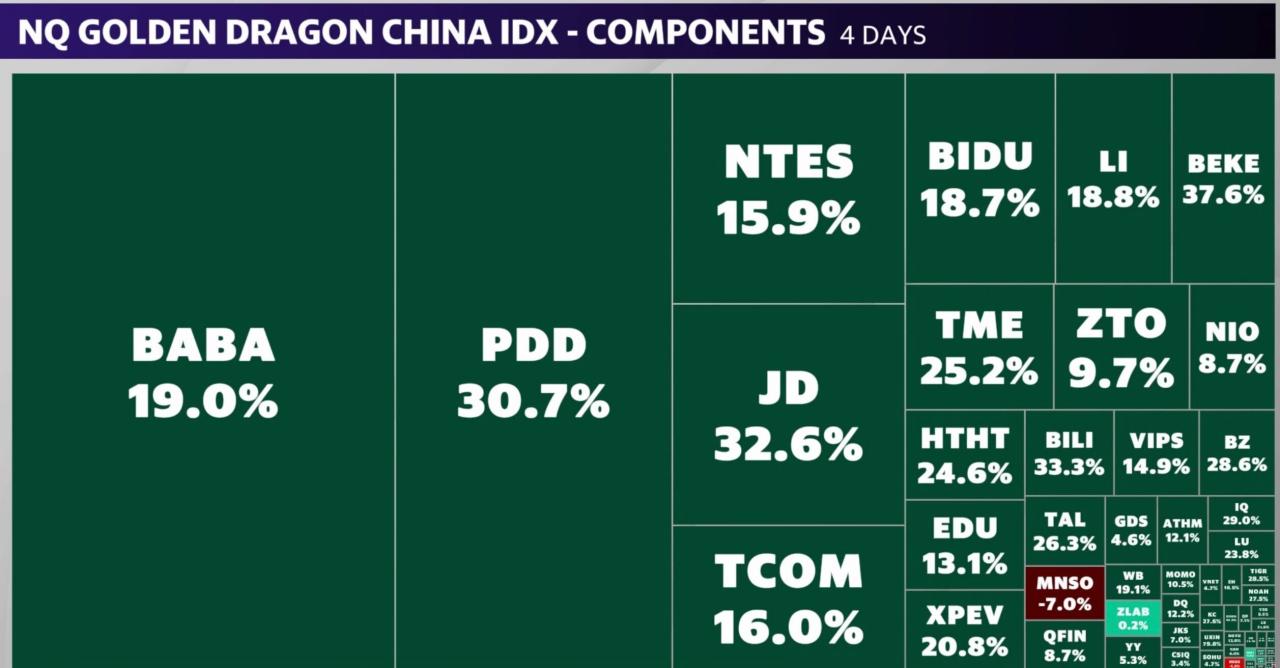

At the same time, China’s leading leaders signified they are taking out the quits to restore its moribund economic situation with brand-new promises to raise financial investing, stop the building situation, and sustain the stock exchange. A huge enter landmass supplies established the CSI 300 (000300. SS) on the right track for its ideal week in a years.

Up following, Friday will certainly bring a very prepared for analysis on the Identity Intake Expenses (PCE) index, the rising cost of living statistics favored by the Fed.

In private supply actions, Super Micro Computer System (SMCI) tanked 12% after The Wall surface Road Journal reported the Division of Justice is penetrating the web server manufacturer complying with a brief vendor record from Hindenburg Study released last month.

Find Out More: What the Fed price reduced methods for checking account, CDs, lendings, and bank card

Live 14 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.